- South Korea

- /

- Semiconductors

- /

- KOSDAQ:A102120

ABOV Semiconductor (KOSDAQ:102120) shareholders are still up 84% over 5 years despite pulling back 10% in the past week

ABOV Semiconductor Co., Ltd. (KOSDAQ:102120) shareholders might understandably be very concerned that the share price has dropped 32% in the last quarter. On the bright side the returns have been quite good over the last half decade. Its return of 68% has certainly bested the market return!

While this past week has detracted from the company's five-year return, let's look at the recent trends of the underlying business and see if the gains have been in alignment.

See our latest analysis for ABOV Semiconductor

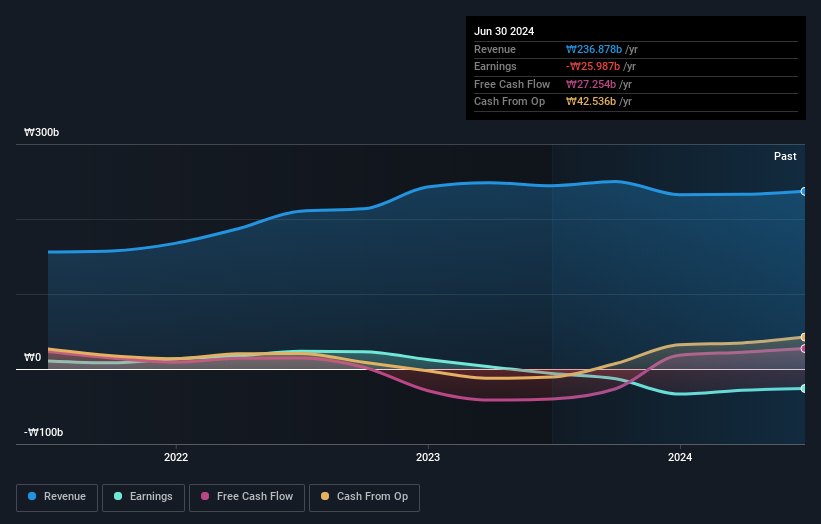

Because ABOV Semiconductor made a loss in the last twelve months, we think the market is probably more focussed on revenue and revenue growth, at least for now. When a company doesn't make profits, we'd generally hope to see good revenue growth. That's because fast revenue growth can be easily extrapolated to forecast profits, often of considerable size.

In the last 5 years ABOV Semiconductor saw its revenue grow at 17% per year. Even measured against other revenue-focussed companies, that's a good result. It's good to see that the stock has 11%, but not entirely surprising given revenue shows strong growth. If you think there could be more growth to come, now might be the time to take a close look at ABOV Semiconductor. Of course, you'll have to research the business more fully to figure out if this is an attractive opportunity.

You can see below how earnings and revenue have changed over time (discover the exact values by clicking on the image).

This free interactive report on ABOV Semiconductor's balance sheet strength is a great place to start, if you want to investigate the stock further.

What About Dividends?

When looking at investment returns, it is important to consider the difference between total shareholder return (TSR) and share price return. The TSR incorporates the value of any spin-offs or discounted capital raisings, along with any dividends, based on the assumption that the dividends are reinvested. Arguably, the TSR gives a more comprehensive picture of the return generated by a stock. As it happens, ABOV Semiconductor's TSR for the last 5 years was 84%, which exceeds the share price return mentioned earlier. And there's no prize for guessing that the dividend payments largely explain the divergence!

A Different Perspective

It's nice to see that ABOV Semiconductor shareholders have received a total shareholder return of 26% over the last year. Of course, that includes the dividend. Since the one-year TSR is better than the five-year TSR (the latter coming in at 13% per year), it would seem that the stock's performance has improved in recent times. In the best case scenario, this may hint at some real business momentum, implying that now could be a great time to delve deeper. It's always interesting to track share price performance over the longer term. But to understand ABOV Semiconductor better, we need to consider many other factors. For instance, we've identified 2 warning signs for ABOV Semiconductor (1 is concerning) that you should be aware of.

If you would prefer to check out another company -- one with potentially superior financials -- then do not miss this free list of companies that have proven they can grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on South Korean exchanges.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KOSDAQ:A102120

ABOV Semiconductor

Designs, manufactures, and sells microcontrollers, and memory and semiconductor solutions in South Korea and internationally.

Adequate balance sheet and fair value.