- South Korea

- /

- Communications

- /

- KOSDAQ:A175140

Investors bid HUMAN TECHNOLOGY (KOSDAQ:175140) up ₩20b despite increasing losses YoY, taking one-year return to 51%

If you want to compound wealth in the stock market, you can do so by buying an index fund. But if you pick the right individual stocks, you could make more than that. For example, the HUMAN TECHNOLOGY Co., Ltd (KOSDAQ:175140) share price is up 51% in the last 1 year, clearly besting the market decline of around 3.4% (not including dividends). So that should have shareholders smiling. On the other hand, longer term shareholders have had a tougher run, with the stock falling 30% in three years.

The past week has proven to be lucrative for HUMAN TECHNOLOGY investors, so let's see if fundamentals drove the company's one-year performance.

See our latest analysis for HUMAN TECHNOLOGY

HUMAN TECHNOLOGY isn't currently profitable, so most analysts would look to revenue growth to get an idea of how fast the underlying business is growing. When a company doesn't make profits, we'd generally hope to see good revenue growth. As you can imagine, fast revenue growth, when maintained, often leads to fast profit growth.

HUMAN TECHNOLOGY grew its revenue by 49% last year. That's a head and shoulders above most loss-making companies. While the share price gain of 51% over twelve months is pretty tasty, you might argue it doesn't fully reflect the strong revenue growth. If that's the case, now might be the time to take a close look at HUMAN TECHNOLOGY. Since we evolved from monkeys, we think in linear terms by nature. So if growth goes exponential, opportunity may exist for the enlightened.

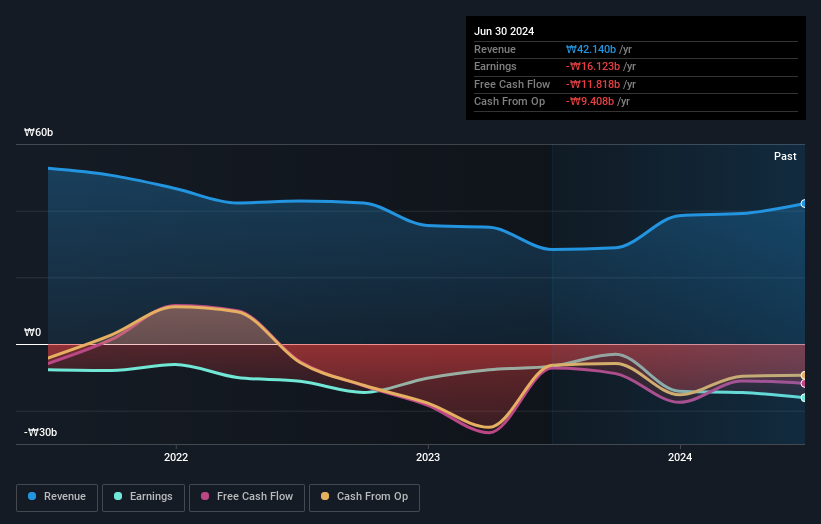

The image below shows how earnings and revenue have tracked over time (if you click on the image you can see greater detail).

You can see how its balance sheet has strengthened (or weakened) over time in this free interactive graphic.

A Different Perspective

It's nice to see that HUMAN TECHNOLOGY shareholders have received a total shareholder return of 51% over the last year. Notably the five-year annualised TSR loss of 9% per year compares very unfavourably with the recent share price performance. We generally put more weight on the long term performance over the short term, but the recent improvement could hint at a (positive) inflection point within the business. It's always interesting to track share price performance over the longer term. But to understand HUMAN TECHNOLOGY better, we need to consider many other factors. Like risks, for instance. Every company has them, and we've spotted 4 warning signs for HUMAN TECHNOLOGY (of which 1 doesn't sit too well with us!) you should know about.

If you would prefer to check out another company -- one with potentially superior financials -- then do not miss this free list of companies that have proven they can grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on South Korean exchanges.

Valuation is complex, but we're here to simplify it.

Discover if HUMAN TECHNOLOGY might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KOSDAQ:A175140

HUMAN TECHNOLOGY

Provides mobile hotspot router and wearable products for kids in South Korea, China, the United States, Australia, and internationally.

Flawless balance sheet slight.