High Growth Tech And 2 Other Promising Stocks Backed By Strong Fundamentals

Reviewed by Simply Wall St

In recent weeks, global markets have experienced broad-based gains, with smaller-cap indexes notably outperforming their larger counterparts as U.S. indexes approach record highs and economic indicators like jobless claims hitting favorable levels. Amidst this backdrop of positive sentiment and stable macroeconomic conditions, identifying stocks with strong fundamentals is crucial for investors looking to capitalize on high growth opportunities in the tech sector and beyond.

Top 10 High Growth Tech Companies

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Yggdrazil Group | 24.66% | 85.53% | ★★★★★★ |

| eWeLLLtd | 27.24% | 28.74% | ★★★★★★ |

| Waystream Holding | 22.16% | 113.25% | ★★★★★★ |

| Pharma Mar | 25.97% | 56.89% | ★★★★★★ |

| Ascelia Pharma | 76.15% | 47.16% | ★★★★★★ |

| Sarepta Therapeutics | 24.00% | 42.88% | ★★★★★★ |

| TG Therapeutics | 34.66% | 56.98% | ★★★★★★ |

| Elliptic Laboratories | 65.73% | 103.55% | ★★★★★★ |

| Alkami Technology | 21.89% | 98.60% | ★★★★★★ |

| Travere Therapeutics | 31.70% | 72.51% | ★★★★★★ |

Click here to see the full list of 1292 stocks from our High Growth Tech and AI Stocks screener.

Let's dive into some prime choices out of from the screener.

PharmaResearch (KOSDAQ:A214450)

Simply Wall St Growth Rating: ★★★★★☆

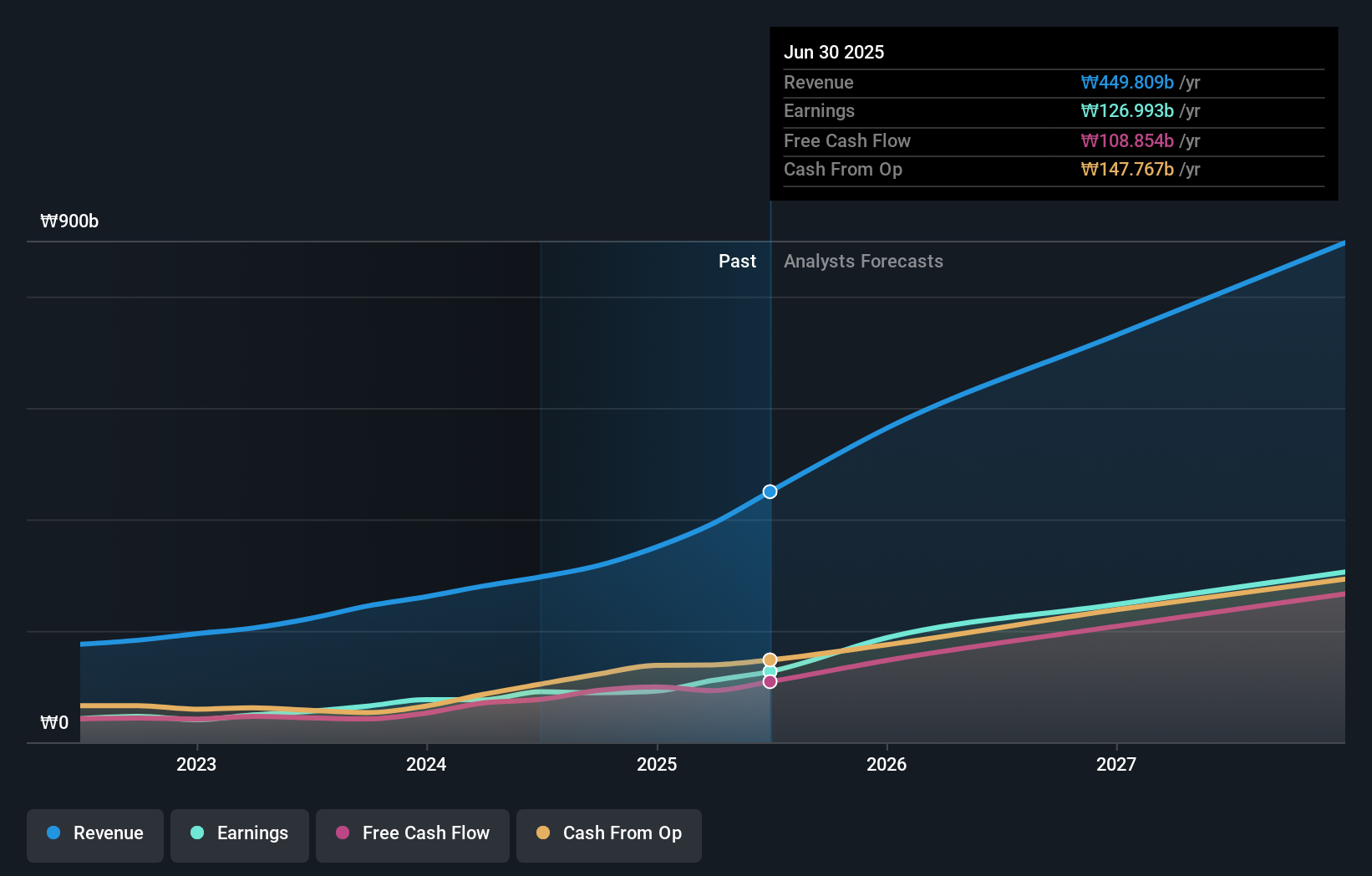

Overview: PharmaResearch Co., Ltd., along with its subsidiaries, is a biopharmaceutical company operating mainly in South Korea with a market cap of ₩2.08 billion.

Operations: The company generates revenue primarily from its pharmaceuticals segment, amounting to ₩296.59 billion. With a market cap of approximately ₩2.08 trillion, it focuses on the biopharmaceutical sector in South Korea.

PharmaResearch has demonstrated robust growth, outpacing the biotech industry with a 63.2% earnings increase over the past year, significantly ahead of the industry's -1.3%. This upward trajectory is supported by projections of a 25.3% annual earnings growth and an even more impressive revenue forecast at 24.3% per year, both figures notably surpassing broader market averages. The company's strategic moves, including recent private placements aimed at raising nearly KRW 200 billion, underscore its aggressive expansion efforts and potential to leverage increasing capital for future innovations. With R&D expenses consistently aligned with these ambitious growth targets, PharmaResearch is not only enhancing its competitive edge but also solidifying its standing in a rapidly evolving sector.

- Unlock comprehensive insights into our analysis of PharmaResearch stock in this health report.

Assess PharmaResearch's past performance with our detailed historical performance reports.

Cybozu (TSE:4776)

Simply Wall St Growth Rating: ★★★★★☆

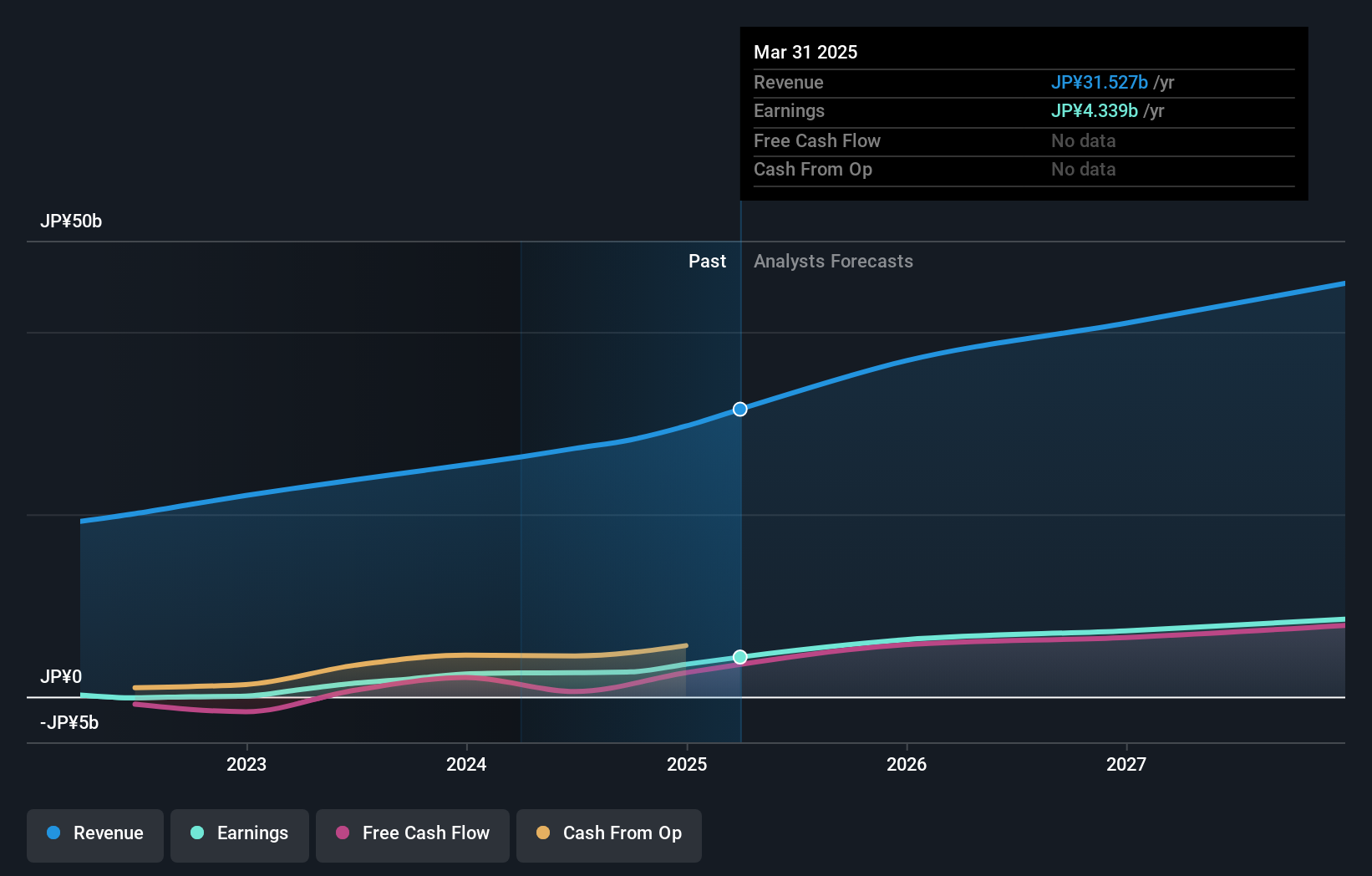

Overview: Cybozu, Inc. specializes in the development, sale, and operation of groupware solutions across several countries including Japan, China, Vietnam, Taiwan, Malaysia, Australia, and the United States with a market capitalization of ¥97.16 billion.

Operations: The company generates revenue primarily through its groupware solutions, which are offered in multiple international markets. It focuses on software development and sales, catering to business collaboration needs across various regions.

Cybozu's aggressive capital restructuring, highlighted by a recent share repurchase program for up to 3 million shares, underscores its strategic intent to optimize financial flexibility amidst evolving market conditions. This move coincides with an impressive earnings forecast growth of 20.5% annually, outpacing the Japanese market's average of 7.9%. Additionally, the company's commitment to innovation is evident from its R&D spending trends which align closely with its revenue growth projections of 14.7% per year—significantly higher than the broader market expectation of 4.2%. These factors collectively suggest Cybozu is not only maintaining but accelerating its competitive edge in a dynamic tech landscape.

- Click to explore a detailed breakdown of our findings in Cybozu's health report.

Review our historical performance report to gain insights into Cybozu's's past performance.

init innovation in traffic systems (XTRA:IXX)

Simply Wall St Growth Rating: ★★★★★☆

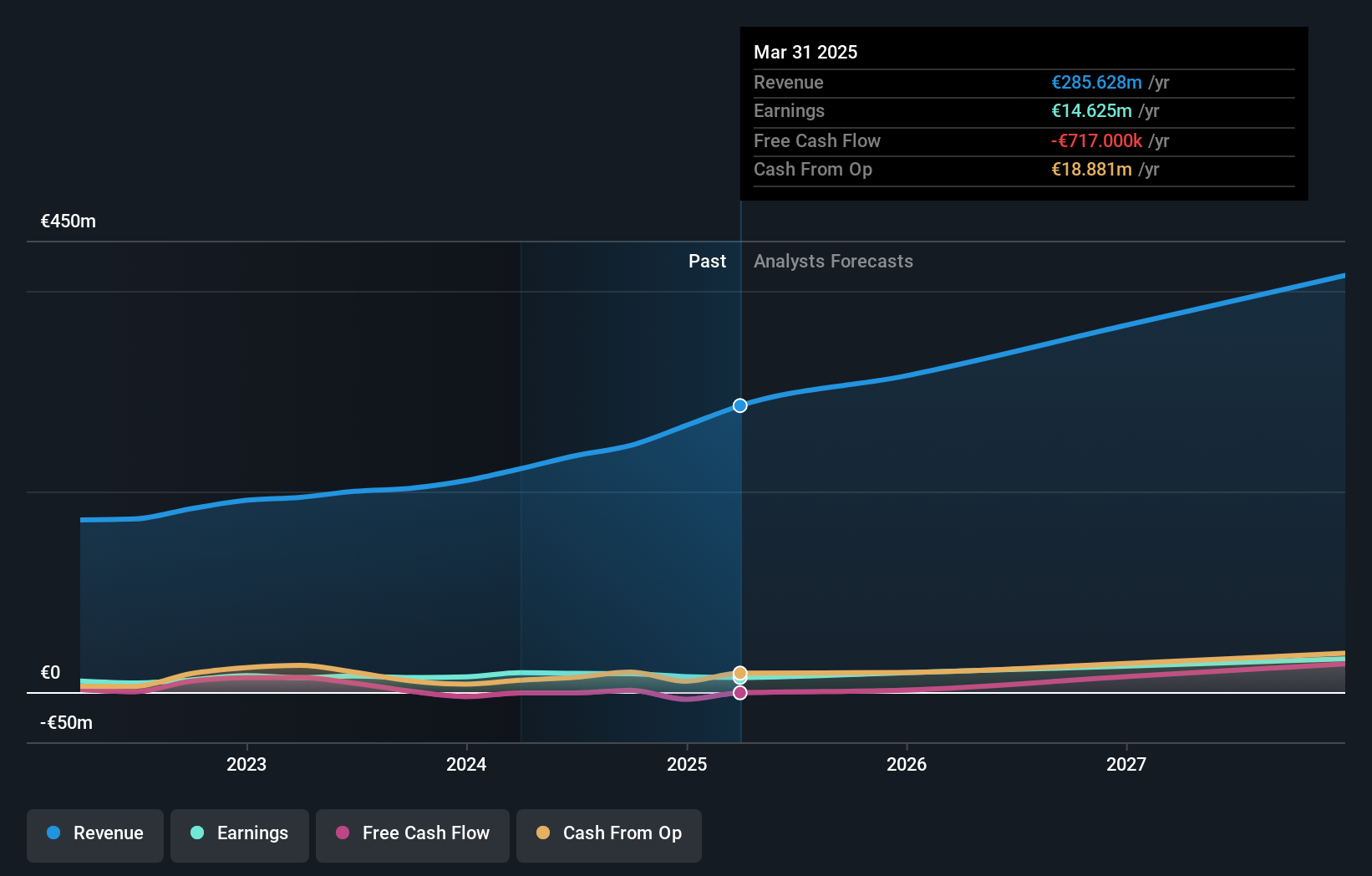

Overview: Init innovation in traffic systems SE, along with its subsidiaries, specializes in providing intelligent transportation systems solutions for public transportation globally, with a market cap of approximately €355.54 million.

Operations: The company generates revenue primarily through its Wireless Communications Equipment segment, which contributes €245.89 million. The focus is on delivering intelligent transportation systems solutions for public transit worldwide.

Init innovation in traffic systems SE, amidst a competitive tech landscape, has demonstrated robust financial growth with a significant 25% earnings increase over the past year. This performance is complemented by an aggressive R&D strategy, where expenditures are closely aligned with revenue increases—illustrating a clear commitment to innovation and market expansion. Notably, the company's recent earnings report shows a surge in sales to €178.12 million from €143.04 million year-over-year, underpinning its strong market position and operational efficiency. With expected annual profit growth of 27.8%, init stands out for its potential to outpace the German market's average growth rate significantly.

Turning Ideas Into Actions

- Discover the full array of 1292 High Growth Tech and AI Stocks right here.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:4776

Cybozu

Engages in the development, sale, and operation of groupware solutions in Japan, China, Vietnam, Taiwan, Malaysia, Australia, and the United States.

Flawless balance sheet with high growth potential.