- South Korea

- /

- Entertainment

- /

- KOSE:A352820

High Growth Tech Stocks In South Korea Including 3 Promising Companies

Reviewed by Simply Wall St

In the last week, the South Korean market has stayed flat, yet it is up 8.7% over the past year with earnings expected to grow by 29% per annum over the next few years. In this context, identifying high growth tech stocks involves looking for companies that are well-positioned to capitalize on technological advancements and robust market conditions.

Top 10 High Growth Tech Companies In South Korea

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| IMLtd | 21.80% | 111.43% | ★★★★★★ |

| Seojin SystemLtd | 33.39% | 49.13% | ★★★★★★ |

| NEXON Games | 27.93% | 67.05% | ★★★★★★ |

| FLITTO | 32.60% | 106.82% | ★★★★★★ |

| Bioneer | 23.53% | 97.58% | ★★★★★★ |

| ALTEOGEN | 64.22% | 99.46% | ★★★★★★ |

| AmosenseLtd | 24.04% | 71.97% | ★★★★★★ |

| Devsisters | 29.08% | 63.02% | ★★★★★★ |

| Park Systems | 23.21% | 34.63% | ★★★★★★ |

| UTI | 114.97% | 134.60% | ★★★★★★ |

Click here to see the full list of 48 stocks from our KRX High Growth Tech and AI Stocks screener.

Here's a peek at a few of the choices from the screener.

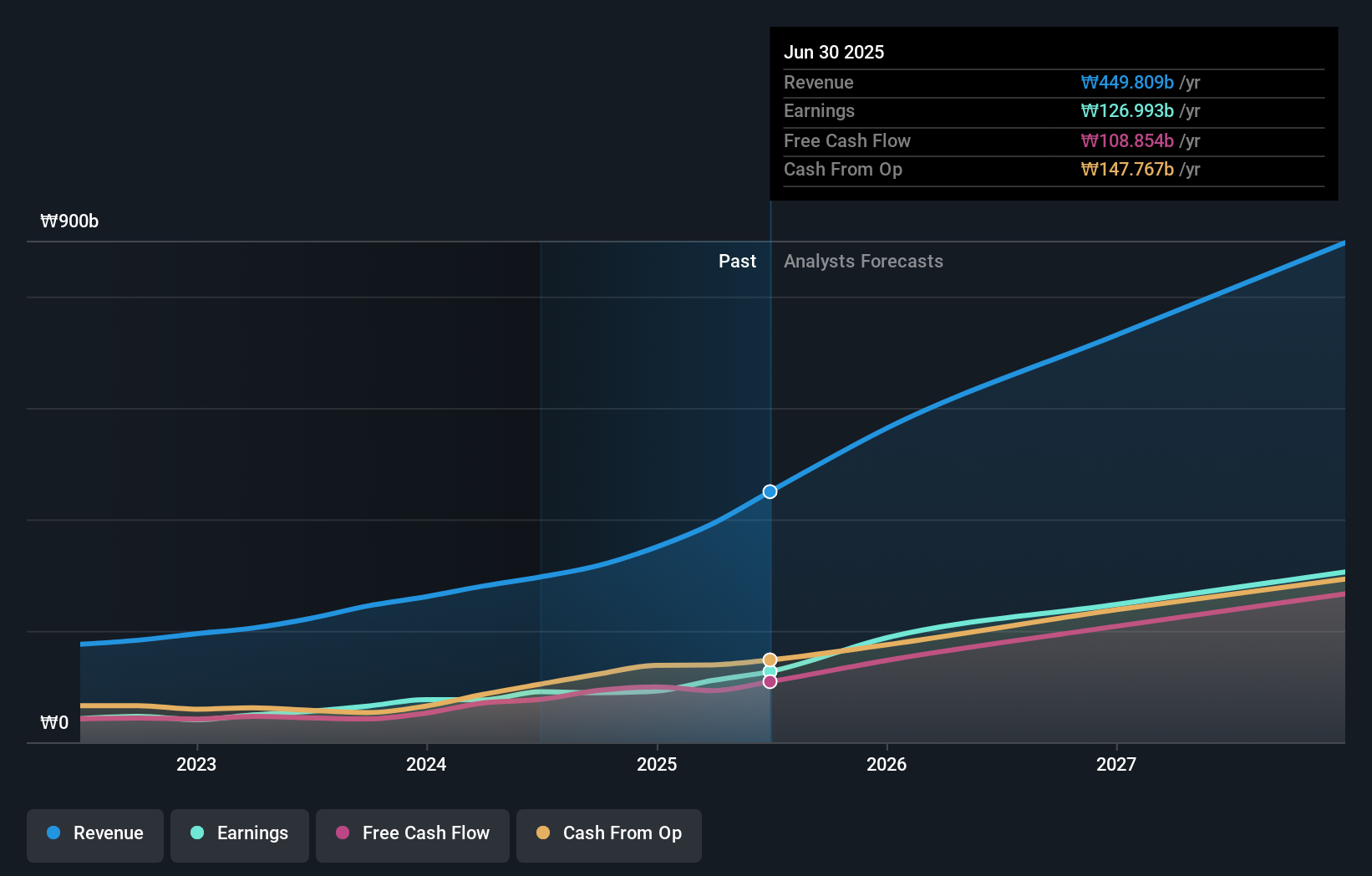

PharmaResearch (KOSDAQ:A214450)

Simply Wall St Growth Rating: ★★★★★☆

Overview: PharmaResearch Co., Ltd. is a biopharmaceutical company operating mainly in South Korea with a market capitalization of ₩2.38 trillion.

Operations: PharmaResearch Co., Ltd. generates revenue primarily from its pharmaceuticals segment, amounting to approximately ₩296.59 billion.

PharmaResearch has demonstrated robust growth, with revenue projected to increase by 22.3% annually, outpacing the South Korean market's average of 10.3%. This growth is supported by recent strategic moves, including a significant private placement that raised nearly KRW 200 billion, enhancing their financial flexibility for further innovations. Despite earnings expected to grow at 22.2%, slightly below the market average of 29.4%, PharmaResearch's past year earnings surged by an impressive 63.2%, indicating strong operational efficiency and market acceptance of its biotechnological advancements. With a high forecast return on equity at 21.3% in three years and high-quality past earnings, the company is well-positioned to leverage its R&D investments effectively amidst competitive pressures in the biotech sector.

- Delve into the full analysis health report here for a deeper understanding of PharmaResearch.

Explore historical data to track PharmaResearch's performance over time in our Past section.

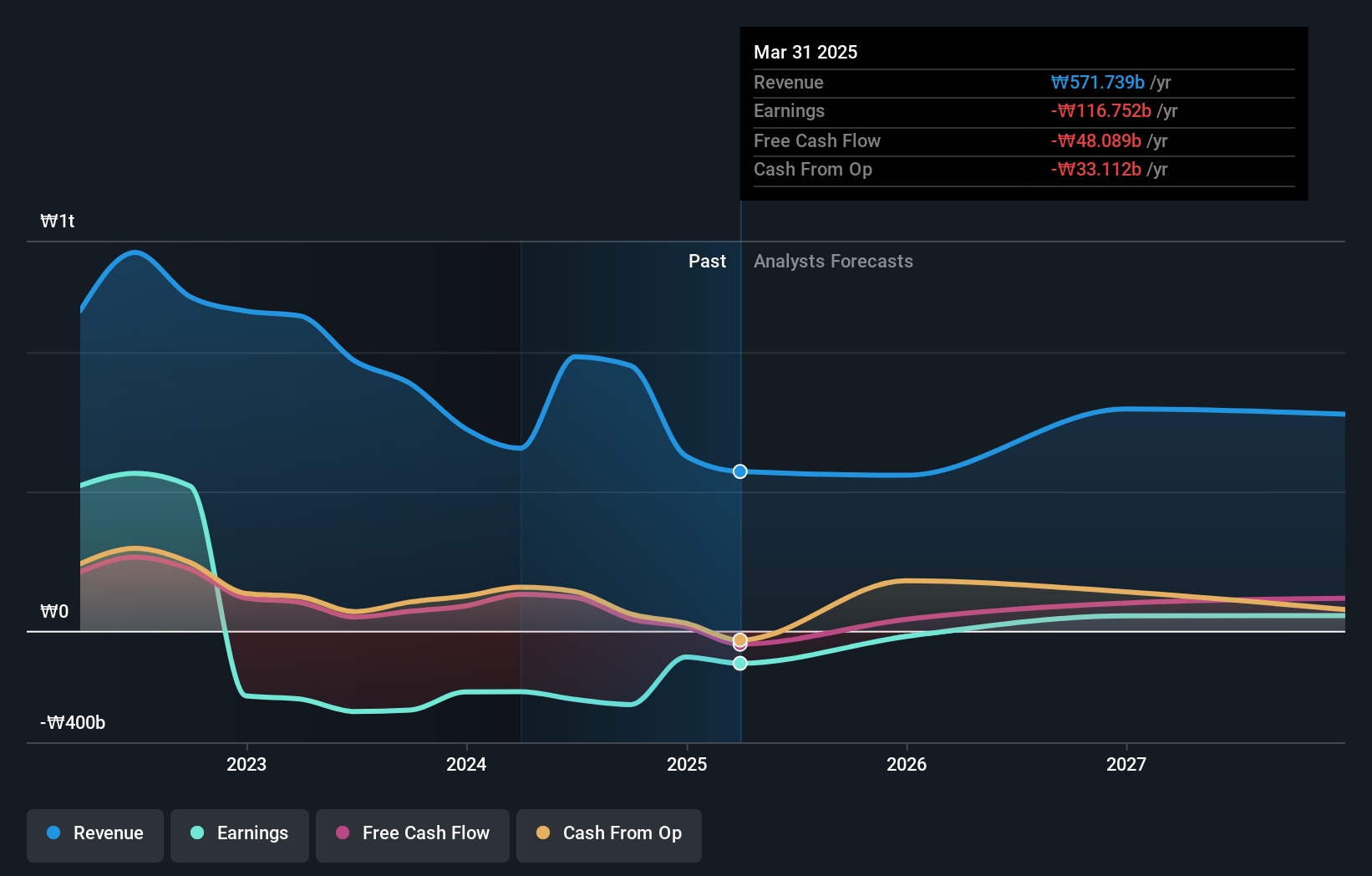

Kakao Games (KOSDAQ:A293490)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Kakao Games Corporation operates a mobile and PC online game service platform for gamers worldwide with a market capitalization of ₩1.37 trillion.

Operations: The company generates revenue primarily from its computer graphics segment, which amounts to ₩986.72 million.

Kakao Games, amidst a dynamic tech landscape in South Korea, has strategically bolstered its financial standing through a recent private placement raising KRW 270 billion. This move not only enhances its capacity for innovation but also supports an aggressive R&D strategy, crucial as it navigates the competitive gaming sector. With revenue growth projected at 10.5% annually and earnings expected to surge by 110.9%, the company is setting a robust pace against an industry growth rate of just over 10%. Despite current unprofitability, these figures reflect potential for significant market impact if trends continue favorably, underpinned by a focus on expanding into lucrative gaming niches and leveraging new technologies.

- Click here to discover the nuances of Kakao Games with our detailed analytical health report.

Assess Kakao Games' past performance with our detailed historical performance reports.

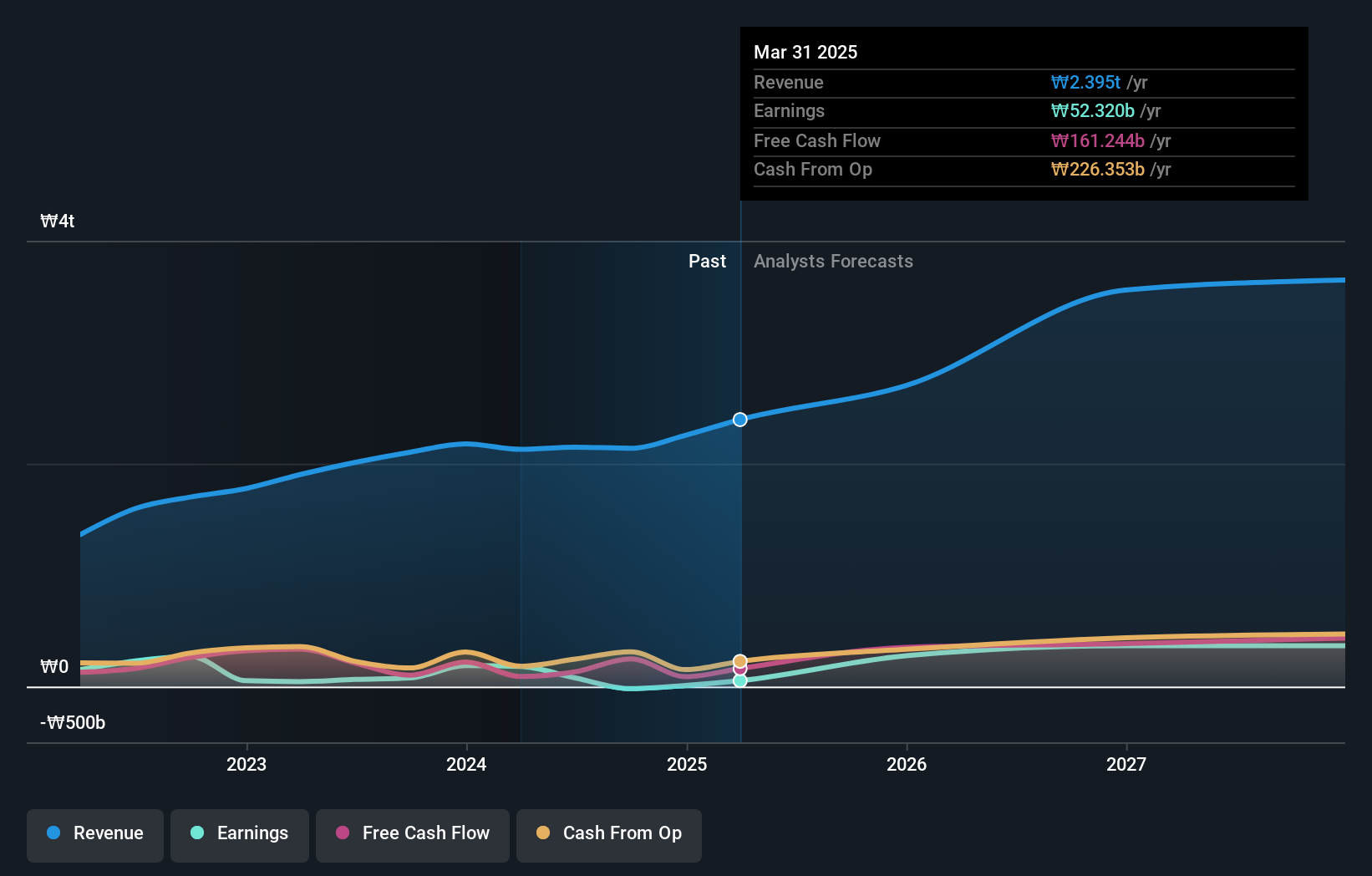

HYBE (KOSE:A352820)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: HYBE Co., Ltd. operates in music production, publishing, and artist development and management, with a market cap of ₩8.16 trillion.

Operations: HYBE Co., Ltd. generates revenue primarily from its Label and Solution segments, contributing significantly with figures of ₩1.28 trillion and ₩1.24 trillion, respectively. The Platform segment adds to its diverse income streams with ₩361.12 billion in revenue.

HYBE, a South Korean entertainment giant, has demonstrated resilience and strategic foresight in its financial activities. The company's recent share repurchase, totaling 150,000 shares for KRW 26.09 billion, underscores its commitment to stabilizing stock prices amidst fluctuating market conditions. Despite a significant one-off loss of ₩189.4 billion affecting the last year's financial results, HYBE has outpaced the industry with a 21.6% earnings growth compared to the entertainment sector’s average of 7.3%. Looking ahead, HYBE is poised for robust growth with earnings expected to surge by an impressive 42.5% annually and revenue projected to increase by 13.7% each year, signaling strong future prospects in an increasingly competitive landscape.

- Take a closer look at HYBE's potential here in our health report.

Evaluate HYBE's historical performance by accessing our past performance report.

Next Steps

- Explore the 48 names from our KRX High Growth Tech and AI Stocks screener here.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if HYBE might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About KOSE:A352820

HYBE

Engages in the music production, publishing, and artist development and management businesses.

Excellent balance sheet with reasonable growth potential.