Stock Analysis

Highnoon Laboratories Leads Three Key Dividend Stocks For Investors

Reviewed by Simply Wall St

As global markets show signs of resilience, with indices like the S&P 500 nearing record highs and the UK economy emerging from recession, investors are increasingly attentive to opportunities that offer stability and potential income. In this context, dividend stocks such as Highnoon Laboratories become particularly appealing, providing not only potential income through dividends but also a degree of safety in fluctuating markets.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Wuliangye YibinLtd (SZSE:000858) | 3.09% | ★★★★★★ |

| Chongqing Rural Commercial Bank (SEHK:3618) | 8.45% | ★★★★★★ |

| Guaranty Trust Holding (NGSE:GTCO) | 7.72% | ★★★★★★ |

| Mitsubishi Shokuhin (TSE:7451) | 3.38% | ★★★★★★ |

| Ryoyu Systems (TSE:4685) | 3.45% | ★★★★★★ |

| GakkyushaLtd (TSE:9769) | 4.07% | ★★★★★★ |

| HITO-Communications HoldingsInc (TSE:4433) | 3.24% | ★★★★★★ |

| Banque Cantonale Vaudoise (SWX:BCVN) | 4.47% | ★★★★★★ |

| Toyo Kanetsu K.K (TSE:6369) | 3.55% | ★★★★★★ |

| Innotech (TSE:9880) | 3.98% | ★★★★★★ |

Click here to see the full list of 1802 stocks from our Top Dividend Stocks screener.

Let's review some notable picks from our screened stocks.

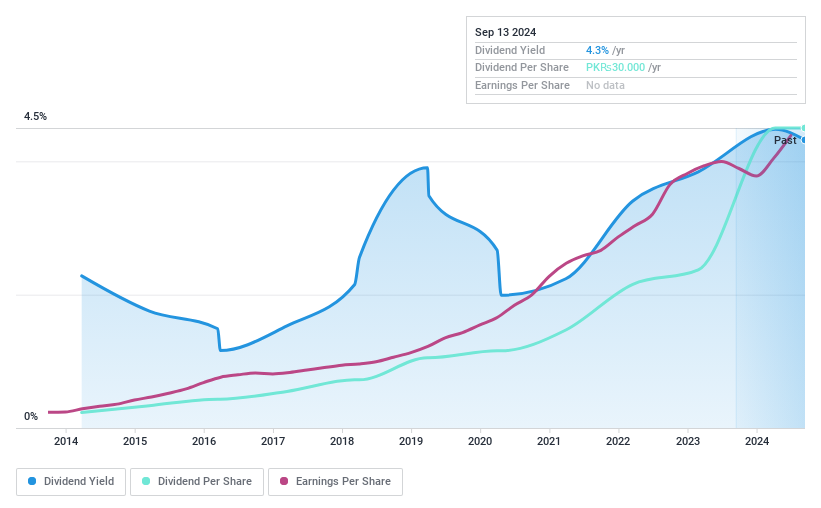

Highnoon Laboratories (KASE:HINOON)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Highnoon Laboratories Limited operates in the pharmaceutical sector, engaging in the manufacture, import, sale, export, and marketing of pharmaceutical and allied consumer products with a market capitalization of PKR 36.28 billion.

Operations: Highnoon Laboratories Limited generates its revenue primarily from the pharmaceuticals segment, totaling PKR 19.77 billion.

Dividend Yield: 4.4%

Highnoon Laboratories reported a slight decrease in net income for 2023, with earnings per share marginally lower at PKR 46.2 from PKR 46.67 the previous year. Despite this, the company maintains a stable dividend history over the past decade, recently declaring a cash dividend of PKR 30.0. However, its current dividend yield of 4.38% is modest compared to top Pakistani market payers and struggles with coverage by cash flows and earnings, reflecting potential sustainability issues despite a below-average P/E ratio of 14.8x against the industry's 27.3x.

- Get an in-depth perspective on Highnoon Laboratories' performance by reading our dividend report here.

- Our comprehensive valuation report raises the possibility that Highnoon Laboratories is priced higher than what may be justified by its financials.

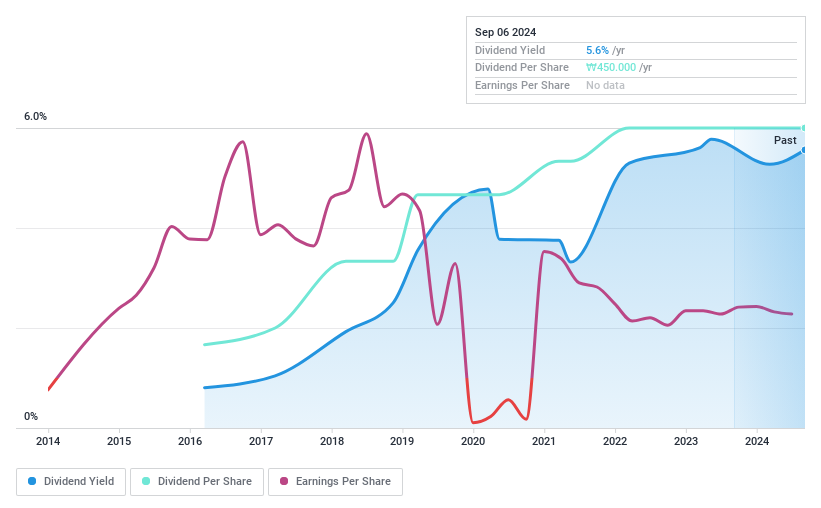

HDC I-Controls (KOSE:A039570)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: HDC I-Controls Co., Ltd. specializes in providing construction IT solutions across South Korea, Southeast Asia, and the Middle East, with a market capitalization of approximately ₩183.80 billion.

Operations: HDC I-Controls Co., Ltd. generates revenue through four primary segments: Home Service (₩0.12 billion), Interior/Landscape (₩0.90 billion), Real Estate Management (₩0.25 billion), and Electrical and Electronics (₩0.14 billion).

Dividend Yield: 4.6%

HDC I-Controls reported a slight increase in net income to KRW 13.16 billion for 2023, up from KRW 12.43 billion the previous year, with stable basic earnings per share at KRW 573. Despite a short dividend history of less than ten years, dividends are well-covered by earnings and cash flows, with payout ratios of 78.5% and 53.7% respectively. The dividend yield stands at a competitive 4.64%, higher than the market average of 3.48%. However, the company's track record for dividend growth remains uncertain due to its relatively recent initiation of payouts.

- Take a closer look at HDC I-Controls' potential here in our dividend report.

- In light of our recent valuation report, it seems possible that HDC I-Controls is trading beyond its estimated value.

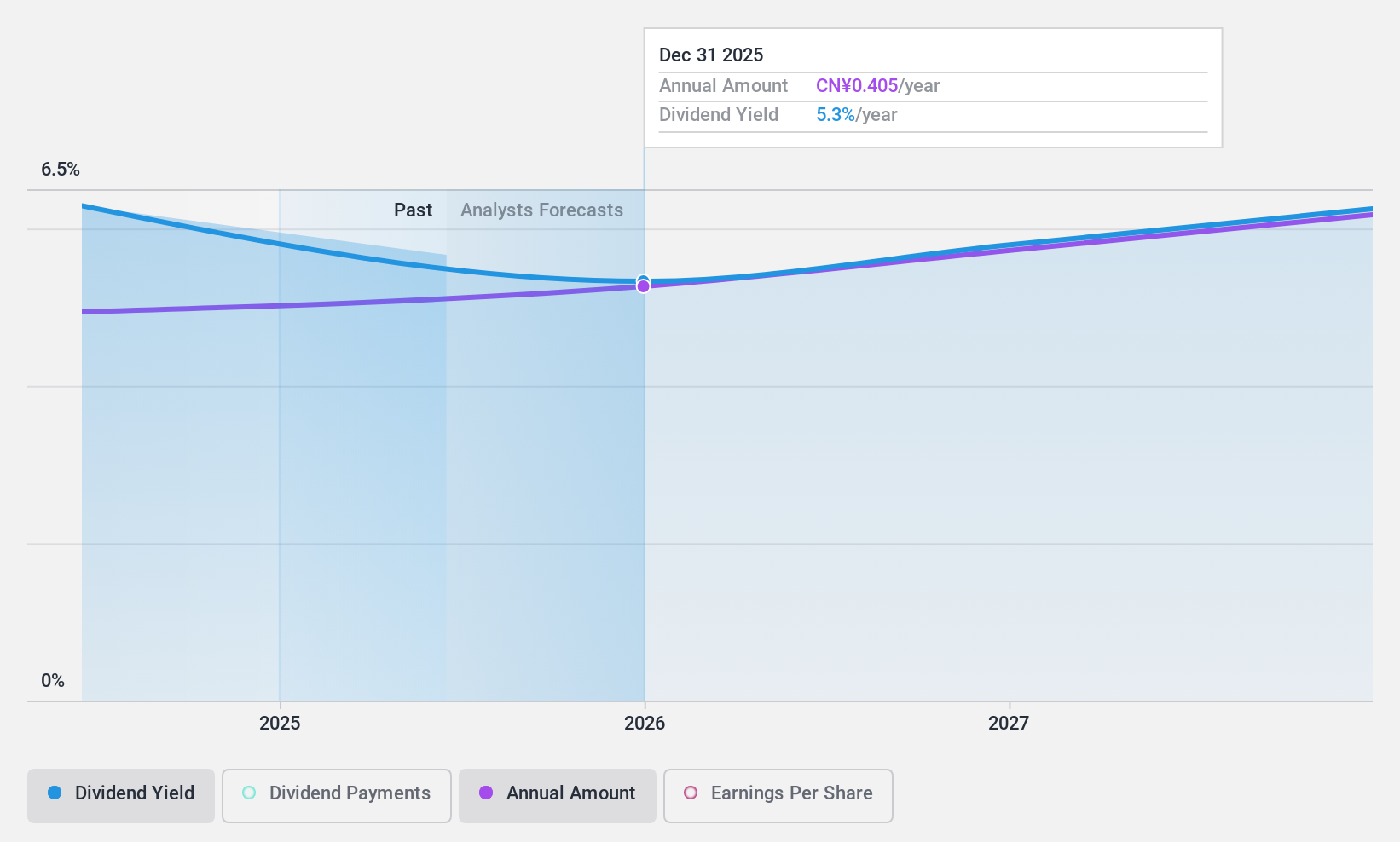

Star Lake BioscienceZhaoqing Guangdong (SHSE:600866)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Star Lake Bioscience Co., Inc., operating under the Star Lake and Yue Bao brand names, manufactures and sells pharmaceutical raw materials, as well as food and feed additives in China and globally, with a market capitalization of approximately CN¥13.31 billion.

Operations: Star Lake Bioscience Co., Inc. generates its revenue through the production and distribution of pharmaceutical raw materials, along with food and feed additives.

Dividend Yield: 4.6%

Star Lake BioscienceZhaoqing Guangdong has shown a robust financial performance with first-quarter net income doubling to CNY 251.48 million from the previous year. Despite a recent start in dividend payments, the company's low price-to-earnings ratio of 16.8x suggests good value relative to the Chinese market average of 32.4x. Dividends appear sustainable with a payout ratio at 78% and covered by earnings growth, which is expected to rise by approximately 16.59% annually. However, its dividend history lacks stability and it carries high levels of debt, which could impact future payouts.

- Unlock comprehensive insights into our analysis of Star Lake BioscienceZhaoqing Guangdong stock in this dividend report.

- The analysis detailed in our Star Lake BioscienceZhaoqing Guangdong valuation report hints at an deflated share price compared to its estimated value.

Key Takeaways

- Unlock our comprehensive list of 1802 Top Dividend Stocks by clicking here.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're helping make it simple.

Find out whether Star Lake BioscienceZhaoqing Guangdong is potentially over or undervalued by checking out our comprehensive analysis, which includes fair value estimates, risks and warnings, dividends, insider transactions and financial health.

View the Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:600866

Star Lake BioscienceZhaoqing Guangdong

Star Lake Bioscience Co., Inc. engages in the manufacture and sale of pharmaceutical raw materials, and food and feed additives under the Star Lake and Yue Bao brand names in China and internationally.

Solid track record, good value and pays a dividend.