- South Korea

- /

- Media

- /

- KOSDAQ:A036000

YeaRimDang Publishing Co., Ltd. (KOSDAQ:036000) Stock Rockets 47% As Investors Are Less Pessimistic Than Expected

Despite an already strong run, YeaRimDang Publishing Co., Ltd. (KOSDAQ:036000) shares have been powering on, with a gain of 47% in the last thirty days. The annual gain comes to 129% following the latest surge, making investors sit up and take notice.

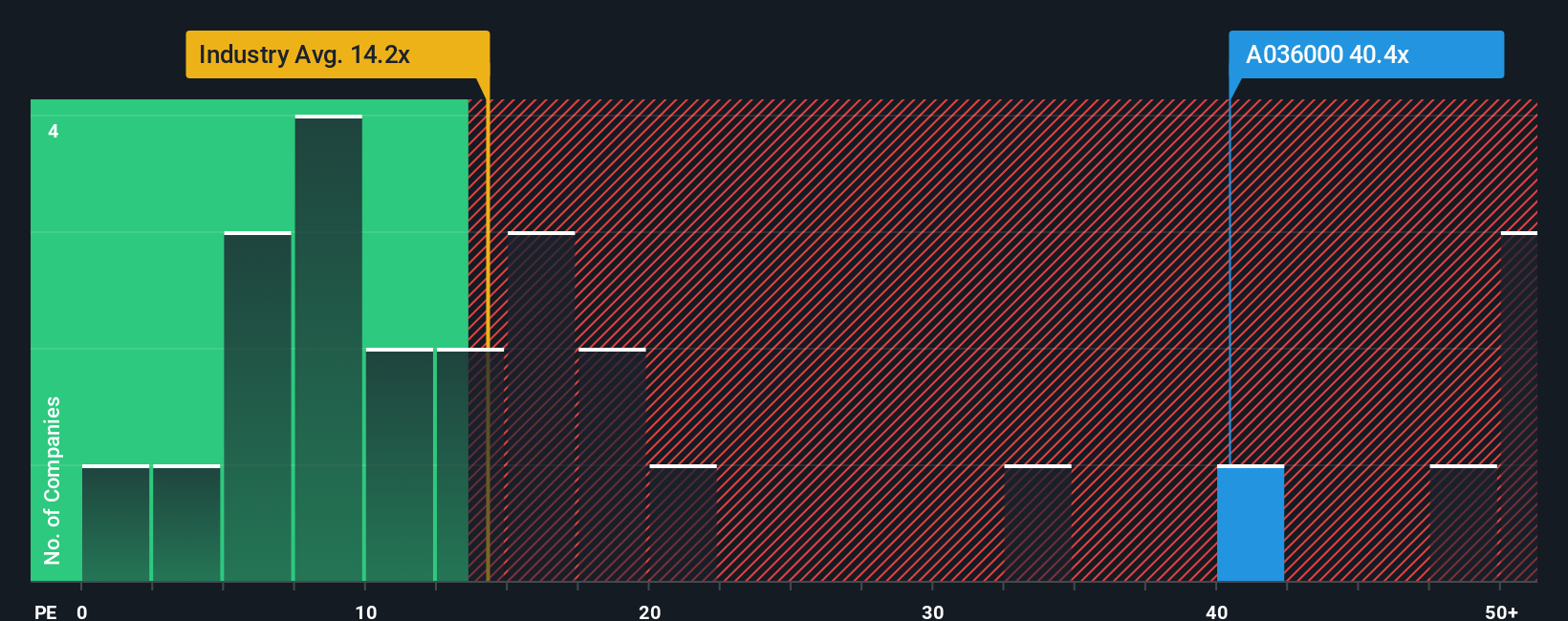

Since its price has surged higher, given close to half the companies in Korea have price-to-earnings ratios (or "P/E's") below 12x, you may consider YeaRimDang Publishing as a stock to avoid entirely with its 40.4x P/E ratio. Although, it's not wise to just take the P/E at face value as there may be an explanation why it's so lofty.

With earnings growth that's exceedingly strong of late, YeaRimDang Publishing has been doing very well. It seems that many are expecting the strong earnings performance to beat most other companies over the coming period, which has increased investors’ willingness to pay up for the stock. If not, then existing shareholders might be a little nervous about the viability of the share price.

See our latest analysis for YeaRimDang Publishing

Does Growth Match The High P/E?

There's an inherent assumption that a company should far outperform the market for P/E ratios like YeaRimDang Publishing's to be considered reasonable.

Taking a look back first, we see that the company grew earnings per share by an impressive 105% last year. Although, its longer-term performance hasn't been as strong with three-year EPS growth being relatively non-existent overall. Therefore, it's fair to say that earnings growth has been inconsistent recently for the company.

Comparing that to the market, which is predicted to deliver 29% growth in the next 12 months, the company's momentum is weaker based on recent medium-term annualised earnings results.

In light of this, it's alarming that YeaRimDang Publishing's P/E sits above the majority of other companies. It seems most investors are ignoring the fairly limited recent growth rates and are hoping for a turnaround in the company's business prospects. Only the boldest would assume these prices are sustainable as a continuation of recent earnings trends is likely to weigh heavily on the share price eventually.

The Final Word

Shares in YeaRimDang Publishing have built up some good momentum lately, which has really inflated its P/E. While the price-to-earnings ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of earnings expectations.

We've established that YeaRimDang Publishing currently trades on a much higher than expected P/E since its recent three-year growth is lower than the wider market forecast. Right now we are increasingly uncomfortable with the high P/E as this earnings performance isn't likely to support such positive sentiment for long. If recent medium-term earnings trends continue, it will place shareholders' investments at significant risk and potential investors in danger of paying an excessive premium.

Before you settle on your opinion, we've discovered 2 warning signs for YeaRimDang Publishing that you should be aware of.

If these risks are making you reconsider your opinion on YeaRimDang Publishing, explore our interactive list of high quality stocks to get an idea of what else is out there.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KOSDAQ:A036000

YeaRimDang Publishing

YeaRimDang Publishing Co., Ltd. publishes books for children in South Korea.

Flawless balance sheet with solid track record.

Market Insights

Community Narratives