- South Korea

- /

- Electronic Equipment and Components

- /

- KOSDAQ:A078600

Exploring Three High Growth Tech Stocks In South Korea

Reviewed by Simply Wall St

The South Korea stock market recently halted a three-day winning streak, with the KOSPI index now resting just above the 2,700-point mark amid mixed performances across various sectors. Despite this slight dip, optimism over interest rates and positive cues from European and U.S. markets suggest renewed support for Asian bourses. In this context of fluctuating market conditions, identifying high-growth tech stocks becomes crucial as they have the potential to capitalize on favorable economic indicators and global market sentiment.

Top 10 High Growth Tech Companies In South Korea

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Seojin SystemLtd | 33.61% | 52.05% | ★★★★★★ |

| IMLtd | 20.76% | 106.30% | ★★★★★★ |

| Bioneer | 22.49% | 89.69% | ★★★★★★ |

| ALTEOGEN | 64.22% | 99.46% | ★★★★★★ |

| NEXON Games | 31.70% | 66.31% | ★★★★★★ |

| FLITTO | 32.07% | 100.38% | ★★★★★★ |

| Devsisters | 26.11% | 65.92% | ★★★★★★ |

| AmosenseLtd | 24.29% | 55.45% | ★★★★★★ |

| Park Systems | 22.50% | 37.52% | ★★★★★★ |

| UTI | 103.56% | 122.67% | ★★★★★★ |

Click here to see the full list of 52 stocks from our KRX High Growth Tech and AI Stocks screener.

Let's review some notable picks from our screened stocks.

Daejoo Electronic Materials (KOSDAQ:A078600)

Simply Wall St Growth Rating: ★★★★★★

Overview: Daejoo Electronic Materials Co., Ltd. develops and sells electronic materials across various international markets including South Korea, China, Taiwan, the United States, Europe, and Southeast Asia with a market cap of ₩1.68 trillion.

Operations: Daejoo Electronic Materials Co., Ltd. primarily generates revenue from the development, production, and sale of electrical and electronic components, amounting to ₩206.32 billion. The company operates in various international markets including South Korea, China, Taiwan, the United States, Europe, and Southeast Asia.

Daejoo Electronic Materials has seen robust growth, with earnings forecasted to increase by 48.7% annually over the next three years, outpacing the South Korean market's 28.8%. The company reported net income of ₩12.21 billion for the first half of 2024, a significant turnaround from a net loss of ₩402.46 million in the same period last year. Additionally, Daejoo's revenue is expected to grow at an impressive rate of 42.2% per year, driven by its innovative electronic materials segment and strategic investments in R&D. The company's recent private placement raised ₩61 billion through convertible bonds with notable participation from Samsung Securities and NH Investment & Securities, indicating strong investor confidence. This capital influx is likely to bolster Daejoo’s R&D initiatives further; their current R&D expenses contribute significantly to their innovation pipeline, ensuring sustained growth potential in high-tech applications like semiconductors and advanced materials used by clients such as TSMC and Samsung Electronics.

UTI (KOSDAQ:A179900)

Simply Wall St Growth Rating: ★★★★★★

Overview: UTI Inc. engages in the research, development, manufacture, and sale of smartphone camera windows and sensor glasses in South Korea and internationally with a market cap of ₩390.79 billion.

Operations: UTI Inc. generates revenue primarily from its electronic components and parts segment, which accounted for ₩20.10 billion. The company focuses on the smartphone camera windows and sensor glasses market, both domestically and internationally.

UTI Inc. has demonstrated impressive growth prospects with revenue expected to surge by 103.6% annually, far outpacing the South Korean market's average of 10.7%. The company is set to become profitable within three years, boasting an anticipated earnings growth rate of 122.7% per year. Recent private placements raised ₩2.70 billion and CNY 25.85 billion, indicating strong investor confidence and bolstering their R&D initiatives significantly for future innovations in tech and AI sectors.

- Delve into the full analysis health report here for a deeper understanding of UTI.

Gain insights into UTI's past trends and performance with our Past report.

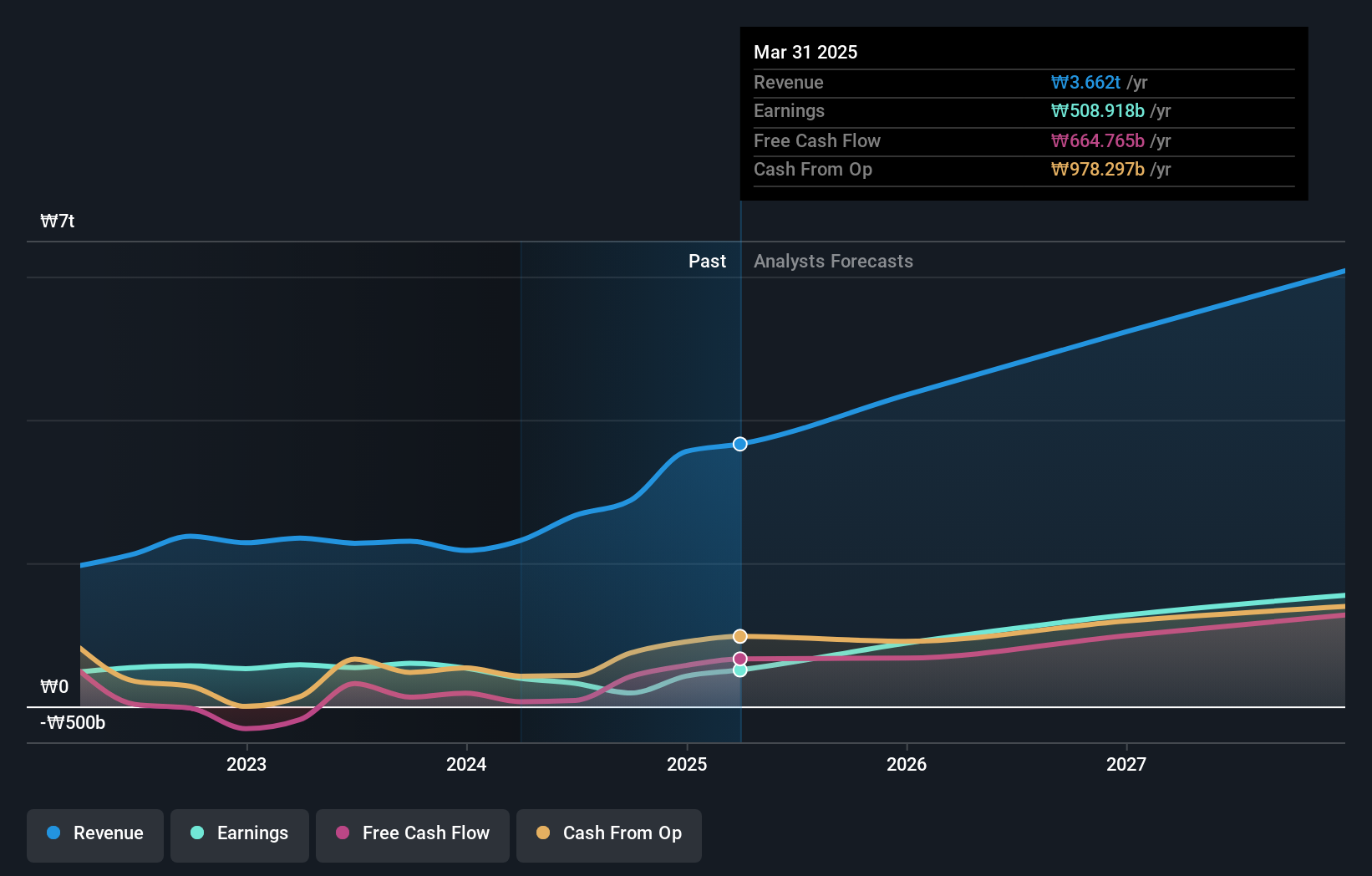

Celltrion (KOSE:A068270)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Celltrion, Inc., along with its subsidiaries, develops and produces protein-based drugs for oncology treatment in South Korea and has a market cap of ₩41.79 trillion.

Operations: Celltrion, Inc. generates revenue primarily from the production and sale of protein-based drugs for oncology treatment, with significant contributions from its biomedical supply segment (₩3.54 trillion) and chemical drugs segment (₩507.02 billion). The company operates in South Korea and has a market cap of ₩41.79 trillion.

Celltrion is poised for significant growth, with revenue expected to increase by 25.7% annually, outpacing the South Korean market's average of 10.7%. The company's earnings are forecast to grow at an impressive rate of 59.8% per year. Despite a challenging past year with a -40.4% earnings drop, Celltrion's commitment to innovation is evident in their substantial R&D expenditure and recent Phase III success for CT-P47, a biosimilar candidate for rheumatoid arthritis treatment.

Next Steps

- Delve into our full catalog of 52 KRX High Growth Tech and AI Stocks here.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About KOSDAQ:A078600

Daejoo Electronic Materials

Develops and sells electronic materials in South Korea, China, Taiwan, the United States, Europe, and Southeast Asia.

Exceptional growth potential low.