- South Korea

- /

- Semiconductors

- /

- KOSDAQ:A323280

There's Reason For Concern Over Taesung Co.,Ltd.'s (KOSDAQ:323280) Massive 26% Price Jump

Despite an already strong run, Taesung Co.,Ltd. (KOSDAQ:323280) shares have been powering on, with a gain of 26% in the last thirty days. The last month tops off a massive increase of 188% in the last year.

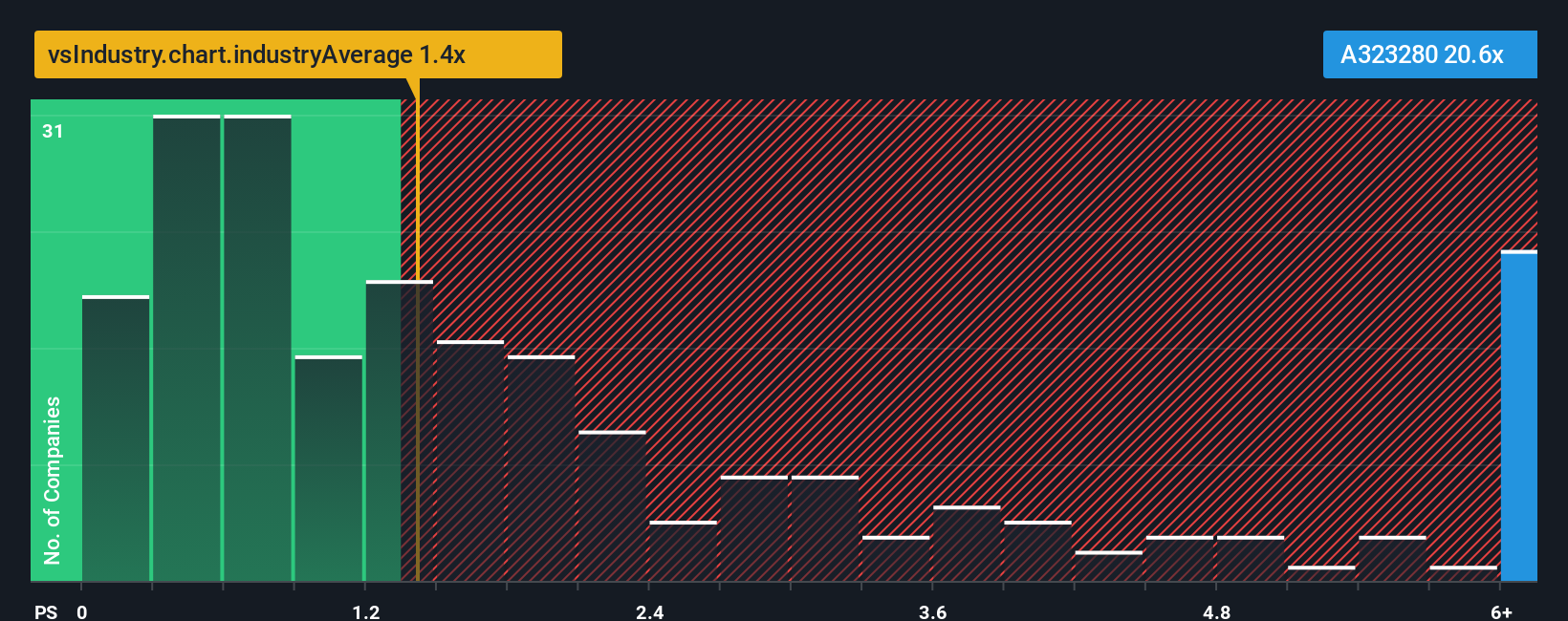

Since its price has surged higher, given around half the companies in Korea's Semiconductor industry have price-to-sales ratios (or "P/S") below 1.4x, you may consider TaesungLtd as a stock to avoid entirely with its 20.6x P/S ratio. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's so lofty.

View our latest analysis for TaesungLtd

How TaesungLtd Has Been Performing

Revenue has risen firmly for TaesungLtd recently, which is pleasing to see. One possibility is that the P/S ratio is high because investors think this respectable revenue growth will be enough to outperform the broader industry in the near future. If not, then existing shareholders may be a little nervous about the viability of the share price.

We don't have analyst forecasts, but you can see how recent trends are setting up the company for the future by checking out our free report on TaesungLtd's earnings, revenue and cash flow.What Are Revenue Growth Metrics Telling Us About The High P/S?

TaesungLtd's P/S ratio would be typical for a company that's expected to deliver very strong growth, and importantly, perform much better than the industry.

If we review the last year of revenue growth, the company posted a terrific increase of 25%. Still, revenue has fallen 3.5% in total from three years ago, which is quite disappointing. So unfortunately, we have to acknowledge that the company has not done a great job of growing revenues over that time.

In contrast to the company, the rest of the industry is expected to grow by 24% over the next year, which really puts the company's recent medium-term revenue decline into perspective.

With this information, we find it concerning that TaesungLtd is trading at a P/S higher than the industry. Apparently many investors in the company are way more bullish than recent times would indicate and aren't willing to let go of their stock at any price. Only the boldest would assume these prices are sustainable as a continuation of recent revenue trends is likely to weigh heavily on the share price eventually.

The Key Takeaway

Shares in TaesungLtd have seen a strong upwards swing lately, which has really helped boost its P/S figure. While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

Our examination of TaesungLtd revealed its shrinking revenue over the medium-term isn't resulting in a P/S as low as we expected, given the industry is set to grow. With a revenue decline on investors' minds, the likelihood of a souring sentiment is quite high which could send the P/S back in line with what we'd expect. If recent medium-term revenue trends continue, it will place shareholders' investments at significant risk and potential investors in danger of paying an excessive premium.

It's always necessary to consider the ever-present spectre of investment risk. We've identified 4 warning signs with TaesungLtd (at least 2 which are concerning), and understanding these should be part of your investment process.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

Valuation is complex, but we're here to simplify it.

Discover if TaesungLtd might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KOSDAQ:A323280

TaesungLtd

Develops, manufactures, and sells PCB automation equipment in South Korea and internationally.

Moderate risk with adequate balance sheet.

Market Insights

Community Narratives