- South Korea

- /

- Specialty Stores

- /

- KOSE:A008770

KRX Stocks That May Be Priced Below Intrinsic Value In October 2024

Reviewed by Simply Wall St

As the South Korean stock market experiences slight fluctuations, with the KOSPI index hovering just below the 2,600-point mark amid mixed performances across sectors, investors are closely monitoring global economic indicators and interest rate expectations. In this environment of cautious optimism and potential volatility, identifying stocks that may be priced below their intrinsic value can offer opportunities for those seeking to capitalize on market inefficiencies.

Top 10 Undervalued Stocks Based On Cash Flows In South Korea

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| T'Way Air (KOSE:A091810) | ₩3475.00 | ₩5734.24 | 39.4% |

| TSE (KOSDAQ:A131290) | ₩51200.00 | ₩99686.51 | 48.6% |

| Cosmecca Korea (KOSDAQ:A241710) | ₩77700.00 | ₩147763.77 | 47.4% |

| Lutronic (KOSDAQ:A085370) | ₩36700.00 | ₩63217.94 | 41.9% |

| Intellian Technologies (KOSDAQ:A189300) | ₩54500.00 | ₩91061.47 | 40.2% |

| Oscotec (KOSDAQ:A039200) | ₩39800.00 | ₩65156.22 | 38.9% |

| Shinsung E&GLtd (KOSE:A011930) | ₩1610.00 | ₩2946.48 | 45.4% |

| Global Tax Free (KOSDAQ:A204620) | ₩3585.00 | ₩6405.09 | 44% |

| Kakao Games (KOSDAQ:A293490) | ₩16960.00 | ₩29527.12 | 42.6% |

| Hotel ShillaLtd (KOSE:A008770) | ₩45600.00 | ₩75913.28 | 39.9% |

Let's take a closer look at a couple of our picks from the screened companies.

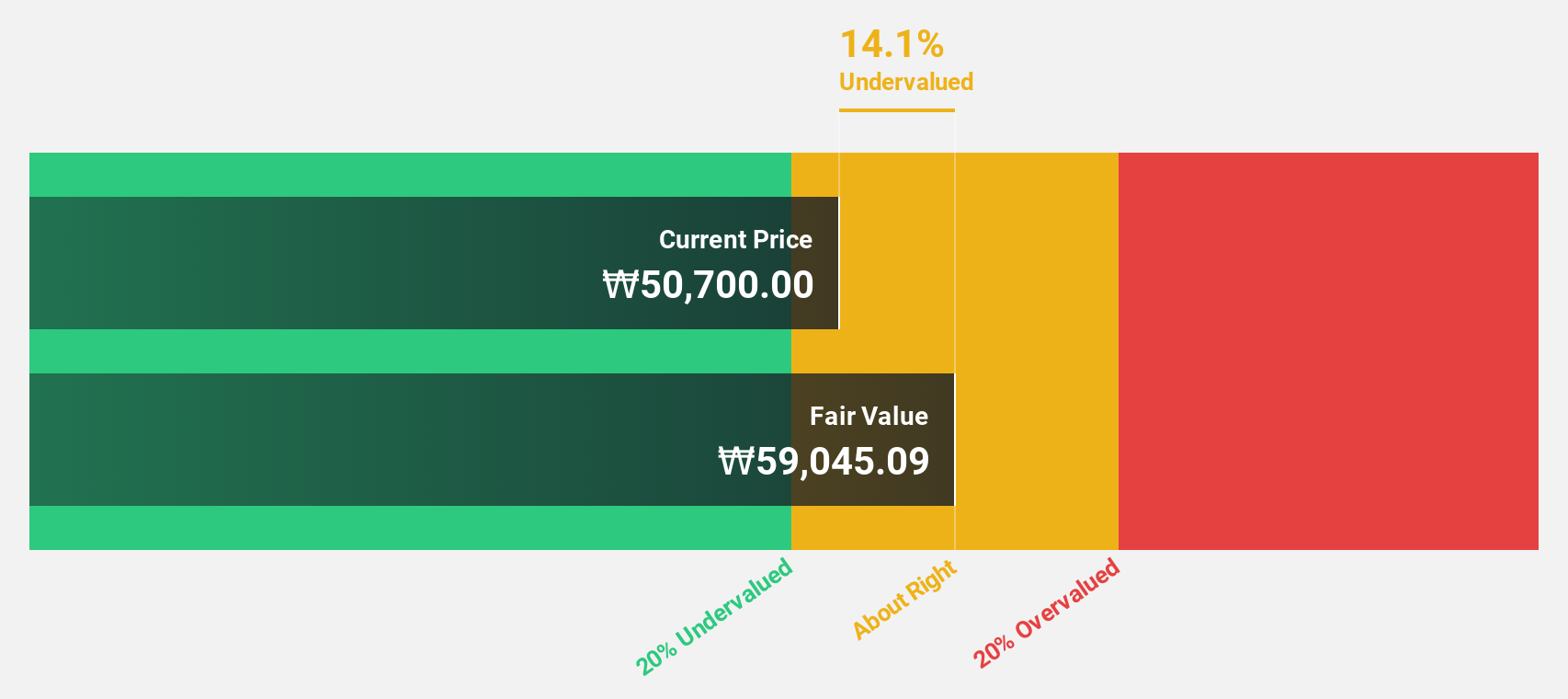

TSE (KOSDAQ:A131290)

Overview: TSE Co., Ltd offers semiconductor test solutions both in South Korea and internationally, with a market cap of approximately ₩547.04 billion.

Operations: The company's revenue segments include Electronic Product Inspection (₩112.77 billion), Semiconductor, Etc. Inspection Service (₩13.67 billion), Semiconductor Light Inspection Equipment (₩160.25 billion), and Semiconductors, Etc. & Production Line (₩21.04 billion).

Estimated Discount To Fair Value: 48.6%

TSE is trading at ₩51,200, significantly below its estimated fair value of ₩99,686.51 and 48.6% under analysts' price targets. Despite recent volatility, earnings are projected to grow at 48.5% annually over the next three years—outpacing the South Korean market's average growth rate of 30.3%. While revenue growth is slower than desired at 13.5%, it's still above the market average of 10.4%, highlighting its potential as an undervalued cash flow investment in South Korea.

- In light of our recent growth report, it seems possible that TSE's financial performance will exceed current levels.

- Delve into the full analysis health report here for a deeper understanding of TSE.

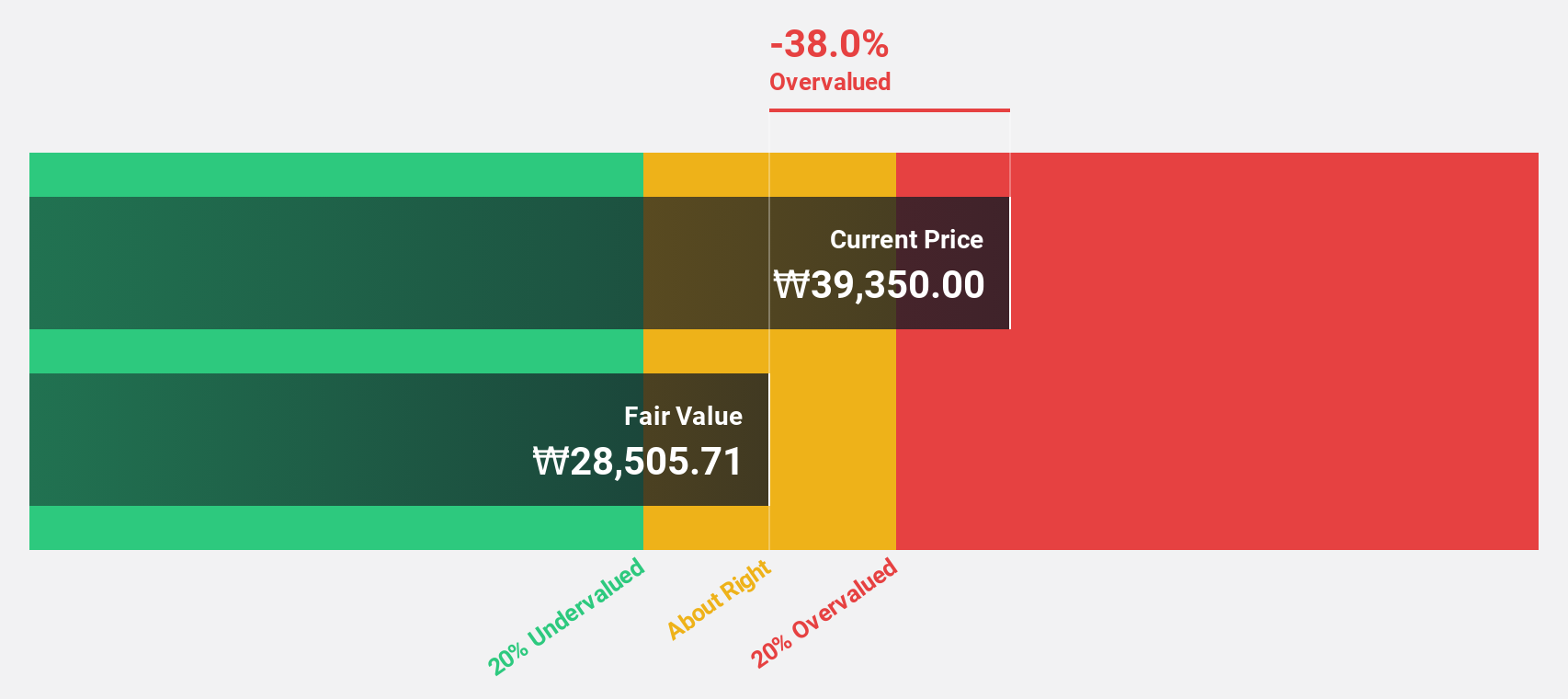

Hotel ShillaLtd (KOSE:A008770)

Overview: Hotel Shilla Co., Ltd is a hospitality company that operates both in South Korea and internationally, with a market cap of ₩1.72 trillion.

Operations: The company generates revenue through its Travel Retail segment, which accounts for ₩3.31 trillion, and its Hotel & Leisure sector, contributing ₩701.77 billion.

Estimated Discount To Fair Value: 39.9%

Hotel Shilla Ltd. is trading at ₩45,600, substantially below its estimated fair value of ₩75,913.28. The company is expected to become profitable in the next three years with earnings growth forecasted at 70.35% annually, surpassing average market expectations. Although revenue growth of 11.4% per year lags behind the desired rate of 20%, it still exceeds the South Korean market average of 10.4%. However, interest payments are not well covered by earnings, indicating potential financial strain.

- Our comprehensive growth report raises the possibility that Hotel ShillaLtd is poised for substantial financial growth.

- Click here and access our complete balance sheet health report to understand the dynamics of Hotel ShillaLtd.

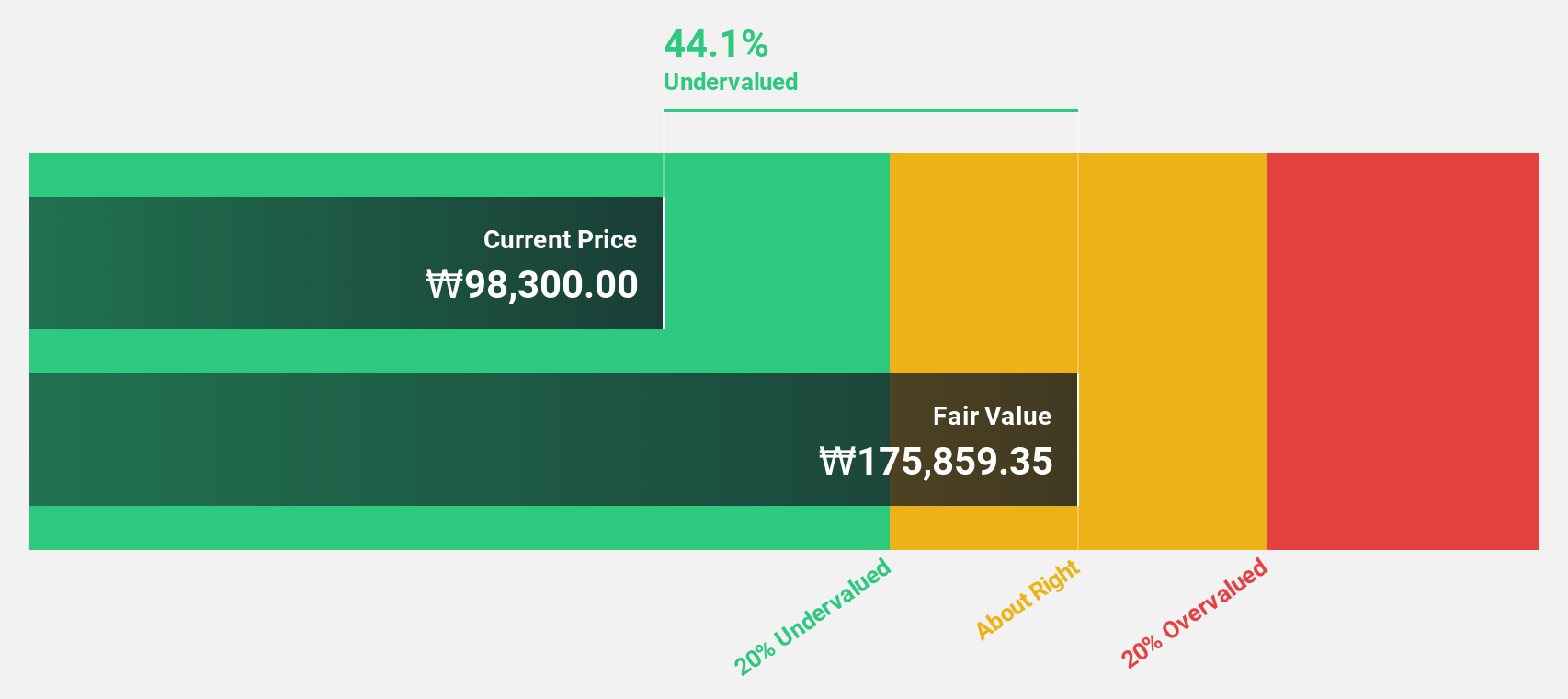

SK Biopharmaceuticals (KOSE:A326030)

Overview: SK Biopharmaceuticals Co., Ltd. is a pharmaceutical company focused on researching and developing drugs for central nervous system disorders, with a market cap of ₩9.23 trillion.

Operations: The company generates revenue of ₩465.06 million from its new drug development segment, focusing on treatments for central nervous system disorders.

Estimated Discount To Fair Value: 34.5%

SK Biopharmaceuticals is trading at ₩117,800, well below its estimated fair value of ₩179,969.09. The company turned profitable this year and anticipates robust earnings growth of 70.6% annually over the next three years, outpacing the South Korean market's average growth rate. Revenue is projected to grow at 22.4% per year, significantly faster than both the market average and desired benchmarks. However, recent earnings calls highlight ongoing strategic evaluations impacting investor sentiment.

- Upon reviewing our latest growth report, SK Biopharmaceuticals' projected financial performance appears quite optimistic.

- Take a closer look at SK Biopharmaceuticals' balance sheet health here in our report.

Where To Now?

- Unlock more gems! Our Undervalued KRX Stocks Based On Cash Flows screener has unearthed 29 more companies for you to explore.Click here to unveil our expertly curated list of 32 Undervalued KRX Stocks Based On Cash Flows.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Hotel ShillaLtd might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About KOSE:A008770

Hotel ShillaLtd

Operates as a hospitality company in South Korea and internationally.

Undervalued with reasonable growth potential.