- South Korea

- /

- Semiconductors

- /

- KOSDAQ:A078150

Will the Promising Trends At HB TechnologyLTD (KOSDAQ:078150) Continue?

Finding a business that has the potential to grow substantially is not easy, but it is possible if we look at a few key financial metrics. Typically, we'll want to notice a trend of growing return on capital employed (ROCE) and alongside that, an expanding base of capital employed. Put simply, these types of businesses are compounding machines, meaning they are continually reinvesting their earnings at ever-higher rates of return. So when we looked at HB TechnologyLTD (KOSDAQ:078150) and its trend of ROCE, we really liked what we saw.

What is Return On Capital Employed (ROCE)?

For those who don't know, ROCE is a measure of a company's yearly pre-tax profit (its return), relative to the capital employed in the business. The formula for this calculation on HB TechnologyLTD is:

Return on Capital Employed = Earnings Before Interest and Tax (EBIT) ÷ (Total Assets - Current Liabilities)

0.079 = ₩18b ÷ (₩287b - ₩57b) (Based on the trailing twelve months to September 2020).

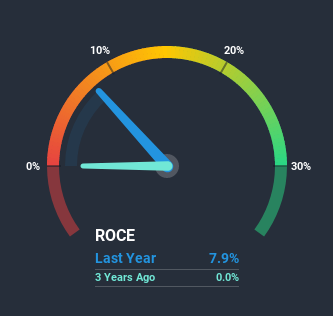

Thus, HB TechnologyLTD has an ROCE of 7.9%. On its own, that's a low figure but it's around the 9.8% average generated by the Semiconductor industry.

Check out our latest analysis for HB TechnologyLTD

Above you can see how the current ROCE for HB TechnologyLTD compares to its prior returns on capital, but there's only so much you can tell from the past. If you'd like to see what analysts are forecasting going forward, you should check out our free report for HB TechnologyLTD.

How Are Returns Trending?

HB TechnologyLTD's ROCE growth is quite impressive. The figures show that over the last two years, ROCE has grown 188% whilst employing roughly the same amount of capital. So our take on this is that the business has increased efficiencies to generate these higher returns, all the while not needing to make any additional investments. It's worth looking deeper into this though because while it's great that the business is more efficient, it might also mean that going forward the areas to invest internally for the organic growth are lacking.

The Bottom Line On HB TechnologyLTD's ROCE

To sum it up, HB TechnologyLTD is collecting higher returns from the same amount of capital, and that's impressive. Investors may not be impressed by the favorable underlying trends yet because over the last five years the stock has only returned 19% to shareholders. So with that in mind, we think the stock deserves further research.

On a separate note, we've found 1 warning sign for HB TechnologyLTD you'll probably want to know about.

For those who like to invest in solid companies, check out this free list of companies with solid balance sheets and high returns on equity.

If you’re looking to trade HB TechnologyLTD, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if HB TechnologyLTD might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

About KOSDAQ:A078150

HB TechnologyLTD

Engages in the manufacture and sale of inspection display equipment in South Korea and internationally.

Excellent balance sheet and slightly overvalued.

Similar Companies

Market Insights

Community Narratives