- South Korea

- /

- Electronic Equipment and Components

- /

- KOSDAQ:A045390

Positive earnings growth hasn't been enough to get DAEA TI (KOSDAQ:045390) shareholders a favorable return over the last three years

DAEA TI Co., Ltd. (KOSDAQ:045390) shareholders should be happy to see the share price up 13% in the last month. But that cannot eclipse the less-than-impressive returns over the last three years. After all, the share price is down 45% in the last three years, significantly under-performing the market.

The recent uptick of 10% could be a positive sign of things to come, so let's take a look at historical fundamentals.

Check out our latest analysis for DAEA TI

While markets are a powerful pricing mechanism, share prices reflect investor sentiment, not just underlying business performance. One way to examine how market sentiment has changed over time is to look at the interaction between a company's share price and its earnings per share (EPS).

During the unfortunate three years of share price decline, DAEA TI actually saw its earnings per share (EPS) improve by 13% per year. This is quite a puzzle, and suggests there might be something temporarily buoying the share price. Alternatively, growth expectations may have been unreasonable in the past.

It's worth taking a look at other metrics, because the EPS growth doesn't seem to match with the falling share price.

The company has kept revenue pretty healthy over the last three years, so we doubt that explains the falling share price. We're not entirely sure why the share price is dropped, but it does seem likely investors have become less optimistic about the business.

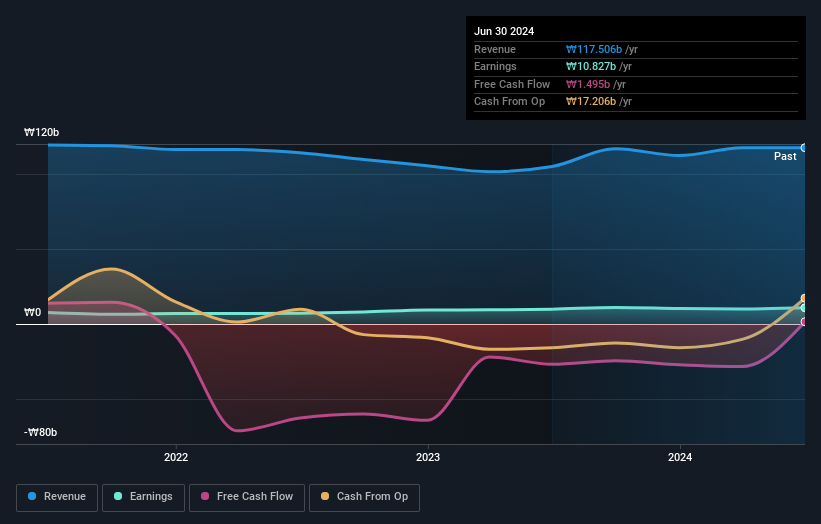

You can see how earnings and revenue have changed over time in the image below (click on the chart to see the exact values).

This free interactive report on DAEA TI's balance sheet strength is a great place to start, if you want to investigate the stock further.

A Different Perspective

While the broader market lost about 0.8% in the twelve months, DAEA TI shareholders did even worse, losing 13%. However, it could simply be that the share price has been impacted by broader market jitters. It might be worth keeping an eye on the fundamentals, in case there's a good opportunity. Unfortunately, last year's performance may indicate unresolved challenges, given that it was worse than the annualised loss of 7% over the last half decade. We realise that Baron Rothschild has said investors should "buy when there is blood on the streets", but we caution that investors should first be sure they are buying a high quality business. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. Take risks, for example - DAEA TI has 1 warning sign we think you should be aware of.

But note: DAEA TI may not be the best stock to buy. So take a peek at this free list of interesting companies with past earnings growth (and further growth forecast).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on South Korean exchanges.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KOSDAQ:A045390

DAEA TI

Engages in the design, manufacture, construction, testing, commissioning, and maintenance of railway signaling and communication systems in South Korea.

Adequate balance sheet with questionable track record.