- South Korea

- /

- Real Estate

- /

- KOSDAQ:A034810

Haesung Industrial (KOSDAQ:034810) Is Due To Pay A Dividend Of ₩225.00

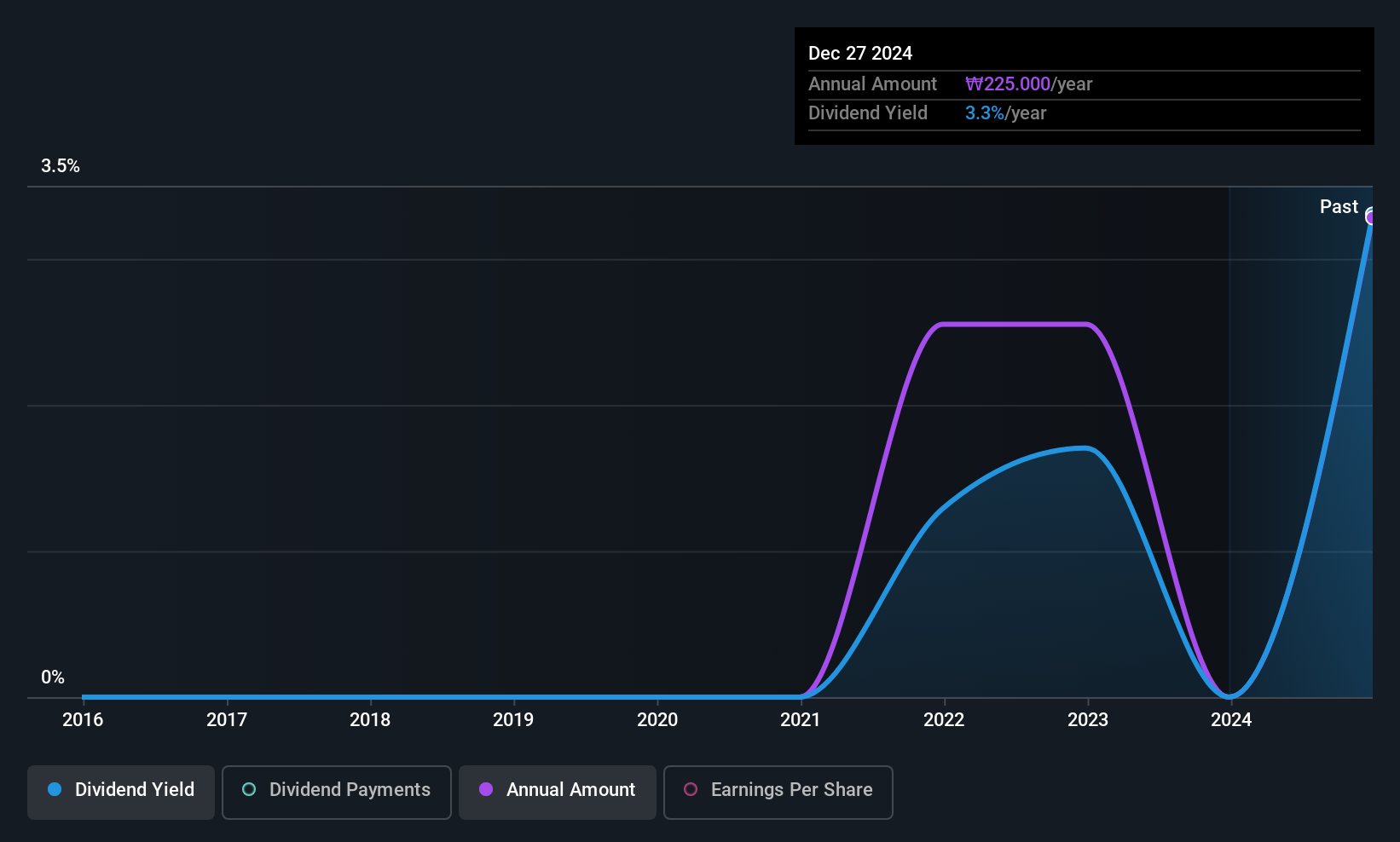

Haesung Industrial Co., Ltd. (KOSDAQ:034810) has announced that it will pay a dividend of ₩225.00 per share on the 28th of April. Including this payment, the dividend yield on the stock will be 3.1%, which is a modest boost for shareholders' returns.

Haesung Industrial's Distributions May Be Difficult To Sustain

Even a low dividend yield can be attractive if it is sustained for years on end. Even in the absence of profits, Haesung Industrial is paying a dividend. The company is also yet to generate cash flow, so the dividend sustainability is definitely questionable.

Looking forward, earnings per share could 90.5% over the next year if the trend of the last few years can't be broken. This will push the company into unprofitability, which means the managers will have to choose between suspending the dividend, or paying it out of cash reserves.

View our latest analysis for Haesung Industrial

Haesung Industrial Is Still Building Its Track Record

The dividend's track record has been pretty solid, but with only 5 years of history we want to see a few more years of history before making any solid conclusions. Since 2020, the dividend has gone from ₩175.00 total annually to ₩225.00. This works out to be a compound annual growth rate (CAGR) of approximately 5.2% a year over that time. Investors will likely want to see a longer track record of growth before making decision to add this to their income portfolio.

Dividend Growth Potential Is Shaky

Investors could be attracted to the stock based on the quality of its payment history. Let's not jump to conclusions as things might not be as good as they appear on the surface. Earnings per share has been sinking by 90% over the last five years. A sharp decline in earnings per share is not great from from a dividend perspective. Even conservative payout ratios can come under pressure if earnings fall far enough.

We're Not Big Fans Of Haesung Industrial's Dividend

Overall, while some might be pleased that the dividend wasn't cut, we think this may help Haesung Industrial make more consistent payments in the future. The company isn't making enough to be paying as much as it is, and the other factors don't look particularly promising either. Overall, the dividend is not reliable enough to make this a good income stock.

Investors generally tend to favour companies with a consistent, stable dividend policy as opposed to those operating an irregular one. However, there are other things to consider for investors when analysing stock performance. As an example, we've identified 3 warning signs for Haesung Industrial that you should be aware of before investing. If you are a dividend investor, you might also want to look at our curated list of high yield dividend stocks.

Valuation is complex, but we're here to simplify it.

Discover if Haesung Industrial might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KOSDAQ:A034810

Haesung Industrial

Engages in the real estate development, rental, and management business in South Korea.

Low risk and slightly overvalued.

Market Insights

Community Narratives