- South Korea

- /

- Semiconductors

- /

- KOSDAQ:A054090

Samjin LND Co., Ltd. (KOSDAQ:054090) Looks Inexpensive After Falling 27% But Perhaps Not Attractive Enough

Samjin LND Co., Ltd. (KOSDAQ:054090) shareholders won't be pleased to see that the share price has had a very rough month, dropping 27% and undoing the prior period's positive performance. The recent drop completes a disastrous twelve months for shareholders, who are sitting on a 50% loss during that time.

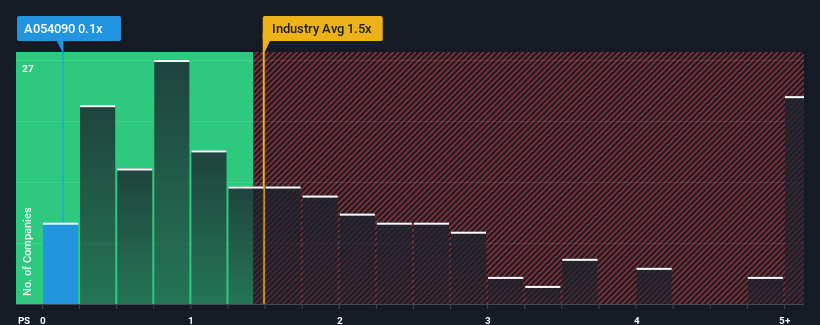

After such a large drop in price, given about half the companies operating in Korea's Semiconductor industry have price-to-sales ratios (or "P/S") above 1.5x, you may consider Samjin LND as an attractive investment with its 0.1x P/S ratio. However, the P/S might be low for a reason and it requires further investigation to determine if it's justified.

See our latest analysis for Samjin LND

How Has Samjin LND Performed Recently?

As an illustration, revenue has deteriorated at Samjin LND over the last year, which is not ideal at all. One possibility is that the P/S is low because investors think the company won't do enough to avoid underperforming the broader industry in the near future. Those who are bullish on Samjin LND will be hoping that this isn't the case so that they can pick up the stock at a lower valuation.

We don't have analyst forecasts, but you can see how recent trends are setting up the company for the future by checking out our free report on Samjin LND's earnings, revenue and cash flow.Is There Any Revenue Growth Forecasted For Samjin LND?

The only time you'd be truly comfortable seeing a P/S as low as Samjin LND's is when the company's growth is on track to lag the industry.

Taking a look back first, the company's revenue growth last year wasn't something to get excited about as it posted a disappointing decline of 12%. Regardless, revenue has managed to lift by a handy 15% in aggregate from three years ago, thanks to the earlier period of growth. Although it's been a bumpy ride, it's still fair to say the revenue growth recently has been mostly respectable for the company.

This is in contrast to the rest of the industry, which is expected to grow by 87% over the next year, materially higher than the company's recent medium-term annualised growth rates.

With this in consideration, it's easy to understand why Samjin LND's P/S falls short of the mark set by its industry peers. Apparently many shareholders weren't comfortable holding on to something they believe will continue to trail the wider industry.

The Bottom Line On Samjin LND's P/S

Samjin LND's recently weak share price has pulled its P/S back below other Semiconductor companies. Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

As we suspected, our examination of Samjin LND revealed its three-year revenue trends are contributing to its low P/S, given they look worse than current industry expectations. At this stage investors feel the potential for an improvement in revenue isn't great enough to justify a higher P/S ratio. Unless the recent medium-term conditions improve, they will continue to form a barrier for the share price around these levels.

Plus, you should also learn about these 2 warning signs we've spotted with Samjin LND (including 1 which doesn't sit too well with us).

If you're unsure about the strength of Samjin LND's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KOSDAQ:A054090

Samjin LND

Manufactures and sells LCD and TV parts, secondary cells, office automation parts, automobile parts, molds, LED lighting products, and light guide plate products in South Korea, the United States, Mexico, and Vietnam.

Good value with mediocre balance sheet.

Market Insights

Community Narratives