Stock Analysis

- South Korea

- /

- Entertainment

- /

- KOSE:A036570

High Growth Tech Stocks with Strong Potential on None Exchange

Reviewed by Simply Wall St

In recent weeks, global markets have experienced volatility with U.S. stocks declining amid cautious Federal Reserve commentary and looming government shutdown fears, while smaller-cap indexes generally faced greater losses. Despite these challenges, strong economic data such as robust consumer spending and retail sales growth have provided some support to market sentiment. In this environment, identifying high-growth tech stocks with strong potential involves looking for companies that demonstrate resilience through innovation and adaptability to shifting economic conditions.

Top 10 High Growth Tech Companies

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Material Group | 20.45% | 24.01% | ★★★★★★ |

| Seojin SystemLtd | 35.41% | 39.86% | ★★★★★★ |

| Yggdrazil Group | 30.20% | 87.10% | ★★★★★★ |

| eWeLLLtd | 27.24% | 28.74% | ★★★★★★ |

| Ascelia Pharma | 76.15% | 47.16% | ★★★★★★ |

| Medley | 25.57% | 31.67% | ★★★★★★ |

| Waystream Holding | 22.09% | 113.25% | ★★★★★★ |

| CD Projekt | 24.92% | 27.00% | ★★★★★★ |

| Fine M-TecLTD | 36.52% | 131.08% | ★★★★★★ |

| JNTC | 29.48% | 104.37% | ★★★★★★ |

Click here to see the full list of 1276 stocks from our High Growth Tech and AI Stocks screener.

Underneath we present a selection of stocks filtered out by our screen.

Northern Data (DB:NB2)

Simply Wall St Growth Rating: ★★★★★☆

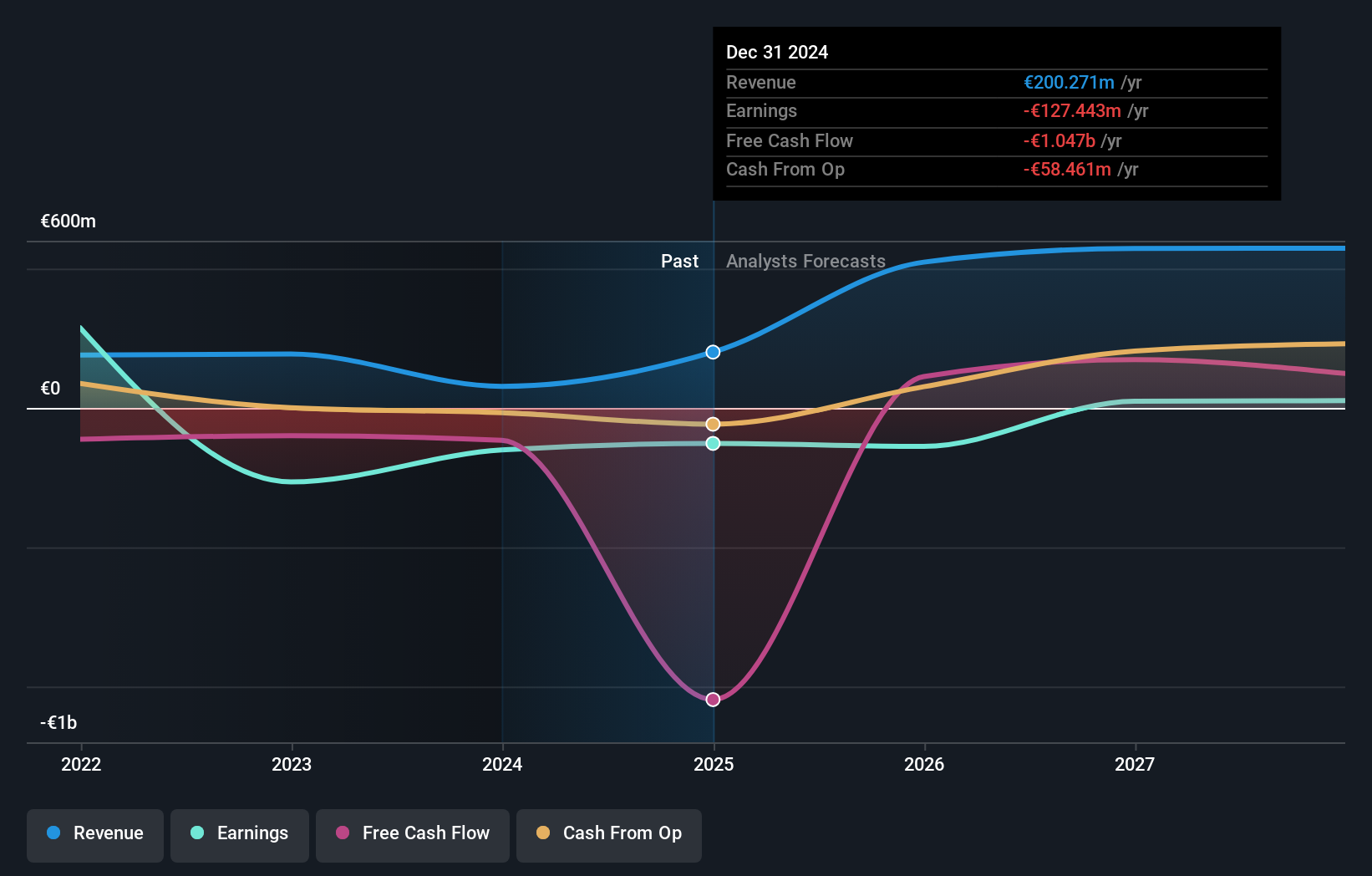

Overview: Northern Data AG develops and operates high-performance computing infrastructure solutions for businesses and research institutions globally, with a market capitalization of approximately €2.70 billion.

Operations: Northern Data AG generates revenue primarily from its Peak Mining segment (€156.13 million) and Ardent Data Centers (€31.46 million), with additional contributions from Taiga Cloud (€22.13 million). The company focuses on providing high-performance computing infrastructure solutions to a global clientele, including businesses and research institutions.

Northern Data's strategic pivot from crypto mining to a pure-play AI solutions provider, including Europe’s largest Generative AI Cloud platform, underscores its commitment to harnessing high-growth sectors. The company recently announced exploring divestments in its legacy operations to focus more on AI-driven solutions, reflecting a robust growth trajectory with third-quarter results showing strong sequential growth in the AI Solutions segment. Moreover, Northern Data's recent initiative of an AI Accelerator program highlights its innovative approach by supporting startups with cutting-edge resources like NVIDIA HGX H100 systems, fostering an ecosystem conducive to breakthroughs in generative AI technologies. This forward-looking strategy is complemented by an impressive forecast of annual revenue growth at 31.5% and earnings expected to surge by 75.56%, positioning Northern Data well within the tech industry's competitive landscape as it transitions towards sustainable and high-demand technology solutions.

- Unlock comprehensive insights into our analysis of Northern Data stock in this health report.

Review our historical performance report to gain insights into Northern Data's's past performance.

NCSOFT (KOSE:A036570)

Simply Wall St Growth Rating: ★★★★☆☆

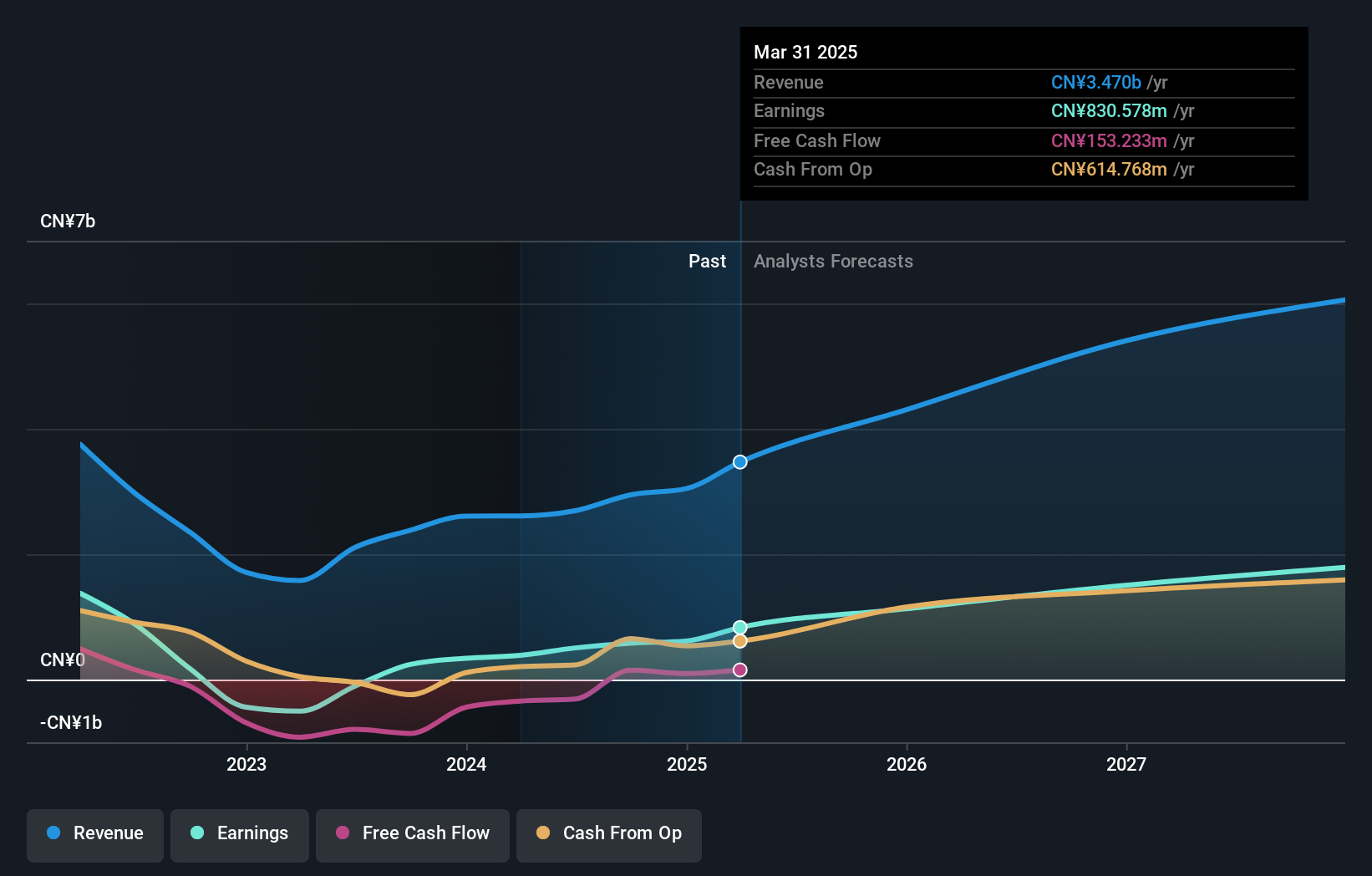

Overview: NCSOFT Corporation is a global developer and publisher of online games, with a market capitalization of ₩3.99 trillion.

Operations: The company generates revenue primarily from online games and game services, amounting to approximately ₩1.61 trillion.

NCSOFT, navigating a challenging landscape with a 10.6% annual revenue growth and an impressive 41.6% forecast in earnings growth, is positioning itself strategically within the tech sector. Despite recent setbacks reflected in a net loss this quarter compared to last year's profit, the firm continues to invest heavily in innovation; its R&D expenses are notably high, ensuring continuous enhancement of their gaming and software offerings. These investments underscore NCSOFT's commitment to evolving its technological capabilities, crucial for maintaining competitiveness in the dynamic gaming industry. The company also actively participated in several prestigious financial conferences recently, signaling robust engagement with global investors and stakeholders which could bolster future prospects.

- Click to explore a detailed breakdown of our findings in NCSOFT's health report.

Assess NCSOFT's past performance with our detailed historical performance reports.

Gan & Lee Pharmaceuticals (SHSE:603087)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Gan & Lee Pharmaceuticals is a biopharmaceutical company focused on the research, development, production, and sale of insulin analog active pharmaceutical ingredients and injections in China, with a market cap of CN¥26.73 billion.

Operations: The company primarily generates revenue from the development, production, and sale of insulin and related products, totaling CN¥2.95 billion. It is involved in the biopharmaceutical sector with a focus on insulin analog APIs and injections within China.

Gan & Lee Pharmaceuticals, demonstrating robust growth with a 27.4% annual revenue increase and an impressive 43.2% surge in earnings, is making significant strides in the biotech sector. The company's commitment to innovation is evident from its R&D spending, which has been strategically allocated to develop groundbreaking treatments like the GZR18 tablets and injections, showcasing potential in obesity management. Recently achieving positive results in early-stage clinical trials, these innovations not only highlight Gan & Lee's focus on addressing major health issues but also underscore its potential to impact global health markets significantly.

- Dive into the specifics of Gan & Lee Pharmaceuticals here with our thorough health report.

Gain insights into Gan & Lee Pharmaceuticals' past trends and performance with our Past report.

Seize The Opportunity

- Click through to start exploring the rest of the 1273 High Growth Tech and AI Stocks now.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if NCSOFT might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About KOSE:A036570

NCSOFT

Develops and publishes online games worldwide.