- South Korea

- /

- Basic Materials

- /

- KOSE:A300720

Hankook And 2 Other Undiscovered Gems In South Korea

Reviewed by Simply Wall St

The South Korean market has remained flat over the past 12 months, with the Utilities sector gaining 11% in just the last week. Despite this stagnation, earnings are expected to grow by 29% per annum over the next few years, making it an opportune time to explore lesser-known stocks that have strong potential for growth.

Top 10 Undiscovered Gems With Strong Fundamentals In South Korea

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| NOROO PAINT & COATINGS | 13.99% | 5.04% | 7.98% | ★★★★★★ |

| Miwon Chemicals | 0.08% | 11.70% | 14.38% | ★★★★★★ |

| Samyang | 49.49% | 6.68% | 23.96% | ★★★★★★ |

| Kyung Dong Navien | 22.40% | 11.19% | 18.84% | ★★★★★★ |

| Synergy Innovation | 12.39% | 12.87% | 28.82% | ★★★★★★ |

| iMarketKorea | 28.53% | 5.35% | 1.30% | ★★★★★☆ |

| Oriental Precision & EngineeringLtd | 54.53% | 3.14% | 0.80% | ★★★★★☆ |

| ASIA Holdings | 34.98% | 8.43% | 16.17% | ★★★★★☆ |

| Daewon Cable | 30.50% | 8.72% | 60.38% | ★★★★★☆ |

| PaperCorea | 53.09% | 1.31% | 77.27% | ★★★★★☆ |

We'll examine a selection from our screener results.

Hankook (KOSE:A000240)

Simply Wall St Value Rating: ★★★★★☆

Overview: Hankook & Company Co., Ltd. manufactures and sells storage batteries with a market cap of ₩1.61 billion.

Operations: Hankook & Company Co., Ltd. generates revenue primarily from the sale of storage batteries. The company's market cap stands at ₩1.61 billion.

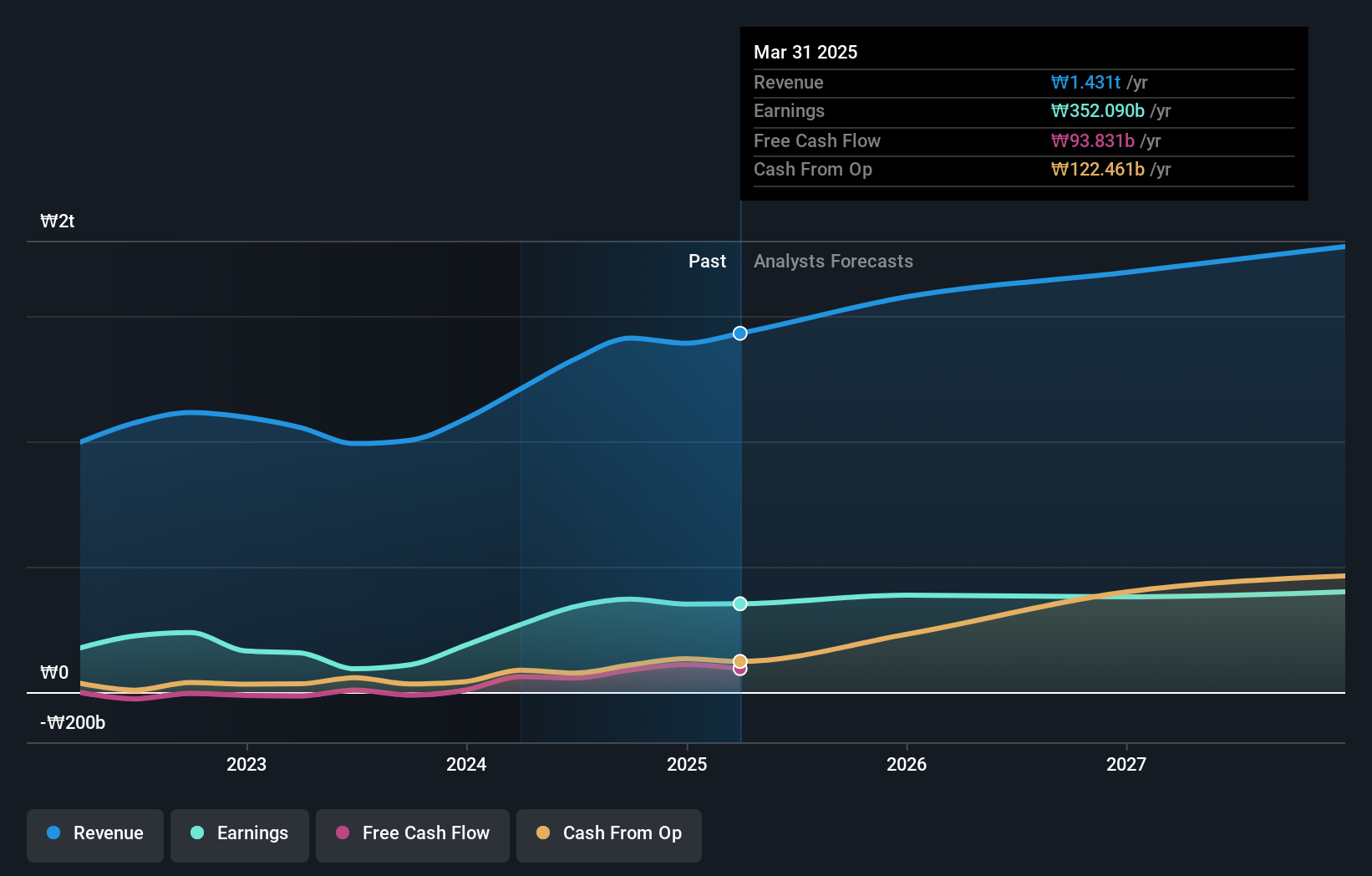

Hankook has demonstrated impressive earnings growth, with a 267% increase over the past year, far exceeding the Auto Components industry’s 17.5%. Trading at a P/E ratio of 4.9x compared to the KR market's 11.5x, it offers good relative value. Recent results show net income for Q2 at KRW 108 billion, up from KRW 36 billion last year. With a debt-to-equity ratio rising from 3% to 8.5% over five years and EBIT covering interest payments by 40x, financial health remains robust despite higher leverage.

- Click here to discover the nuances of Hankook with our detailed analytical health report.

Assess Hankook's past performance with our detailed historical performance reports.

Hyundai G.F. Holdings (KOSE:A005440)

Simply Wall St Value Rating: ★★★★★☆

Overview: Hyundai G.F. Holdings Co., Ltd. engages in the rental and investment businesses, with a market cap of ₩750.68 billion.

Operations: Hyundai G.F. Holdings generates revenue primarily through its rental and investment businesses. The company's financial performance includes key metrics such as gross profit margin and net profit margin, which provide insight into profitability trends.

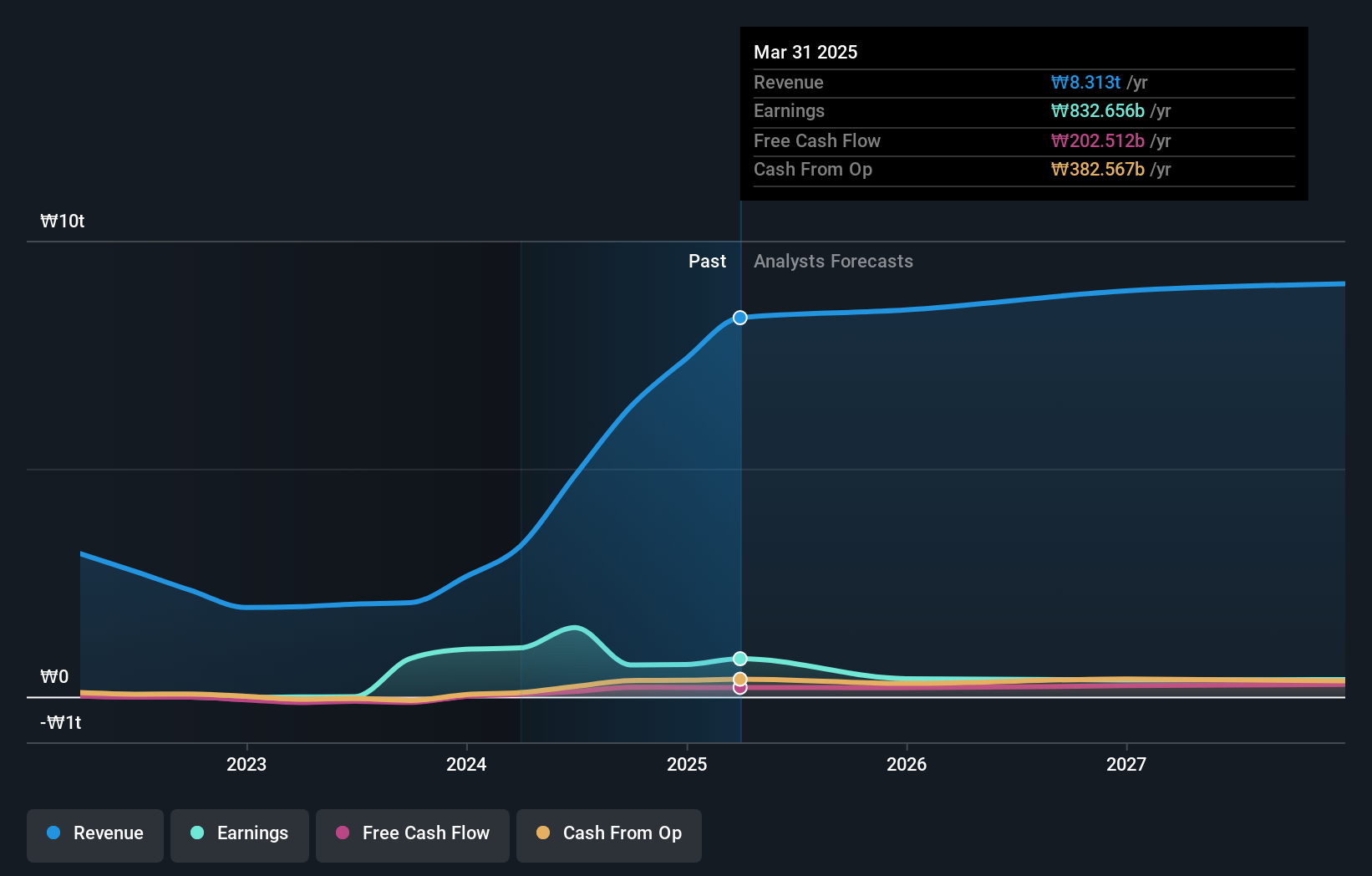

Hyundai G.F. Holdings has shown remarkable performance, with earnings skyrocketing by 242291% over the past year, significantly outpacing the Trade Distributors industry’s 21.7%. The company's debt to equity ratio increased from 1.6 to 10.7 over five years, indicating a higher leverage but manageable given its profitability and high-quality earnings. Trading at around 75% below estimated fair value suggests potential for substantial appreciation, while revenue is expected to grow annually by 22%.

Hanil Cement (KOSE:A300720)

Simply Wall St Value Rating: ★★★★★☆

Overview: Hanil Cement Co., Ltd. produces and sells cements, ready-mixed concretes, and admixtures with a market cap of ₩1.06 trillion.

Operations: Hanil Cement generates revenue primarily from the sale of cements, ready-mixed concretes, and admixtures. The company's market cap stands at ₩1.06 trillion.

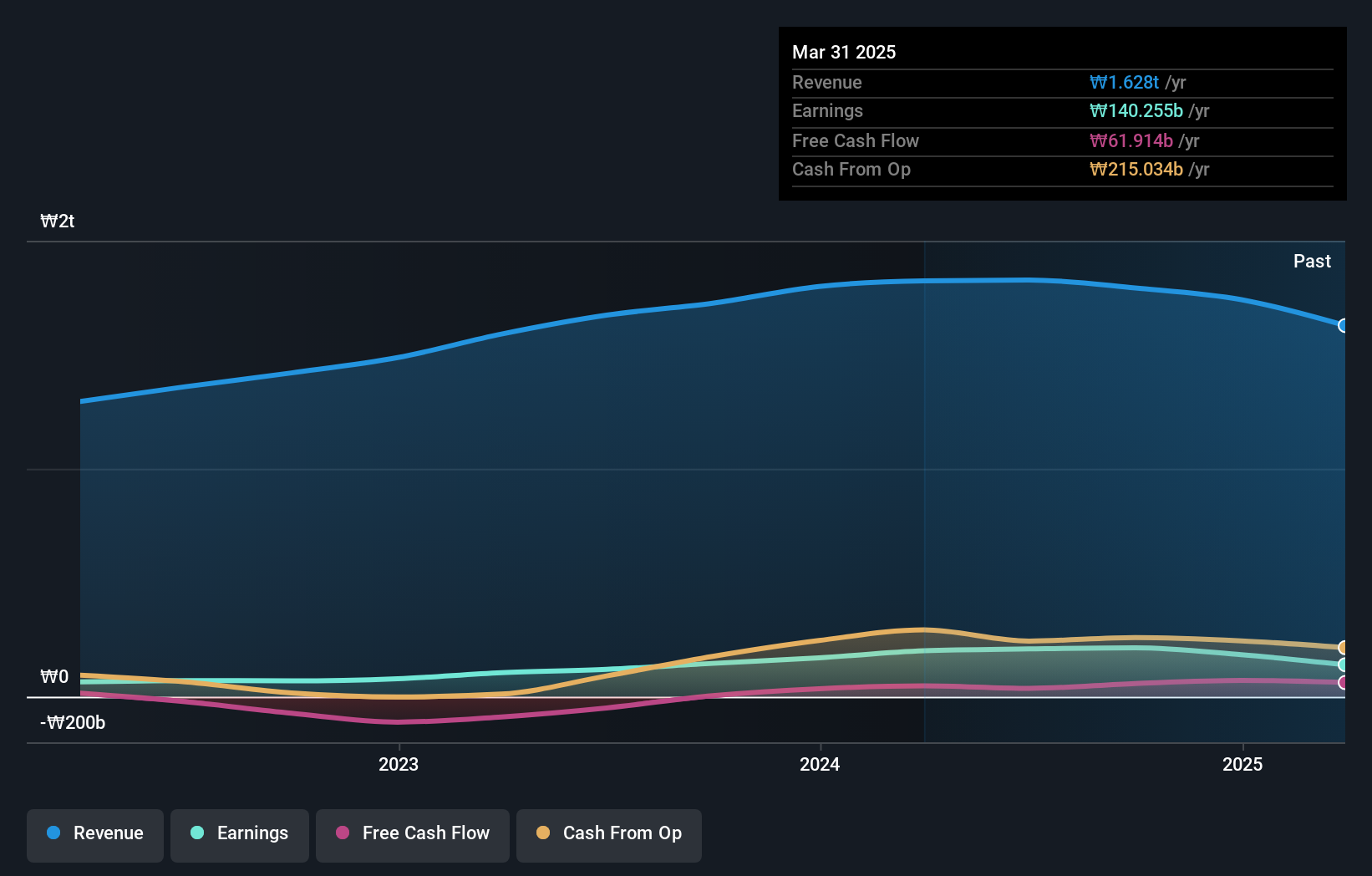

Hanil Cement, a notable player in the construction materials sector, has shown a strong performance with earnings growth of 74.7% over the past year, significantly outpacing the Basic Materials industry at -2.6%. Trading at 12.9% below its estimated fair value, it presents an attractive opportunity for investors. The company's net debt to equity ratio stands at a satisfactory 23.7%, and its interest payments are well covered by EBIT (15.2x coverage).

- Click to explore a detailed breakdown of our findings in Hanil Cement's health report.

Evaluate Hanil Cement's historical performance by accessing our past performance report.

Key Takeaways

- Take a closer look at our KRX Undiscovered Gems With Strong Fundamentals list of 195 companies by clicking here.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Hanil Cement might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About KOSE:A300720

Hanil Cement

Produces and sells cements, ready-mixed concretes, and admixtures.

Solid track record with excellent balance sheet.