- South Korea

- /

- Electronic Equipment and Components

- /

- KOSDAQ:A078600

Top 3 High Growth Tech Stocks in South Korea

Reviewed by Simply Wall St

The Healthcare sector in South Korea gained 5.6% while the market remained flat over the last week, and it has also been flat over the past year with earnings forecast to grow by 29% annually. In this context, identifying high-growth tech stocks that can outperform the broader market becomes crucial for investors seeking robust returns.

Top 10 High Growth Tech Companies In South Korea

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Seojin SystemLtd | 33.61% | 52.05% | ★★★★★★ |

| IMLtd | 21.80% | 111.43% | ★★★★★★ |

| Bioneer | 23.53% | 97.58% | ★★★★★★ |

| FLITTO | 32.60% | 106.82% | ★★★★★★ |

| NEXON Games | 29.64% | 66.98% | ★★★★★★ |

| ALTEOGEN | 64.22% | 99.46% | ★★★★★★ |

| Devsisters | 29.08% | 63.02% | ★★★★★★ |

| Park Systems | 23.74% | 35.66% | ★★★★★★ |

| AmosenseLtd | 24.04% | 71.97% | ★★★★★★ |

| UTI | 114.97% | 134.59% | ★★★★★★ |

Click here to see the full list of 49 stocks from our KRX High Growth Tech and AI Stocks screener.

Let's dive into some prime choices out of from the screener.

Daejoo Electronic Materials (KOSDAQ:A078600)

Simply Wall St Growth Rating: ★★★★★★

Overview: Daejoo Electronic Materials Co., Ltd. develops and sells electronic materials across various regions including South Korea, China, Taiwan, the United States, Europe, and Southeast Asia with a market cap of ₩1.66 billion.

Operations: Daejoo Electronic Materials generates revenue primarily through the development, production, and sale of electrical and electronic components, amounting to ₩206.32 billion. The company operates in various international markets including South Korea, China, Taiwan, the United States, Europe, and Southeast Asia.

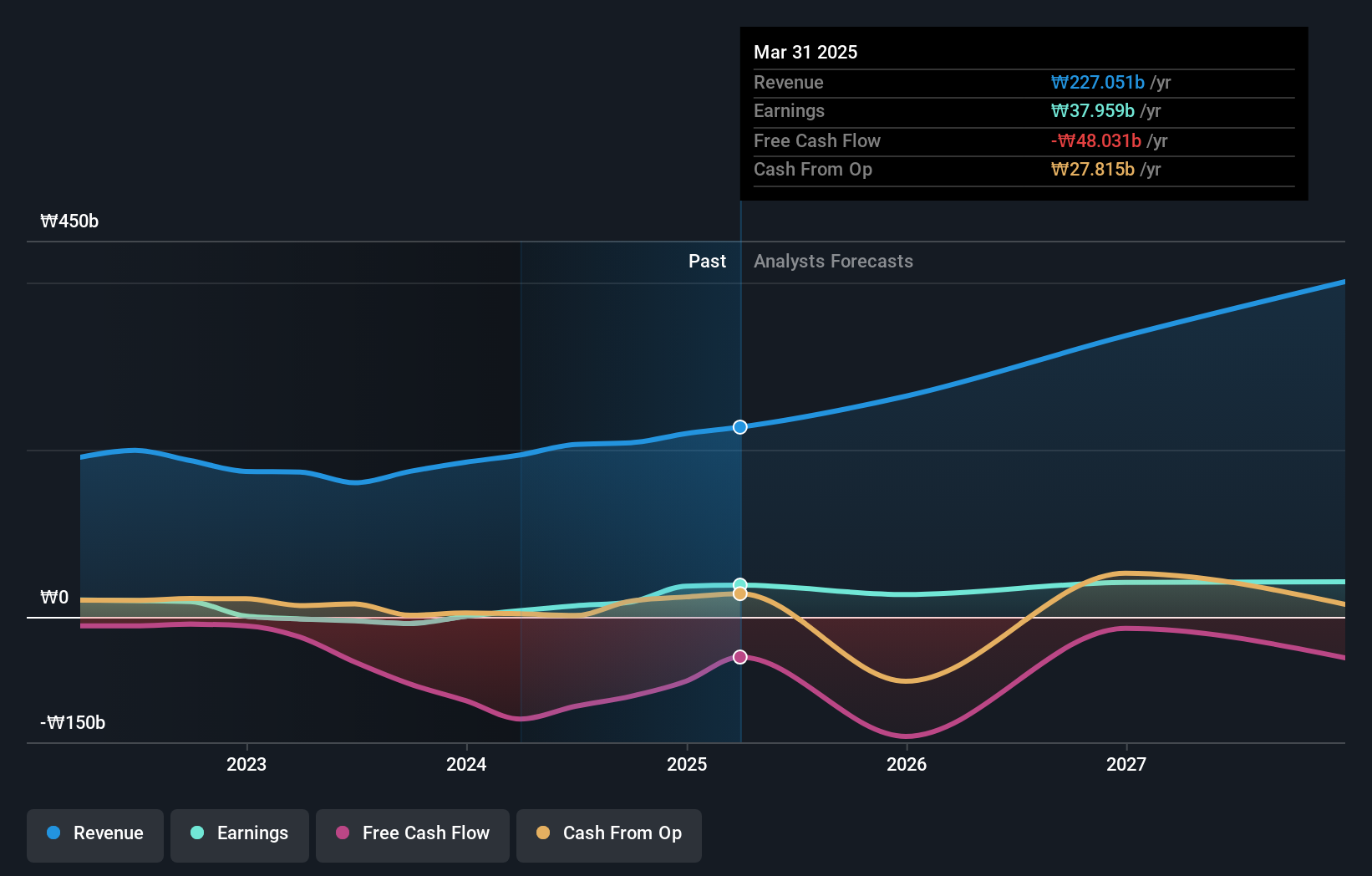

Daejoo Electronic Materials has pivoted remarkably within the tech sector, evidenced by a significant turnaround in its financial performance. Despite a challenging past with negative sales, recent earnings reports from August 2024 highlight a robust net income surge to KRW 6,557.14 million from KRW 821.69 million year-over-year for Q2, and an impressive recovery to KRW 12,206.56 million for the first half of the year after a previous loss. This growth trajectory is underpinned by an anticipated revenue increase at an annual rate of 42.2% and earnings expected to climb by 48.7% per annum over the next three years—outpacing both local market trends and broader industry averages significantly. The company's strategic emphasis on R&D investment aligns with these optimistic forecasts, positioning Daejoo as a resilient contender in South Korea's competitive high-tech landscape despite its historically volatile share price. While debt concerns linger due to insufficient coverage by operating cash flow, Daejoo’s aggressive growth strategy and return on equity projected at an encouraging 26% suggest potential for sustained upward momentum in this dynamic sector.

ALTEOGEN (KOSDAQ:A196170)

Simply Wall St Growth Rating: ★★★★★★

Overview: ALTEOGEN Inc., a biotechnology company, specializes in developing long-acting biobetters, proprietary antibody-drug conjugates, and antibody biosimilars with a market cap of ₩18.75 billion.

Operations: ALTEOGEN Inc. generates revenue primarily through its biotechnology segment, which reported ₩90.79 million. The company focuses on developing long-acting biobetters, proprietary antibody-drug conjugates, and antibody biosimilars.

ALTEOGEN, a South Korean biotech firm, recently marked a significant milestone with the MFDS approval of Tergase®, showcasing its Hybrozyme™ Technology's potential to disrupt traditional markets with high-purity recombinant solutions. This approval could broaden market applications beyond traditional uses, enhancing ALTEOGEN's commercial profile. Financially, ALTEOGEN is navigating through unprofitability but forecasts suggest an impressive turnaround with expected revenue growth at 64.2% annually and earnings potentially surging by 99.5% per year. The company's commitment to R&D is evident as it transitions into profitability and seeks to capitalize on its innovative biologics platform, setting a robust foundation for future growth in the competitive biotech landscape.

Celltrion (KOSE:A068270)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Celltrion, Inc., along with its subsidiaries, specializes in developing and producing protein-based drugs for oncology treatment in South Korea and has a market cap of ₩42.41 trillion.

Operations: Celltrion, Inc., and its subsidiaries generate revenue primarily from bio-medical supplies (₩3.54 trillion) and chemical drugs (₩507.02 billion). The company focuses on protein-based oncology treatments in South Korea.

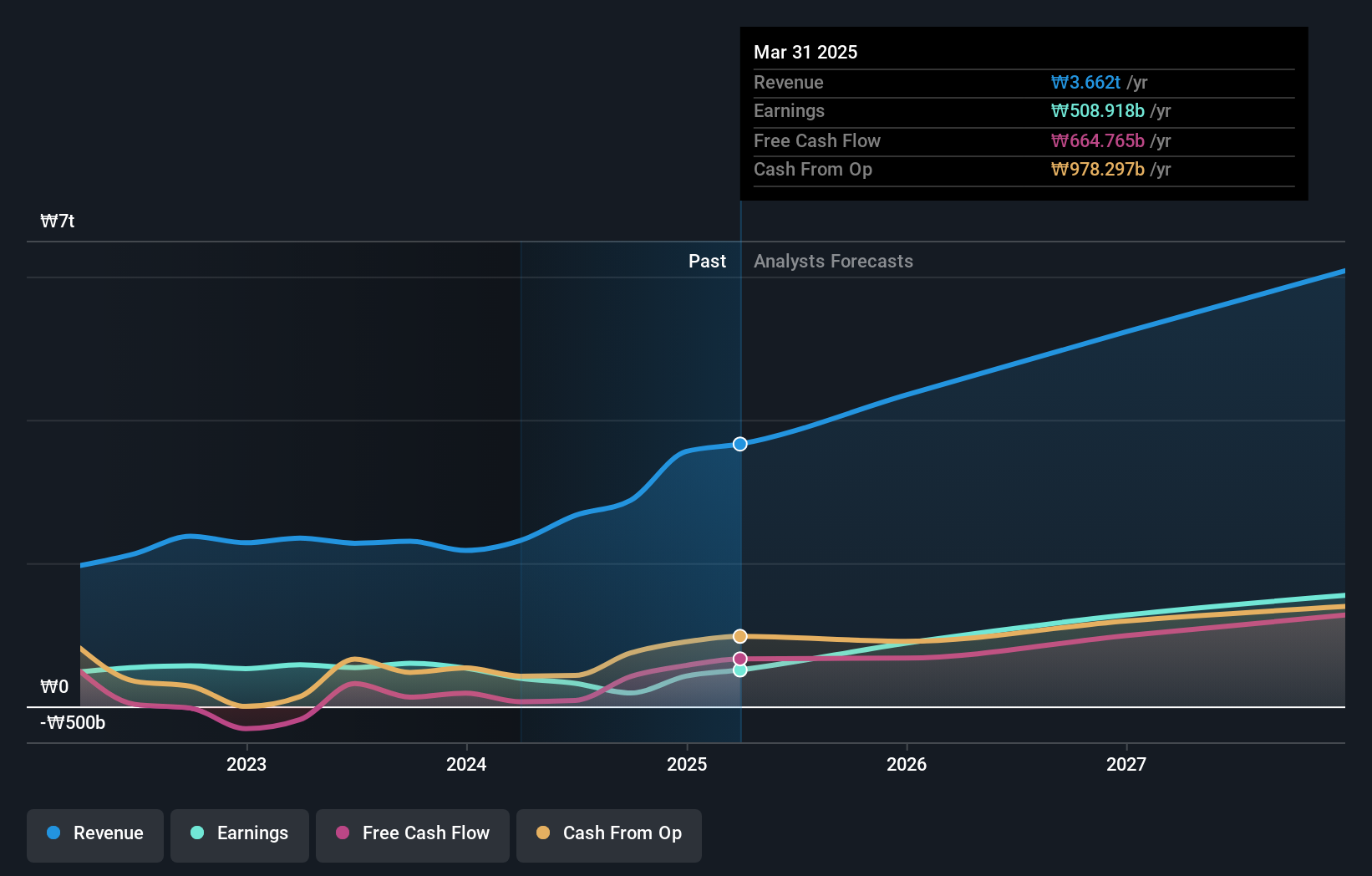

Celltrion has demonstrated resilience and adaptability in the competitive biotech sector, especially with recent FDA approval of ZYMFENTRA for ulcerative colitis and Crohn's disease, enhancing its market footprint in the U.S. This aligns with a robust R&D focus, where Celltrion allocated significant resources—evidenced by a 25.5% annual increase in R&D expenses aimed at fostering innovation. Moreover, the company's strategic share repurchases totaling KRW 75.89 billion reflect a commitment to shareholder value amidst forecasts of earnings growth at an impressive rate of 59.6% annually. These moves underscore Celltrion’s proactive stance in expanding its therapeutic offerings and strengthening market position through both innovative treatments and savvy financial strategies.

- Take a closer look at Celltrion's potential here in our health report.

Gain insights into Celltrion's past trends and performance with our Past report.

Seize The Opportunity

- Get an in-depth perspective on all 49 KRX High Growth Tech and AI Stocks by using our screener here.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About KOSDAQ:A078600

Daejoo Electronic Materials

Develops and sells electronic materials in South Korea, China, Taiwan, the United States, Europe, and Southeast Asia.

Exceptional growth potential low.