- South Korea

- /

- Semiconductors

- /

- KOSDAQ:A066980

Hansung Cleantech Co., Ltd. (KOSDAQ:066980) Might Not Be As Mispriced As It Looks After Plunging 25%

To the annoyance of some shareholders, Hansung Cleantech Co., Ltd. (KOSDAQ:066980) shares are down a considerable 25% in the last month, which continues a horrid run for the company. The drop over the last 30 days has capped off a tough year for shareholders, with the share price down 47% in that time.

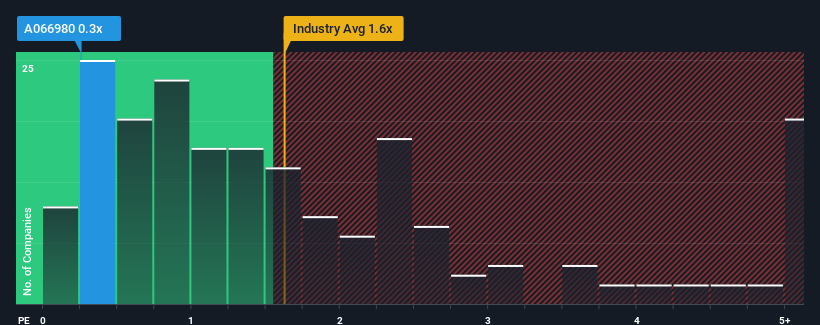

Even after such a large drop in price, when close to half the companies operating in Korea's Semiconductor industry have price-to-sales ratios (or "P/S") above 1.6x, you may still consider Hansung Cleantech as an enticing stock to check out with its 0.3x P/S ratio. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's limited.

View our latest analysis for Hansung Cleantech

How Hansung Cleantech Has Been Performing

We'd have to say that with no tangible growth over the last year, Hansung Cleantech's revenue has been unimpressive. It might be that many expect the uninspiring revenue performance to worsen, which has repressed the P/S. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's out of favour.

We don't have analyst forecasts, but you can see how recent trends are setting up the company for the future by checking out our free report on Hansung Cleantech's earnings, revenue and cash flow.What Are Revenue Growth Metrics Telling Us About The Low P/S?

There's an inherent assumption that a company should underperform the industry for P/S ratios like Hansung Cleantech's to be considered reasonable.

Retrospectively, the last year delivered virtually the same number to the company's top line as the year before. Spectacularly, three year revenue growth has ballooned by several orders of magnitude, even though the last 12 months were nothing to write home about. So while the company has done a great job in the past, it's somewhat concerning to see revenue growth decline so harshly.

This is in contrast to the rest of the industry, which is expected to grow by 88% over the next year, materially lower than the company's recent medium-term annualised growth rates.

With this in mind, we find it intriguing that Hansung Cleantech's P/S isn't as high compared to that of its industry peers. Apparently some shareholders believe the recent performance has exceeded its limits and have been accepting significantly lower selling prices.

The Bottom Line On Hansung Cleantech's P/S

Hansung Cleantech's recently weak share price has pulled its P/S back below other Semiconductor companies. We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

Our examination of Hansung Cleantech revealed its three-year revenue trends aren't boosting its P/S anywhere near as much as we would have predicted, given they look better than current industry expectations. Potential investors that are sceptical over continued revenue performance may be preventing the P/S ratio from matching previous strong performance. At least price risks look to be very low if recent medium-term revenue trends continue, but investors seem to think future revenue could see a lot of volatility.

Before you take the next step, you should know about the 4 warning signs for Hansung Cleantech that we have uncovered.

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

Valuation is complex, but we're here to simplify it.

Discover if Hansung Cleantech might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About KOSDAQ:A066980

Good value with adequate balance sheet.

Market Insights

Community Narratives