- South Korea

- /

- Electronic Equipment and Components

- /

- KOSDAQ:A052710

Amotech Co., Ltd.'s (KOSDAQ:052710) 27% Share Price Plunge Could Signal Some Risk

Amotech Co., Ltd. (KOSDAQ:052710) shareholders won't be pleased to see that the share price has had a very rough month, dropping 27% and undoing the prior period's positive performance. The good news is that in the last year, the stock has shone bright like a diamond, gaining 191%.

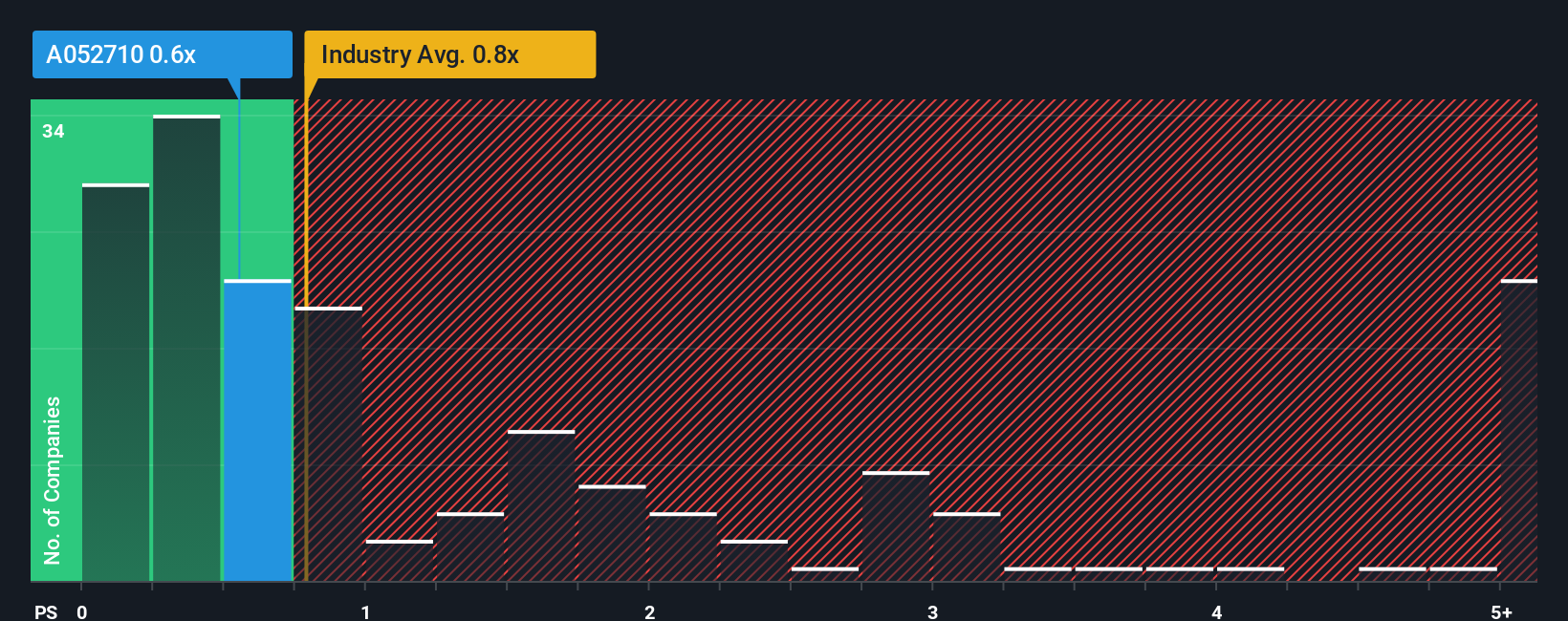

In spite of the heavy fall in price, you could still be forgiven for feeling indifferent about Amotech's P/S ratio of 0.6x, since the median price-to-sales (or "P/S") ratio for the Electronic industry in Korea is also close to 0.8x. Although, it's not wise to simply ignore the P/S without explanation as investors may be disregarding a distinct opportunity or a costly mistake.

See our latest analysis for Amotech

What Does Amotech's Recent Performance Look Like?

With its revenue growth in positive territory compared to the declining revenue of most other companies, Amotech has been doing quite well of late. Perhaps the market is expecting its current strong performance to taper off in accordance to the rest of the industry, which has kept the P/S contained. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's not quite in favour.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Amotech.What Are Revenue Growth Metrics Telling Us About The P/S?

There's an inherent assumption that a company should be matching the industry for P/S ratios like Amotech's to be considered reasonable.

Retrospectively, the last year delivered an exceptional 18% gain to the company's top line. The latest three year period has also seen a 23% overall rise in revenue, aided extensively by its short-term performance. So we can start by confirming that the company has actually done a good job of growing revenue over that time.

Shifting to the future, estimates from the lone analyst covering the company suggest revenue should grow by 9.0% over the next year. Meanwhile, the rest of the industry is forecast to expand by 18%, which is noticeably more attractive.

With this in mind, we find it intriguing that Amotech's P/S is closely matching its industry peers. It seems most investors are ignoring the fairly limited growth expectations and are willing to pay up for exposure to the stock. These shareholders may be setting themselves up for future disappointment if the P/S falls to levels more in line with the growth outlook.

What Does Amotech's P/S Mean For Investors?

Following Amotech's share price tumble, its P/S is just clinging on to the industry median P/S. We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

Our look at the analysts forecasts of Amotech's revenue prospects has shown that its inferior revenue outlook isn't negatively impacting its P/S as much as we would have predicted. At present, we aren't confident in the P/S as the predicted future revenues aren't likely to support a more positive sentiment for long. A positive change is needed in order to justify the current price-to-sales ratio.

It's always necessary to consider the ever-present spectre of investment risk. We've identified 4 warning signs with Amotech (at least 2 which are a bit unpleasant), and understanding them should be part of your investment process.

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KOSDAQ:A052710

Amotech

Provides components for automotive, mobile phone, and home appliances in South Korea and internationally.

Slight risk and slightly overvalued.

Similar Companies

Market Insights

Community Narratives