- South Korea

- /

- Semiconductors

- /

- KOSDAQ:A166090

KRX Stocks That May Be Undervalued In September 2024

Reviewed by Simply Wall St

Over the last 7 days, the South Korean market has dropped 4.2%, and overall, it has remained flat over the past year despite forecasts for earnings to grow by 29% annually. In this context, identifying undervalued stocks becomes crucial as they may offer potential opportunities for investors looking to capitalize on future growth.

Top 10 Undervalued Stocks Based On Cash Flows In South Korea

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| HD Hyundai Electric (KOSE:A267260) | ₩245000.00 | ₩459363.52 | 46.7% |

| APR (KOSE:A278470) | ₩286000.00 | ₩516201.15 | 44.6% |

| HD Korea Shipbuilding & Offshore Engineering (KOSE:A009540) | ₩168000.00 | ₩305085.45 | 44.9% |

| Cosmecca Korea (KOSDAQ:A241710) | ₩83000.00 | ₩150804.96 | 45% |

| Global Tax Free (KOSDAQ:A204620) | ₩3270.00 | ₩6401.50 | 48.9% |

| Oscotec (KOSDAQ:A039200) | ₩35550.00 | ₩65583.14 | 45.8% |

| Intellian Technologies (KOSDAQ:A189300) | ₩50500.00 | ₩91370.65 | 44.7% |

| Shinsung E&GLtd (KOSE:A011930) | ₩1605.00 | ₩2986.73 | 46.3% |

| Raonsecure (KOSDAQ:A042510) | ₩2200.00 | ₩4398.03 | 50% |

| Hotel ShillaLtd (KOSE:A008770) | ₩46500.00 | ₩83244.17 | 44.1% |

Let's dive into some prime choices out of the screener.

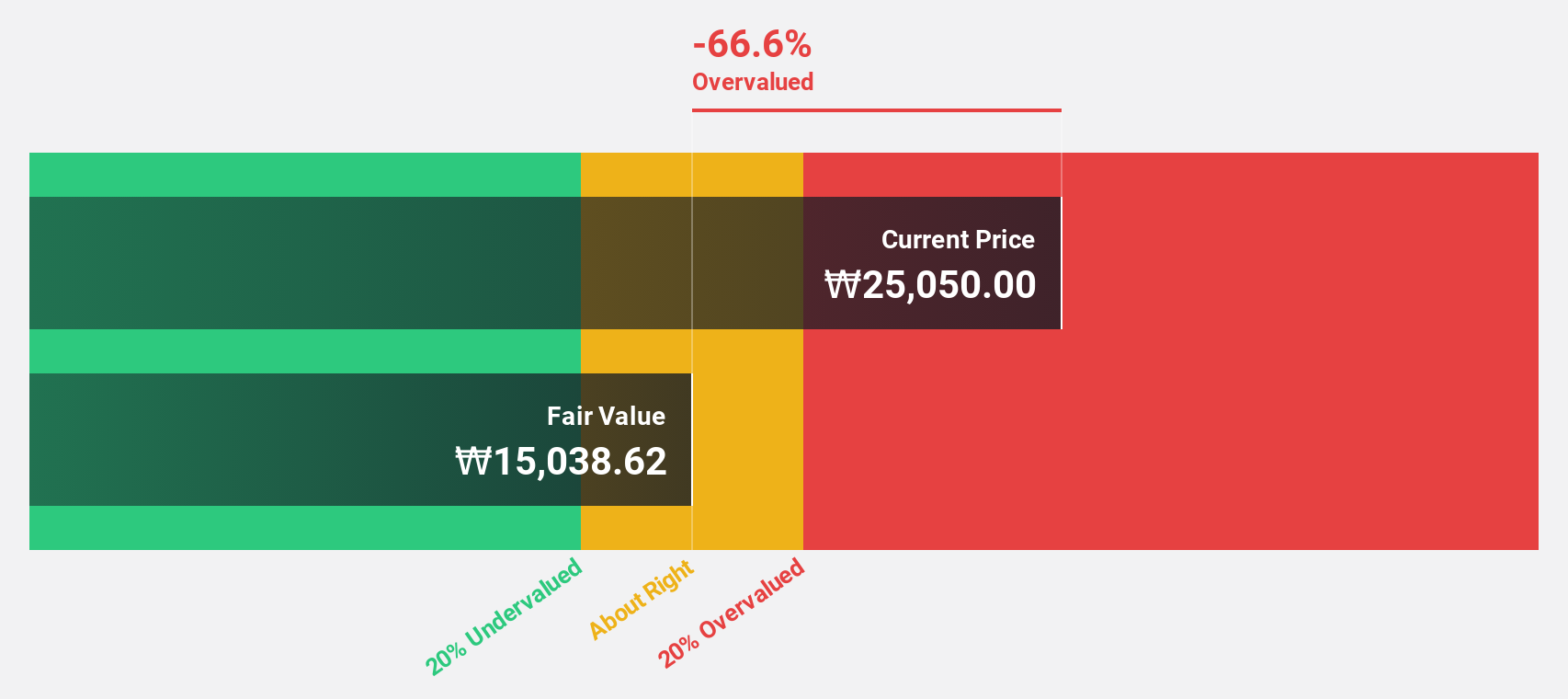

JUSUNG ENGINEERINGLtd (KOSDAQ:A036930)

Overview: JUSUNG ENGINEERING Co., Ltd. manufactures and sells semiconductor, display, solar, and lighting equipment in South Korea and internationally, with a market cap of approximately ₩1.10 billion.

Operations: The company's revenue primarily comes from its semiconductor equipment and services segment, generating approximately ₩338.28 million.

Estimated Discount To Fair Value: 37.1%

JUSUNG ENGINEERING Ltd. is trading at ₩23,350, significantly below its estimated fair value of ₩37,148.24. Analysts forecast revenue growth at 22% per year, outpacing the market's 10.6%. Despite a projected low return on equity (18.3%) in three years and earnings growth slower than the KR market (22.2% vs 28.9%), it remains undervalued based on discounted cash flow analysis and trades at good value compared to peers and industry standards.

- Insights from our recent growth report point to a promising forecast for JUSUNG ENGINEERINGLtd's business outlook.

- Delve into the full analysis health report here for a deeper understanding of JUSUNG ENGINEERINGLtd.

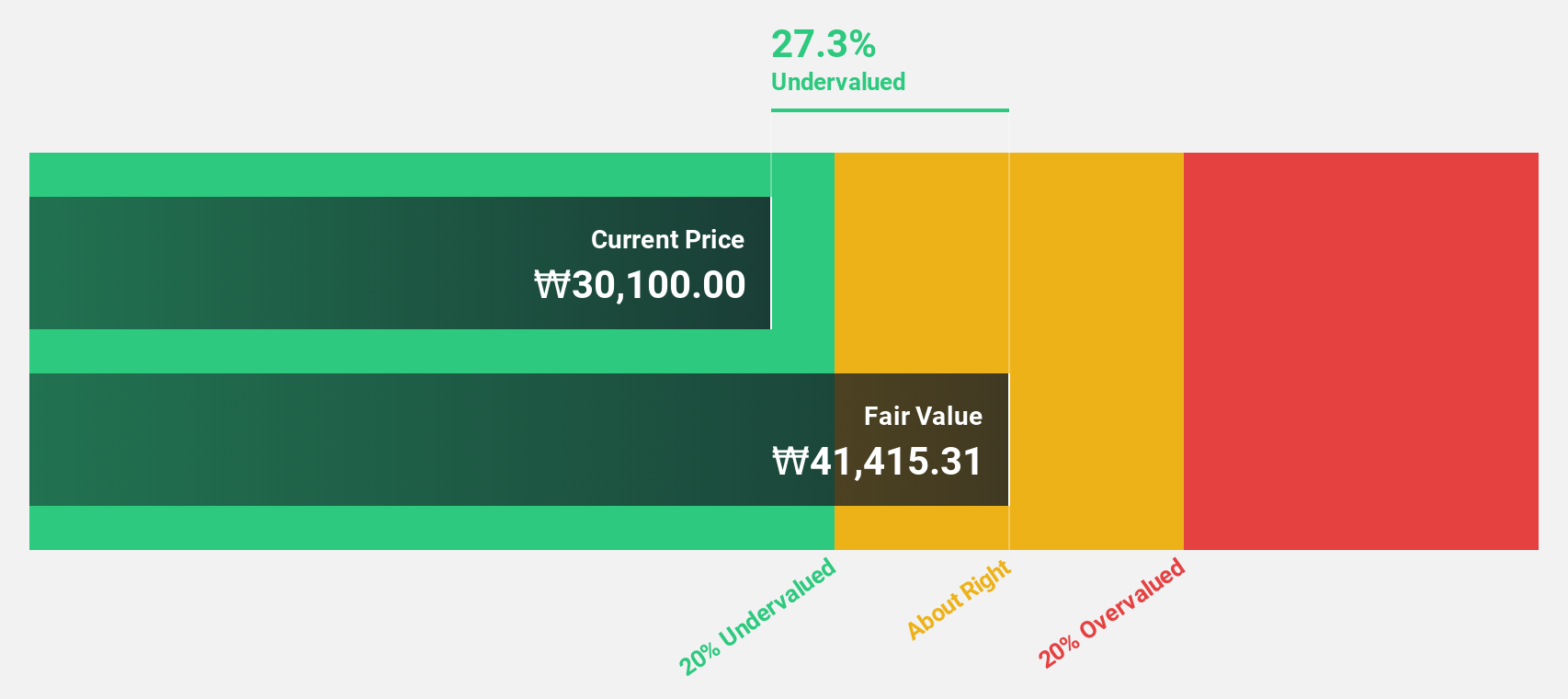

Hana Materials (KOSDAQ:A166090)

Overview: Hana Materials Inc. is a South Korean company that manufactures and sells silicon electrodes and rings, with a market cap of ₩595.16 billion.

Operations: Hana Materials Inc. generates revenue from the manufacture and sale of silicon electrodes and rings in South Korea.

Estimated Discount To Fair Value: 41.1%

Hana Materials is trading at ₩30,450, significantly below its estimated fair value of ₩51,731.88. Analysts forecast revenue growth at 22.3% per year and earnings growth at 52.07% per year, both outpacing the KR market averages of 10.6% and 28.9%, respectively. Despite a high level of debt and declining profit margins (9.6% vs last year's 23.3%), the stock remains undervalued based on discounted cash flow analysis with strong future prospects for revenue and earnings growth.

- Our expertly prepared growth report on Hana Materials implies its future financial outlook may be stronger than recent results.

- Take a closer look at Hana Materials' balance sheet health here in our report.

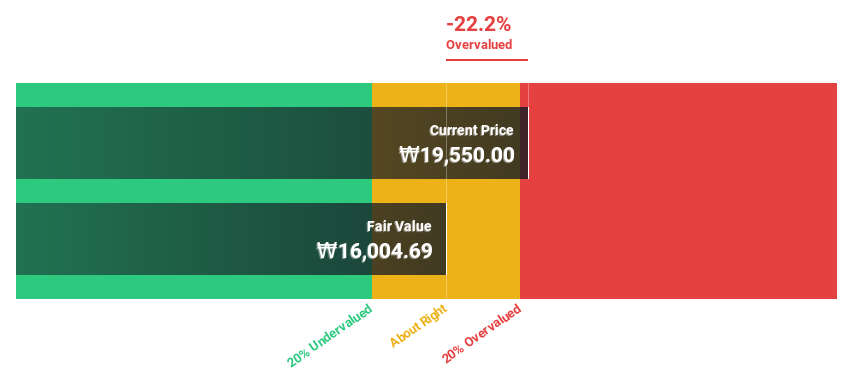

Biodyne (KOSDAQ:A314930)

Overview: Biodyne Co., Ltd. develops and manufactures medical devices, reagents, and consumables in South Korea, with a market cap of ₩408.66 billion.

Operations: The company generates revenue from medical devices, reagents, and consumables in South Korea.

Estimated Discount To Fair Value: 13.8%

Biodyne is trading at ₩13,730, below its estimated fair value of ₩15,932.44. Despite a highly volatile share price over the past three months and low current revenue (₩4B), analysts forecast robust revenue growth of 52.8% per year, outpacing the KR market average of 10.6%. The company is expected to become profitable within three years, making it an attractive option for investors seeking undervalued stocks based on cash flows in South Korea.

- Our growth report here indicates Biodyne may be poised for an improving outlook.

- Get an in-depth perspective on Biodyne's balance sheet by reading our health report here.

Make It Happen

- Delve into our full catalog of 34 Undervalued KRX Stocks Based On Cash Flows here.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Hana Materials might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About KOSDAQ:A166090

Hana Materials

Manufactures and sells silicon electrodes and rings in South Korea.

High growth potential and fair value.