Stock Analysis

- South Korea

- /

- Biotech

- /

- KOSDAQ:A206650

High Growth Tech Stocks To Watch In South Korea September 2024

Reviewed by Simply Wall St

Separated by the Chuseok Thanksgiving holiday, the South Korea stock market has moved higher in three straight sessions, improving more than 65 points or 2.6 percent along the way. This positive momentum, coupled with optimism for interest rates and economic outlooks globally, sets a promising backdrop for high-growth tech stocks in South Korea. In this article, we will explore three tech stocks that are gaining attention as potential high-growth opportunities in this dynamic market environment.

Top 10 High Growth Tech Companies In South Korea

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Seojin SystemLtd | 33.61% | 52.05% | ★★★★★★ |

| IMLtd | 21.80% | 111.43% | ★★★★★★ |

| Bioneer | 23.53% | 97.58% | ★★★★★★ |

| FLITTO | 32.60% | 106.82% | ★★★★★★ |

| ALTEOGEN | 64.22% | 99.46% | ★★★★★★ |

| NEXON Games | 29.64% | 66.98% | ★★★★★★ |

| Park Systems | 23.64% | 35.66% | ★★★★★★ |

| Devsisters | 29.08% | 63.02% | ★★★★★★ |

| AmosenseLtd | 24.04% | 71.97% | ★★★★★★ |

| UTI | 114.97% | 134.59% | ★★★★★★ |

Click here to see the full list of 50 stocks from our KRX High Growth Tech and AI Stocks screener.

Let's uncover some gems from our specialized screener.

Bioneer (KOSDAQ:A064550)

Simply Wall St Growth Rating: ★★★★★★

Overview: Bioneer Corporation is a biotechnology company with operations in South Korea and internationally, holding a market cap of ₩711.07 billion.

Operations: Bioneer Corporation operates as a biotechnology company across multiple continents, including South Korea, the Americas, Europe, Asia, and Africa. The company generates revenue through various biotechnology products and services.

Despite a challenging quarter with a net loss of KRW 3,025.04 million, Bioneer's commitment to innovation is evident in its R&D spending trends, aligning with its strategy to pivot towards more sustainable growth sectors within biotech. The company's revenue is expected to grow by an impressive 23.5% annually, outpacing the South Korean market projection of 10.1%. This growth trajectory is further underscored by forecasts suggesting a substantial increase in earnings by approximately 97.6% per year, signaling potential for significant future profitability and positioning Bioneer as a resilient player in high-growth tech sectors despite current financial setbacks.

- Navigate through the intricacies of Bioneer with our comprehensive health report here.

Examine Bioneer's past performance report to understand how it has performed in the past.

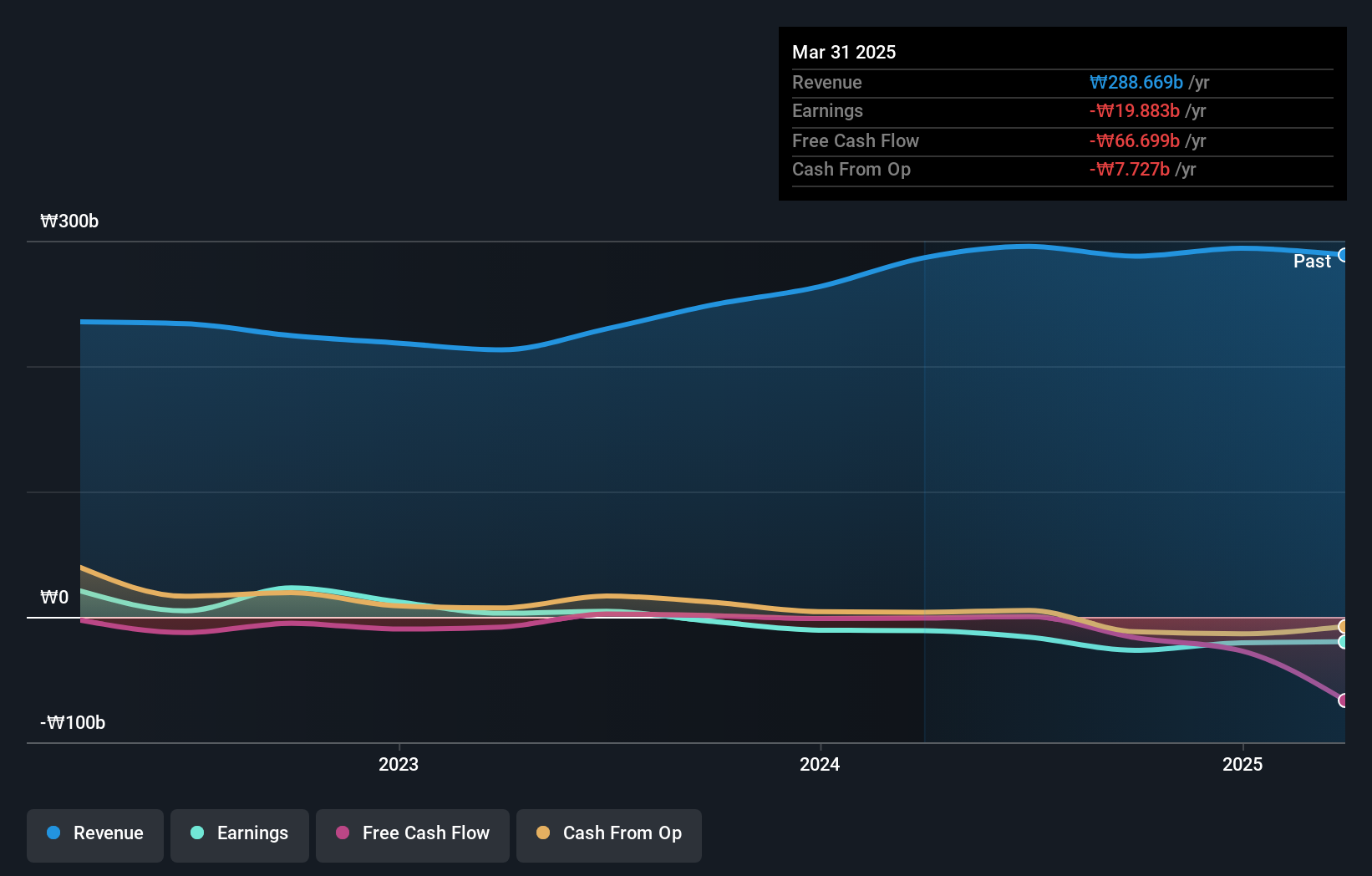

EuBiologics (KOSDAQ:A206650)

Simply Wall St Growth Rating: ★★★★★☆

Overview: EuBiologics Co., Ltd. is a biopharmaceutical company specializing in vaccines for epidemics in South Korea, with a market cap of ₩421.97 billion.

Operations: EuBiologics Co., Ltd. focuses on developing and providing vaccines for epidemic diseases in South Korea, generating revenue primarily from its pharmaceutical segment, which reported ₩69.37 billion. The company operates within the biopharmaceutical industry, leveraging its expertise to address public health challenges through vaccine production.

EuBiologics, a contender in South Korea's high-growth tech landscape, is navigating through robust industry dynamics with a notable 21.9% annual revenue growth forecast, surpassing the broader market's 10.1%. Despite current unprofitability, the firm is channeling significant resources into R&D, dedicating a substantial portion of its revenue to these efforts, which underscores its commitment to securing a competitive edge. This strategic focus is expected to catalyze an impressive earnings growth of 66.3% annually. Moreover, EuBiologics' endeavors in expanding its technological capabilities could potentially reshape its financial health and fortify its standing in biotech innovation.

- Click here and access our complete health analysis report to understand the dynamics of EuBiologics.

DAEDUCK ELECTRONICS (KOSE:A353200)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Daeduck Electronics Co., Ltd. provides various printed circuit boards (PCB) in South Korea and internationally, with a market cap of ₩961.71 billion.

Operations: Daeduck Electronics Co., Ltd. generates revenue primarily from the manufacture and sale of printed circuit boards (PCB), totaling ₩925.14 billion. The company operates both domestically in South Korea and internationally, contributing to its substantial market presence.

Daeduck Electronics, amidst a challenging landscape, has demonstrated a notable turnaround with its recent earnings surge to KRW 12,231.29 million from KRW 4,299.72 million year-over-year. This growth is underpinned by its strategic pivot towards high-density semiconductor substrates for AI servers, notably the large body FCBGA substrate that challenges established markets in Japan and Taiwan. The company’s R&D commitment is evident as it allocates significant resources to develop next-generation packaging technologies that integrate advanced features like silicon capacitor embedding and bridge integration technology. With an expected annual profit growth of 56.5%, Daeduck is not just keeping pace but setting the stage for substantial market influence in tech innovation.

Make It Happen

- Gain an insight into the universe of 50 KRX High Growth Tech and AI Stocks by clicking here.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if EuBiologics might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About KOSDAQ:A206650

EuBiologics

A biopharmaceutical company, provides vaccines for epidemics in South Korea.