- South Korea

- /

- Semiconductors

- /

- KOSDAQ:A078150

HB Technology CO.,LTD. (KOSDAQ:078150) Might Not Be As Mispriced As It Looks After Plunging 26%

The HB Technology CO.,LTD. (KOSDAQ:078150) share price has fared very poorly over the last month, falling by a substantial 26%. Instead of being rewarded, shareholders who have already held through the last twelve months are now sitting on a 20% share price drop.

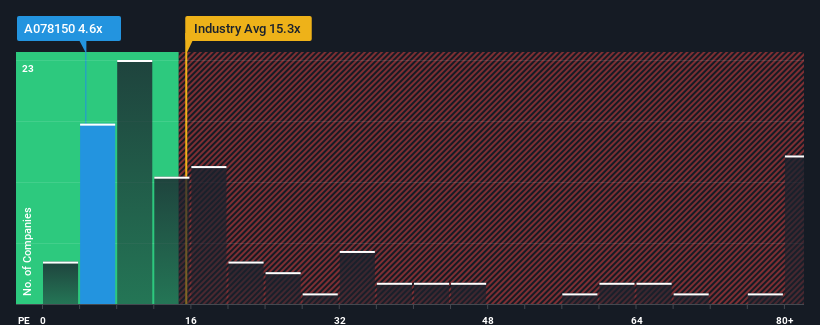

In spite of the heavy fall in price, given about half the companies in Korea have price-to-earnings ratios (or "P/E's") above 12x, you may still consider HB TechnologyLTD as a highly attractive investment with its 4.6x P/E ratio. However, the P/E might be quite low for a reason and it requires further investigation to determine if it's justified.

HB TechnologyLTD hasn't been tracking well recently as its declining earnings compare poorly to other companies, which have seen some growth on average. It seems that many are expecting the dour earnings performance to persist, which has repressed the P/E. If this is the case, then existing shareholders will probably struggle to get excited about the future direction of the share price.

View our latest analysis for HB TechnologyLTD

Does Growth Match The Low P/E?

There's an inherent assumption that a company should far underperform the market for P/E ratios like HB TechnologyLTD's to be considered reasonable.

Taking a look back first, the company's earnings per share growth last year wasn't something to get excited about as it posted a disappointing decline of 13%. Unfortunately, that's brought it right back to where it started three years ago with EPS growth being virtually non-existent overall during that time. Accordingly, shareholders probably wouldn't have been overly satisfied with the unstable medium-term growth rates.

Turning to the outlook, the next year should generate growth of 131% as estimated by the lone analyst watching the company. Meanwhile, the rest of the market is forecast to only expand by 34%, which is noticeably less attractive.

With this information, we find it odd that HB TechnologyLTD is trading at a P/E lower than the market. It looks like most investors are not convinced at all that the company can achieve future growth expectations.

The Key Takeaway

Having almost fallen off a cliff, HB TechnologyLTD's share price has pulled its P/E way down as well. It's argued the price-to-earnings ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

We've established that HB TechnologyLTD currently trades on a much lower than expected P/E since its forecast growth is higher than the wider market. When we see a strong earnings outlook with faster-than-market growth, we assume potential risks are what might be placing significant pressure on the P/E ratio. At least price risks look to be very low, but investors seem to think future earnings could see a lot of volatility.

It's always necessary to consider the ever-present spectre of investment risk. We've identified 3 warning signs with HB TechnologyLTD, and understanding them should be part of your investment process.

Of course, you might find a fantastic investment by looking at a few good candidates. So take a peek at this free list of companies with a strong growth track record, trading on a low P/E.

Valuation is complex, but we're here to simplify it.

Discover if HB TechnologyLTD might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KOSDAQ:A078150

HB TechnologyLTD

Engages in the manufacture and sale of inspection display equipment in South Korea and internationally.

Excellent balance sheet and overvalued.

Similar Companies

Market Insights

Community Narratives