- South Korea

- /

- Biotech

- /

- KOSDAQ:A096530

Top KRX Growth Companies With High Insider Ownership August 2024

Reviewed by Simply Wall St

The South Korean market has climbed 4.1% in the last 7 days and is up 5.1% over the last 12 months, with earnings forecast to grow by 28% annually. In this favorable environment, growth companies with high insider ownership can be particularly attractive as they often indicate strong confidence from those closest to the business.

Top 10 Growth Companies With High Insider Ownership In South Korea

| Name | Insider Ownership | Earnings Growth |

| People & Technology (KOSDAQ:A137400) | 16.5% | 35.6% |

| ALTEOGEN (KOSDAQ:A196170) | 26.6% | 72.9% |

| Bioneer (KOSDAQ:A064550) | 17.5% | 89.7% |

| Global Tax Free (KOSDAQ:A204620) | 21.4% | 90.6% |

| Seojin SystemLtd (KOSDAQ:A178320) | 29.6% | 58.7% |

| Park Systems (KOSDAQ:A140860) | 33% | 37.5% |

| Vuno (KOSDAQ:A338220) | 19.5% | 110.9% |

| HANA Micron (KOSDAQ:A067310) | 20.2% | 97.4% |

| UTI (KOSDAQ:A179900) | 33.1% | 122.7% |

| Techwing (KOSDAQ:A089030) | 18.7% | 77.8% |

Here's a peek at a few of the choices from the screener.

EO Technics (KOSDAQ:A039030)

Simply Wall St Growth Rating: ★★★★★☆

Overview: EO Technics Co., Ltd. manufactures and supplies laser processing equipment worldwide, with a market cap of ₩2.10 trillion.

Operations: The Semiconductor Machine Division generates revenue of ₩305.34 billion for EO Technics Co., Ltd.

Insider Ownership: 30.7%

Revenue Growth Forecast: 25.2% p.a.

EO Technics, a South Korean company with significant insider ownership, is forecasted to experience substantial growth. Analysts predict earnings will grow 48.08% annually over the next three years, with revenue increasing by 25.2% per year—outpacing the market average of 10.7%. Despite trading at 6.2% below its fair value and expectations for a price rise of 48.5%, the stock has been highly volatile recently and profit margins have declined from last year’s figures.

- Navigate through the intricacies of EO Technics with our comprehensive analyst estimates report here.

- The analysis detailed in our EO Technics valuation report hints at an inflated share price compared to its estimated value.

Seegene (KOSDAQ:A096530)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Seegene, Inc. manufactures and sells molecular diagnostics products worldwide, with a market cap of ₩1.59 trillion.

Operations: The company generates revenue of ₩367.27 billion from its diagnostic kits and equipment segment.

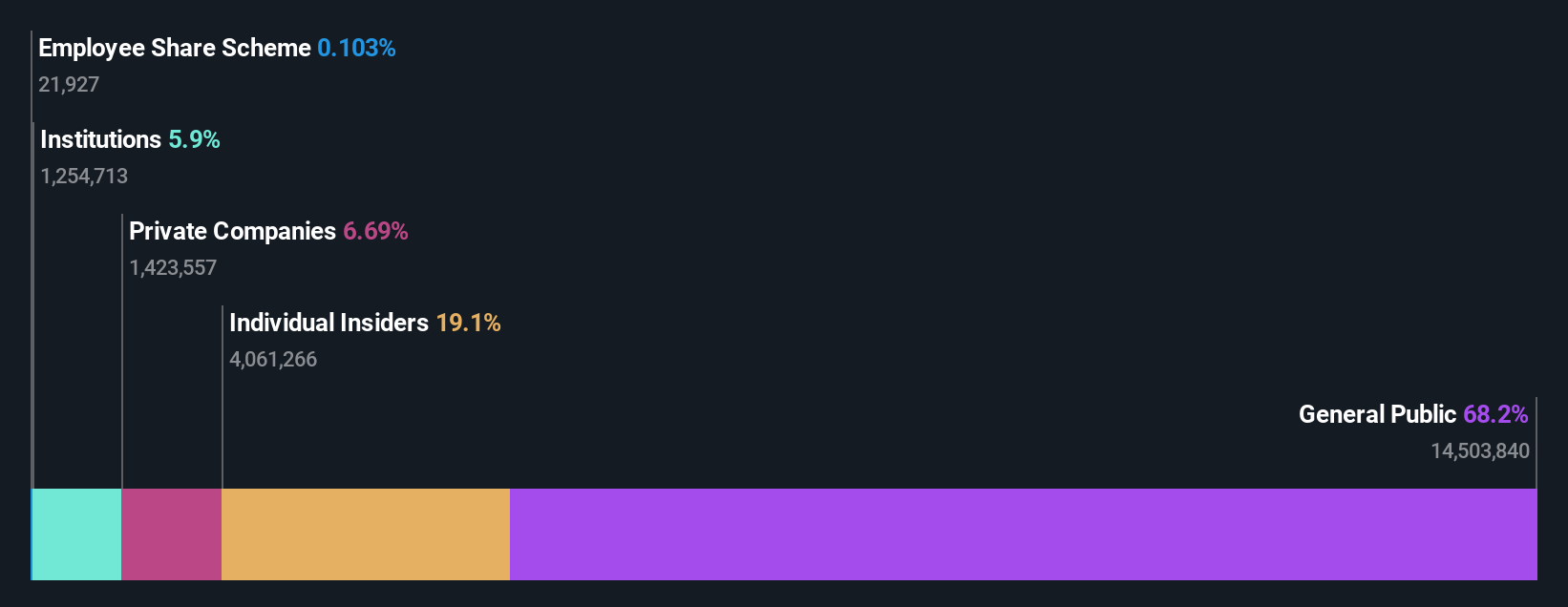

Insider Ownership: 35.7%

Revenue Growth Forecast: 13.9% p.a.

Seegene, with high insider ownership, is forecasted to become profitable within three years and achieve earnings growth of 62.61% annually. Revenue is expected to grow at 13.9% per year, faster than the South Korean market average of 10.7%. However, its Return on Equity is projected to be low at 4%, and the dividend yield of 2.32% isn't well covered by earnings. Recently, Seegene extended its buyback plan duration until July 14, 2025.

- Take a closer look at Seegene's potential here in our earnings growth report.

- Insights from our recent valuation report point to the potential overvaluation of Seegene shares in the market.

Enchem (KOSDAQ:A348370)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Enchem Co., Ltd. manufactures and sells electrolytes and additives for secondary batteries and EDLC, with a market cap of ₩4.26 billion.

Operations: Electronic components and parts generated ₩357.37 billion in revenue for Enchem Co., Ltd.

Insider Ownership: 19.4%

Revenue Growth Forecast: 56.5% p.a.

Enchem, with significant insider ownership, is forecast to become profitable within three years and achieve earnings growth of 144.8% annually. Its revenue is expected to grow at 56.5% per year, significantly outpacing the South Korean market average of 10.7%. However, the share price has been highly volatile over the past three months and shareholders have experienced dilution in the past year.

- Delve into the full analysis future growth report here for a deeper understanding of Enchem.

- Our valuation report unveils the possibility Enchem's shares may be trading at a premium.

Turning Ideas Into Actions

- Dive into all 88 of the Fast Growing KRX Companies With High Insider Ownership we have identified here.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About KOSDAQ:A096530

Reasonable growth potential with adequate balance sheet.