- South Korea

- /

- Biotech

- /

- KOSDAQ:A196170

Exploring High Growth Tech Stocks in South Korea

Reviewed by Simply Wall St

The Utilities sector in South Korea gained 11% while the market remained flat over the last week, and over the past year, the market has also been flat. With earnings expected to grow by 29% per annum over the next few years, identifying high-growth tech stocks that can outperform in such conditions involves looking for companies with strong innovation capabilities and robust financial health.

Top 10 High Growth Tech Companies In South Korea

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Seojin SystemLtd | 33.61% | 52.05% | ★★★★★★ |

| IMLtd | 20.76% | 106.30% | ★★★★★★ |

| Bioneer | 22.49% | 89.69% | ★★★★★★ |

| FLITTO | 32.07% | 100.38% | ★★★★★★ |

| ALTEOGEN | 64.22% | 99.46% | ★★★★★★ |

| NEXON Games | 31.70% | 66.31% | ★★★★★★ |

| Devsisters | 26.11% | 65.92% | ★★★★★★ |

| AmosenseLtd | 24.29% | 55.45% | ★★★★★★ |

| Park Systems | 22.50% | 37.52% | ★★★★★★ |

| UTI | 103.56% | 122.67% | ★★★★★★ |

Click here to see the full list of 51 stocks from our KRX High Growth Tech and AI Stocks screener.

Let's uncover some gems from our specialized screener.

ALTEOGEN (KOSDAQ:A196170)

Simply Wall St Growth Rating: ★★★★★★

Overview: ALTEOGEN Inc., a biotechnology company, specializes in developing long-acting biobetters, proprietary antibody-drug conjugates, and antibody biosimilars with a market cap of ₩16.60 billion.

Operations: The company generates revenue primarily from its biotechnology segment, amounting to ₩90.79 million. It focuses on developing innovative biopharmaceutical products such as long-acting biobetters, proprietary antibody-drug conjugates, and antibody biosimilars.

Alteogen's recent MFDS approval for Tergase® underscores its innovative edge, leveraging proprietary Hybrozyme™ Technology to produce recombinant hyaluronidase with over 99% purity. This positions the company favorably against competitors using bovine or ovine sources. With a projected revenue growth of 64.2% annually and earnings forecasted to surge by 99.46% per year, the firm is poised for significant expansion in both existing and new markets. Despite being currently unprofitable, Alteogen’s R&D expenses reflect substantial investment in future profitability.

- Get an in-depth perspective on ALTEOGEN's performance by reading our health report here.

Assess ALTEOGEN's past performance with our detailed historical performance reports.

Celltrion (KOSE:A068270)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Celltrion, Inc., along with its subsidiaries, specializes in developing and producing protein-based drugs for oncology treatment in South Korea and has a market cap of ₩42.30 trillion.

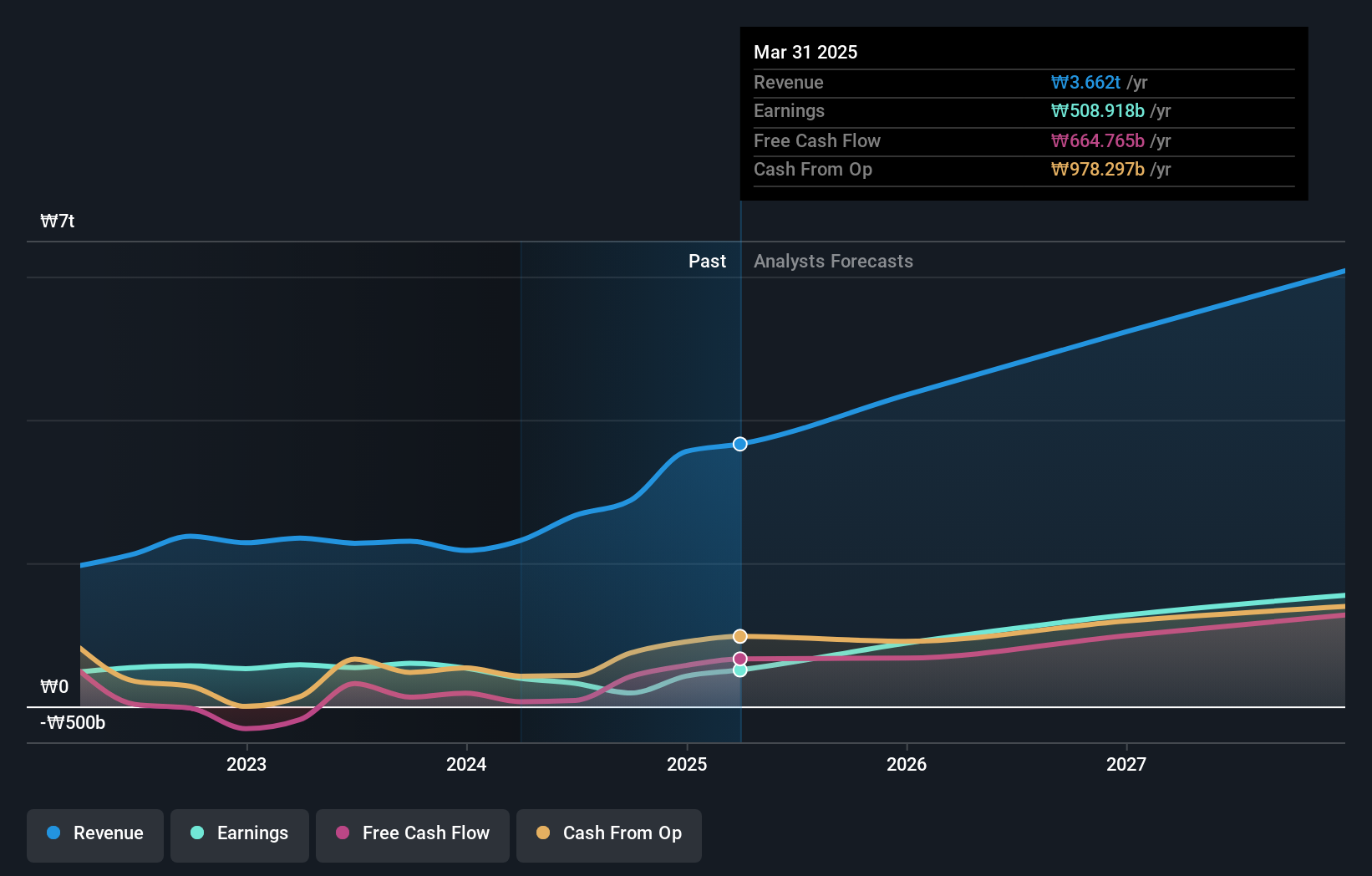

Operations: Celltrion, Inc. generates revenue primarily from its Bio Medical Supply segment (₩3.54 trillion) and Chemical Drugs segment (₩507.02 billion). The company focuses on developing and producing protein-based oncology drugs in South Korea.

Celltrion's recent approval of SteQeyma® by the European Commission highlights its strong position in the biosimilars market, particularly for chronic inflammatory diseases. The company's revenue is forecast to grow at 25.7% annually, outpacing the South Korean market's 10.6%. Despite a past year's earnings drop of 40.4%, future earnings are expected to surge by 59.8% per year, driven by robust R&D investments and strategic product launches like SteQeyma®. Recent share repurchases totaling ₩75.89 billion further emphasize Celltrion’s commitment to enhancing shareholder value.

- Dive into the specifics of Celltrion here with our thorough health report.

Explore historical data to track Celltrion's performance over time in our Past section.

HYBE (KOSE:A352820)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: HYBE Co., Ltd. engages in music production, publishing, and artist development and management businesses with a market cap of ₩7.38 billion.

Operations: HYBE Co., Ltd. generates revenue primarily from music production, platform services, and solutions, with notable figures of ₩1.28 billion and ₩1.24 billion from Label and Solution segments respectively. The company also incurs internal transactions amounting to -₩0.73 billion.

HYBE's recent earnings report reveals a notable increase in sales, reaching ₩640.46 billion for Q2 2024, up from ₩620.99 billion the previous year. However, net income saw a significant drop to ₩14.59 billion from ₩117.34 billion due to large one-off losses amounting to ₩189.4 billion over the past 12 months ending June 30, 2024. Despite these challenges, HYBE's earnings are forecasted to grow at an impressive rate of 42.5% per year over the next three years, outpacing South Korea's market average of 28.8%. The company’s robust R&D investments and strategic initiatives underscore its commitment to innovation and future growth within the entertainment sector.

- Navigate through the intricacies of HYBE with our comprehensive health report here.

Gain insights into HYBE's historical performance by reviewing our past performance report.

Summing It All Up

- Discover the full array of 51 KRX High Growth Tech and AI Stocks right here.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About KOSDAQ:A196170

ALTEOGEN

A bio company, focuses on developing long-acting biobetters, proprietary antibody-drug conjugates, and antibody biosimilars.

Exceptional growth potential with excellent balance sheet.