- South Korea

- /

- Life Sciences

- /

- KOSDAQ:A039860

NanoEntek, Inc.'s (KOSDAQ:039860) 25% Dip Still Leaving Some Shareholders Feeling Restless Over Its P/SRatio

NanoEntek, Inc. (KOSDAQ:039860) shares have retraced a considerable 25% in the last month, reversing a fair amount of their solid recent performance. Instead of being rewarded, shareholders who have already held through the last twelve months are now sitting on a 27% share price drop.

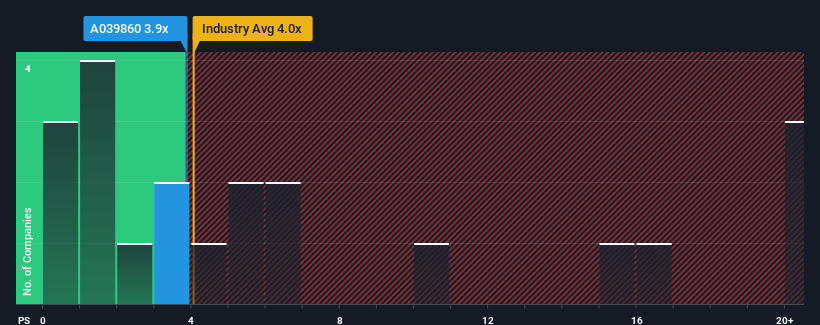

Even after such a large drop in price, you could still be forgiven for feeling indifferent about NanoEntek's P/S ratio of 3.9x, since the median price-to-sales (or "P/S") ratio for the Life Sciences industry in Korea is also close to 4x. While this might not raise any eyebrows, if the P/S ratio is not justified investors could be missing out on a potential opportunity or ignoring looming disappointment.

See our latest analysis for NanoEntek

What Does NanoEntek's Recent Performance Look Like?

For example, consider that NanoEntek's financial performance has been poor lately as its revenue has been in decline. Perhaps investors believe the recent revenue performance is enough to keep in line with the industry, which is keeping the P/S from dropping off. If you like the company, you'd at least be hoping this is the case so that you could potentially pick up some stock while it's not quite in favour.

Want the full picture on earnings, revenue and cash flow for the company? Then our free report on NanoEntek will help you shine a light on its historical performance.Is There Some Revenue Growth Forecasted For NanoEntek?

NanoEntek's P/S ratio would be typical for a company that's only expected to deliver moderate growth, and importantly, perform in line with the industry.

In reviewing the last year of financials, we were disheartened to see the company's revenues fell to the tune of 29%. At least revenue has managed not to go completely backwards from three years ago in aggregate, thanks to the earlier period of growth. Therefore, it's fair to say that revenue growth has been inconsistent recently for the company.

Comparing the recent medium-term revenue trends against the industry's one-year growth forecast of 20% shows it's noticeably less attractive.

In light of this, it's curious that NanoEntek's P/S sits in line with the majority of other companies. Apparently many investors in the company are less bearish than recent times would indicate and aren't willing to let go of their stock right now. They may be setting themselves up for future disappointment if the P/S falls to levels more in line with recent growth rates.

What Does NanoEntek's P/S Mean For Investors?

Following NanoEntek's share price tumble, its P/S is just clinging on to the industry median P/S. Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

We've established that NanoEntek's average P/S is a bit surprising since its recent three-year growth is lower than the wider industry forecast. When we see weak revenue with slower than industry growth, we suspect the share price is at risk of declining, bringing the P/S back in line with expectations. Unless there is a significant improvement in the company's medium-term performance, it will be difficult to prevent the P/S ratio from declining to a more reasonable level.

Don't forget that there may be other risks. For instance, we've identified 3 warning signs for NanoEntek (1 is potentially serious) you should be aware of.

If these risks are making you reconsider your opinion on NanoEntek, explore our interactive list of high quality stocks to get an idea of what else is out there.

Valuation is complex, but we're here to simplify it.

Discover if NanoEntek might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KOSDAQ:A039860

NanoEntek

Engages in the research and development, production, and sale of life-science lab equipment, in vitro diagnostic medical devices, point of care diagnostic devices, and related consumables and solutions in Korea and internationally.

Flawless balance sheet with acceptable track record.

Market Insights

Community Narratives