- South Korea

- /

- Biotech

- /

- KOSDAQ:A298380

KRX Growth Companies With High Insider Ownership In October 2024

Reviewed by Simply Wall St

Over the last seven days, the South Korean market has remained flat, yet it has climbed 3.8% over the past year with earnings forecasted to grow by 30% annually. In this context of steady growth and positive earnings projections, identifying growth companies with high insider ownership can provide valuable insights into potential investment opportunities in the KRX market.

Top 10 Growth Companies With High Insider Ownership In South Korea

| Name | Insider Ownership | Earnings Growth |

| People & Technology (KOSDAQ:A137400) | 16.4% | 35.6% |

| Seojin SystemLtd (KOSDAQ:A178320) | 30.8% | 49.1% |

| Bioneer (KOSDAQ:A064550) | 15.8% | 97.6% |

| Oscotec (KOSDAQ:A039200) | 26.1% | 122% |

| Park Systems (KOSDAQ:A140860) | 33% | 34.6% |

| Vuno (KOSDAQ:A338220) | 19.5% | 110.9% |

| HANA Micron (KOSDAQ:A067310) | 18.3% | 100.3% |

| UTI (KOSDAQ:A179900) | 33.1% | 134.6% |

| Techwing (KOSDAQ:A089030) | 18.7% | 83.6% |

| INTEKPLUS (KOSDAQ:A064290) | 16.3% | 96.7% |

Let's explore several standout options from the results in the screener.

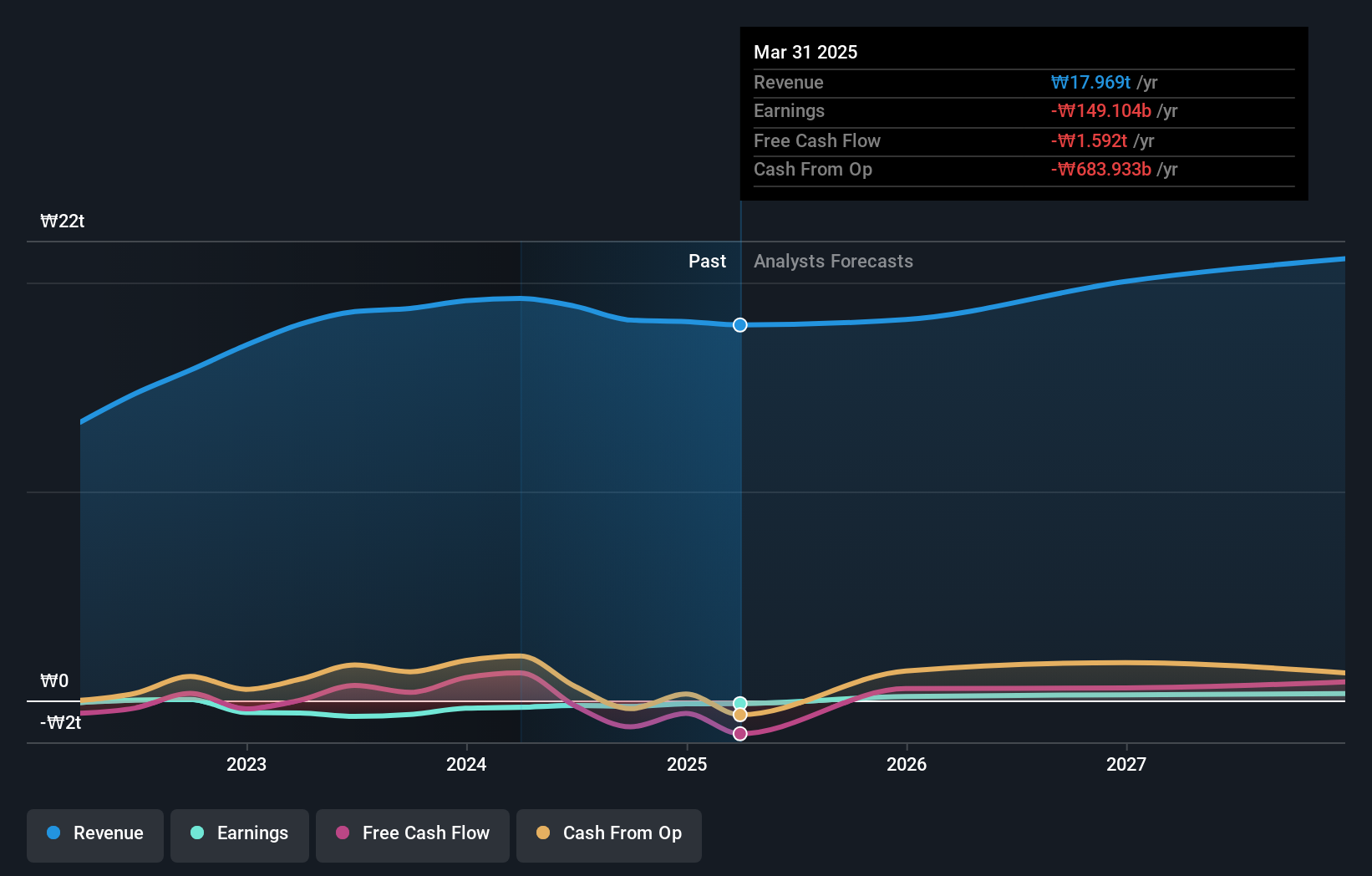

ALTEOGEN (KOSDAQ:A196170)

Simply Wall St Growth Rating: ★★★★★★

Overview: ALTEOGEN Inc. is a biotechnology company that specializes in developing long-acting biobetters, proprietary antibody-drug conjugates, and antibody biosimilars, with a market cap of ₩20.51 trillion.

Operations: The company's revenue is primarily derived from its biotechnology segment, amounting to ₩90.79 billion.

Insider Ownership: 26.6%

Earnings Growth Forecast: 99.5% p.a.

ALTEOGEN is trading at 70.4% below its estimated fair value, suggesting potential undervaluation. Its revenue is forecast to grow significantly faster than the South Korean market at 64.2% per year, and it is expected to become profitable in the next three years with a very high projected Return on Equity of 66.3%. However, shareholders have faced dilution over the past year, and its share price has been highly volatile recently.

- Dive into the specifics of ALTEOGEN here with our thorough growth forecast report.

- Our comprehensive valuation report raises the possibility that ALTEOGEN is priced higher than what may be justified by its financials.

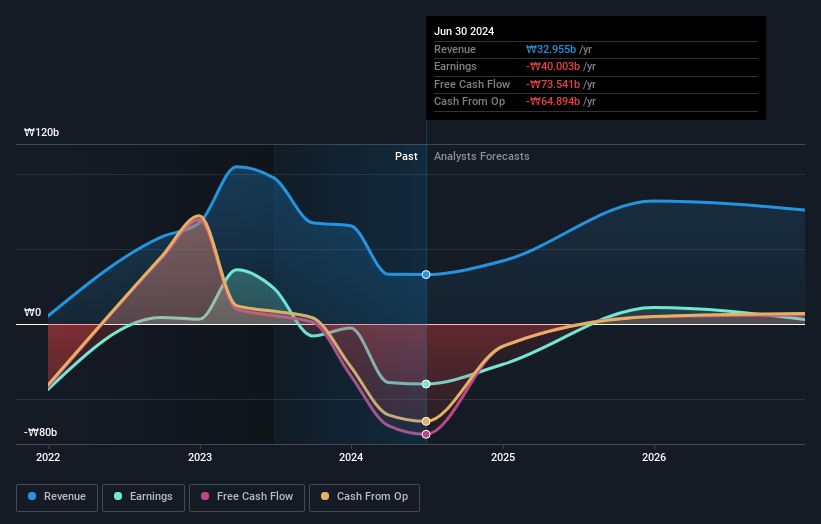

ABL Bio (KOSDAQ:A298380)

Simply Wall St Growth Rating: ★★★★★☆

Overview: ABL Bio Inc. is a biotech research company specializing in the development of therapeutic drugs for immuno-oncology and neurodegenerative diseases, with a market cap of ₩1.95 trillion.

Operations: The company's revenue is primarily generated from its biotechnology startups segment, amounting to ₩32.95 billion.

Insider Ownership: 30.5%

Earnings Growth Forecast: 48.2% p.a.

ABL Bio's revenue is projected to grow at 24.7% annually, outpacing the South Korean market's 10.4% growth rate, with earnings expected to increase by 48.15% per year. The company is anticipated to achieve profitability within three years, surpassing average market growth expectations. Despite a highly volatile share price recently, there has been no significant insider trading activity in the past three months, indicating stable insider confidence amidst its growth trajectory.

- Navigate through the intricacies of ABL Bio with our comprehensive analyst estimates report here.

- Upon reviewing our latest valuation report, ABL Bio's share price might be too optimistic.

Doosan (KOSE:A000150)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Doosan Corporation operates in heavy industry, machinery manufacturing, and apartment construction across South Korea, the United States, Asia, the Middle East, Europe, and globally with a market cap of approximately ₩2.83 trillion.

Operations: The company's revenue is primarily derived from Doosan Bobcat (₩9.31 billion), Doosan Energy (₩8.25 billion), Electronic BG (₩855.42 million), Doosan Fuel Cell (₩279.99 million), and Digital Innovation BU (₩286.29 million).

Insider Ownership: 38.9%

Earnings Growth Forecast: 65.5% p.a.

Doosan's earnings are forecast to grow significantly at 65.51% annually, with profitability expected within three years, surpassing average market growth. Despite its share price volatility and slower revenue growth of 3.7% per year compared to the South Korean market, Doosan trades at a substantial discount of 63.3% below estimated fair value. Recent inclusion in the S&P Global BMI Index highlights its growing recognition, though insider trading activity remains minimal over the past three months.

- Take a closer look at Doosan's potential here in our earnings growth report.

- The valuation report we've compiled suggests that Doosan's current price could be quite moderate.

Make It Happen

- Explore the 86 names from our Fast Growing KRX Companies With High Insider Ownership screener here.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About KOSDAQ:A298380

ABL Bio

A biotech research company, focuses on the development of therapeutic drugs for immuno-oncology and neurodegenerative diseases.

High growth potential with adequate balance sheet.