- South Korea

- /

- Semiconductors

- /

- KOSDAQ:A232140

Undiscovered Gems in South Korea for October 2024

Reviewed by Simply Wall St

In the last week, the South Korean market has remained flat, yet it has seen a 9.5% increase over the past year, with earnings projected to grow by 30% annually. In this environment, identifying stocks that offer strong growth potential and resilience can be crucial for investors seeking opportunities in this dynamic market.

Top 10 Undiscovered Gems With Strong Fundamentals In South Korea

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| NOROO PAINT & COATINGS | 13.99% | 5.04% | 7.74% | ★★★★★★ |

| Korea Airport ServiceLtd | NA | 3.97% | 42.22% | ★★★★★★ |

| Korea Ratings | NA | 1.13% | 0.54% | ★★★★★★ |

| Kyung Dong Navien | 22.40% | 11.19% | 18.84% | ★★★★★★ |

| ONEJOON | 10.13% | 35.30% | -5.78% | ★★★★★☆ |

| iMarketKorea | 28.53% | 5.35% | 1.30% | ★★★★★☆ |

| Oriental Precision & EngineeringLtd | 54.53% | 3.14% | 0.80% | ★★★★★☆ |

| ASIA Holdings | 34.98% | 8.43% | 16.17% | ★★★★★☆ |

| Daewon Cable | 30.50% | 8.72% | 60.28% | ★★★★★☆ |

| PaperCorea | 53.09% | 1.31% | 77.27% | ★★★★★☆ |

Here we highlight a subset of our preferred stocks from the screener.

YC (KOSDAQ:A232140)

Simply Wall St Value Rating: ★★★★★★

Overview: YC Corporation develops, manufactures, and sells inspection equipment for semiconductor memories in South Korea and internationally, with a market cap of approximately ₩946.65 billion.

Operations: YC Corporation generates revenue primarily from its Semiconductor Division, contributing ₩161.99 billion, followed by Electrical and Electronic Accessories at ₩42.12 billion, and Wholesale/Retail at ₩4.71 billion.

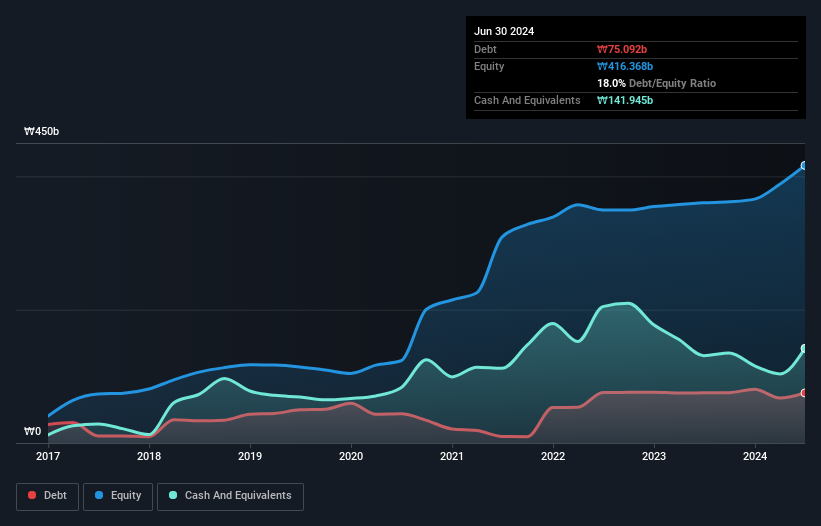

YC, a modestly sized player in the semiconductor industry, has seen its debt-to-equity ratio improve from 43.6% to 18% over the past five years, indicating better financial health. Despite experiencing a 7.1% earnings contraction last year, which lags behind the industry average of -10%, it remains on solid ground with more cash than total debt. The company boasts high-quality past earnings and is projected to grow earnings by nearly 50% annually. However, recent volatility in share price suggests investor caution may be warranted as they navigate market dynamics and future growth potential.

- Dive into the specifics of YC here with our thorough health report.

Evaluate YC's historical performance by accessing our past performance report.

YUNSUNG F&CLtd (KOSDAQ:A372170)

Simply Wall St Value Rating: ★★★★☆☆

Overview: YUNSUNG F&C Co., Ltd operates in South Korea, focusing on the design, engineering, procurement, production, and installation of equipment and materials with a market capitalization of ₩454.81 billion.

Operations: YUNSUNG F&C Co., Ltd generates revenue primarily from its Machinery & Industrial Equipment segment, amounting to ₩350.59 billion.

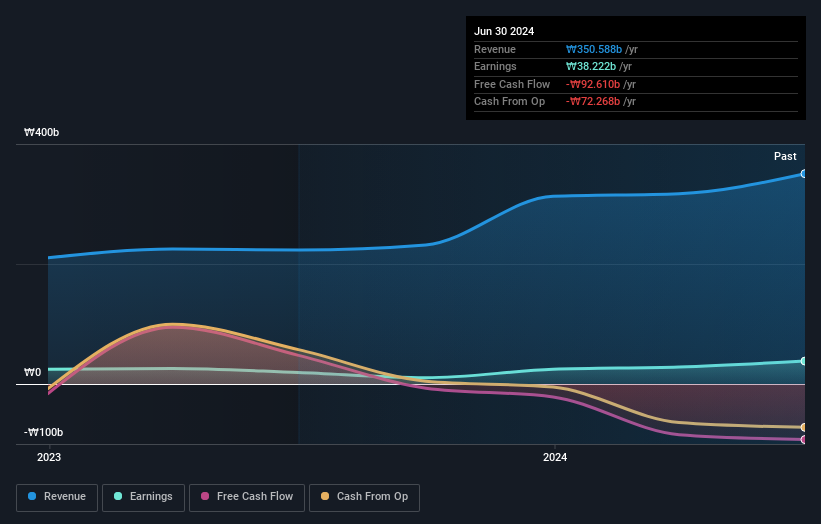

YUNSUNG F&CLtd, a relatively small player in its sector, has shown impressive earnings growth of 99.6% over the past year, outpacing the Machinery industry's average of 1.1%. The company appears to be a good value with a price-to-earnings ratio of 11.9x, which is slightly below the industry norm of 12.1x. Despite having more cash than total debt, YUNSUNG's free cash flow remains negative at -US$92.61 million as of October 2024, suggesting potential challenges in liquidity management. However, its high level of non-cash earnings indicates robust underlying business operations that could support future growth prospects if managed well.

Sajodaerim (KOSE:A003960)

Simply Wall St Value Rating: ★★★★★★

Overview: Sajodaerim Corporation is a Korean company engaged in the fisheries, food, food logistics, and retailing sectors with a market capitalization of ₩351.27 billion.

Operations: The primary revenue streams for Sajodaerim include the Food Division, generating ₩1.40 trillion, and the Sajo Oyang Division with ₩401.90 billion. The company also earns from its Sajowon and Sama Venture Divisions, contributing ₩329 billion and ₩79.25 billion respectively. Notably, the net profit margin exhibits an interesting trend that could be worth analyzing further in terms of profitability dynamics within these diverse sectors.

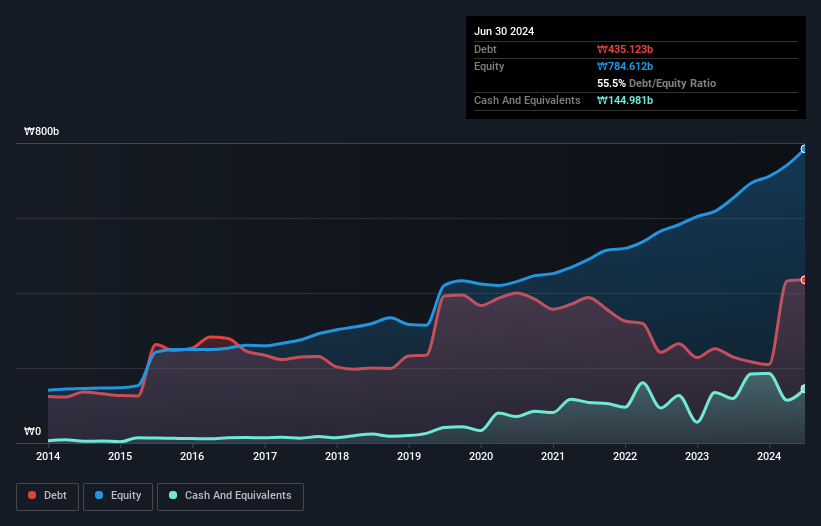

Sajodaerim, a smaller player in the South Korean market, has shown promising financial health with a net debt to equity ratio of 37%, which is satisfactory. Despite its earnings growth of 18.6% over the past year lagging behind the food industry's 23.2%, it boasts high-quality earnings and positive free cash flow. The company's interest payments are well covered by EBIT at 23.1x, indicating strong financial management. Trading at nearly 95% below estimated fair value suggests potential undervaluation, while recent inclusion in the S&P Global BMI Index highlights its growing recognition within global markets.

- Unlock comprehensive insights into our analysis of Sajodaerim stock in this health report.

Examine Sajodaerim's past performance report to understand how it has performed in the past.

Next Steps

- Click this link to deep-dive into the 180 companies within our KRX Undiscovered Gems With Strong Fundamentals screener.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About KOSDAQ:A232140

YC

Engages in the development, manufacture, and sale of inspection equipment for semiconductor memories in South Korea and internationally.

Flawless balance sheet with high growth potential.