- South Korea

- /

- Basic Materials

- /

- KOSE:A300720

Discovering Undiscovered Gems With Potential For November 2024

Reviewed by Simply Wall St

As global markets navigate the complexities of a changing U.S. administration and fluctuating economic indicators, small-cap stocks have shown varied performances, with indices like the S&P 600 reflecting these shifts. Amidst this backdrop of policy uncertainty and interest rate dynamics, investors are increasingly drawn to uncovering hidden opportunities that may offer growth potential. In such an environment, identifying promising stocks often involves looking for companies with strong fundamentals and resilience in sectors poised to benefit from current market trends.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Gallantt Ispat | 15.54% | 36.20% | 40.12% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Impellam Group | 31.12% | -5.43% | -6.86% | ★★★★★★ |

| Macpower CNC Machines | NA | 22.62% | 35.18% | ★★★★★★ |

| Tianyun International Holdings | 10.09% | -5.59% | -9.92% | ★★★★★★ |

| TechNVision Ventures | 100.73% | 20.37% | 68.50% | ★★★★★★ |

| Shree Pushkar Chemicals & Fertilisers | 21.25% | 18.34% | 4.43% | ★★★★★☆ |

| Wilson | 64.79% | 30.09% | 68.29% | ★★★★☆☆ |

| A2B Australia | 15.83% | -7.78% | 25.44% | ★★★★☆☆ |

| Practic | NA | 3.63% | 6.85% | ★★★★☆☆ |

Underneath we present a selection of stocks filtered out by our screen.

Hanil Cement (KOSE:A300720)

Simply Wall St Value Rating: ★★★★★☆

Overview: Hanil Cement Co., Ltd. is engaged in the production and sale of cement, ready-mixed concrete, and admixtures, with a market capitalization of approximately ₩950.27 billion.

Operations: Hanil Cement generates revenue primarily from the cement sector, contributing ₩928.39 billion, followed by the remital sector at ₩486.21 billion and ready-mixed concrete at ₩284.81 billion.

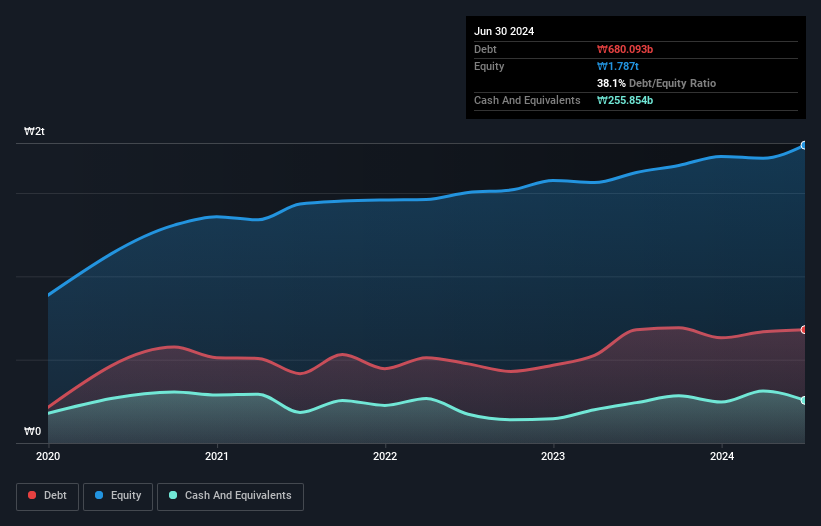

Hanil Cement, a relatively small player in its industry, is trading at 87.2% below our estimate of its fair value, presenting an intriguing opportunity. The company's net debt to equity ratio stands at a satisfactory 23.7%, indicating prudent financial management. Over the past year, Hanil's earnings surged by 74.7%, outpacing the Basic Materials industry's -2.6% performance, showcasing robust growth potential despite market challenges. With interest payments well covered by EBIT at 15 times coverage and positive free cash flow recently recorded, Hanil seems positioned for stability and potential future growth in the cement sector.

- Dive into the specifics of Hanil Cement here with our thorough health report.

Understand Hanil Cement's track record by examining our Past report.

Jeena Sikho Lifecare (NSEI:JSLL)

Simply Wall St Value Rating: ★★★★★★

Overview: Jeena Sikho Lifecare Limited is engaged in trading ayurvedic medicines in India, with a market capitalization of ₹47.69 billion.

Operations: JSLL generates revenue primarily from trading ayurvedic medicines and providing ayurvedic therapies, with revenue amounting to ₹3.81 billion.

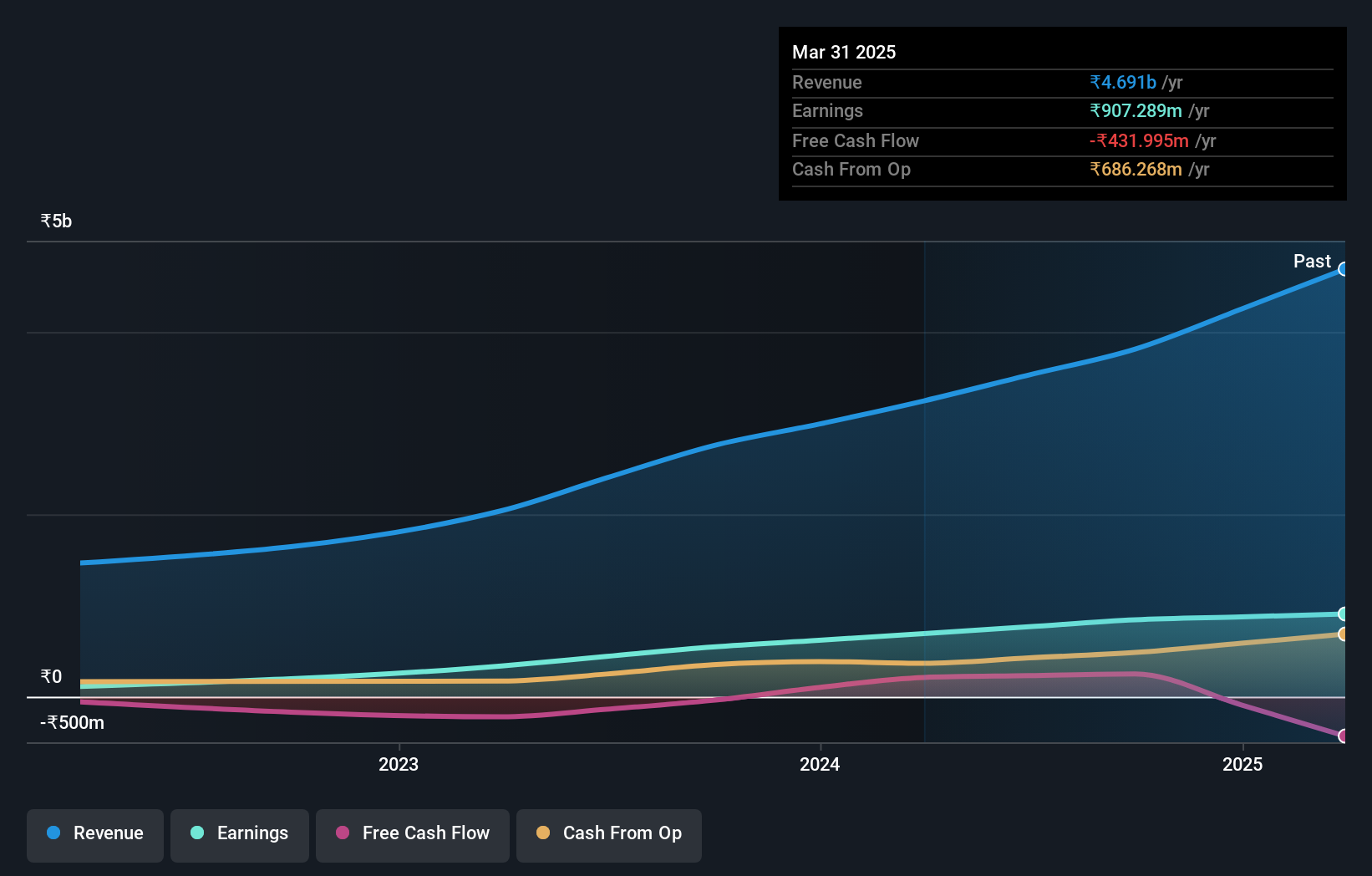

Jeena Sikho Lifecare, a nimble player in the pharmaceuticals sector, has shown impressive financial strides. Over the past year, earnings surged by 54.5%, outpacing the industry average of 20.4%. The company's debt-to-equity ratio dramatically improved from 129.2% to just 0.2% over five years, indicating robust financial health with more cash than total debt. Recent expansions include new Ayurveda Panchkarma hospitals across India, enhancing their healthcare footprint and service capabilities. For the half-year ending September 2024, sales reached INR 2,141 million and net income climbed to INR 469 million compared to last year's figures of INR 1,574 million and INR 318 million respectively.

- Get an in-depth perspective on Jeena Sikho Lifecare's performance by reading our health report here.

Precision Tsugami (China) (SEHK:1651)

Simply Wall St Value Rating: ★★★★★★

Overview: Precision Tsugami (China) Corporation Limited is an investment holding company that focuses on the manufacturing and sale of computer numerical control machine tools both in Mainland China and internationally, with a market capitalization of approximately HK$4.64 billion.

Operations: The company generates revenue primarily from the manufacture and sale of CNC high precision machine tools, amounting to CN¥3.60 billion.

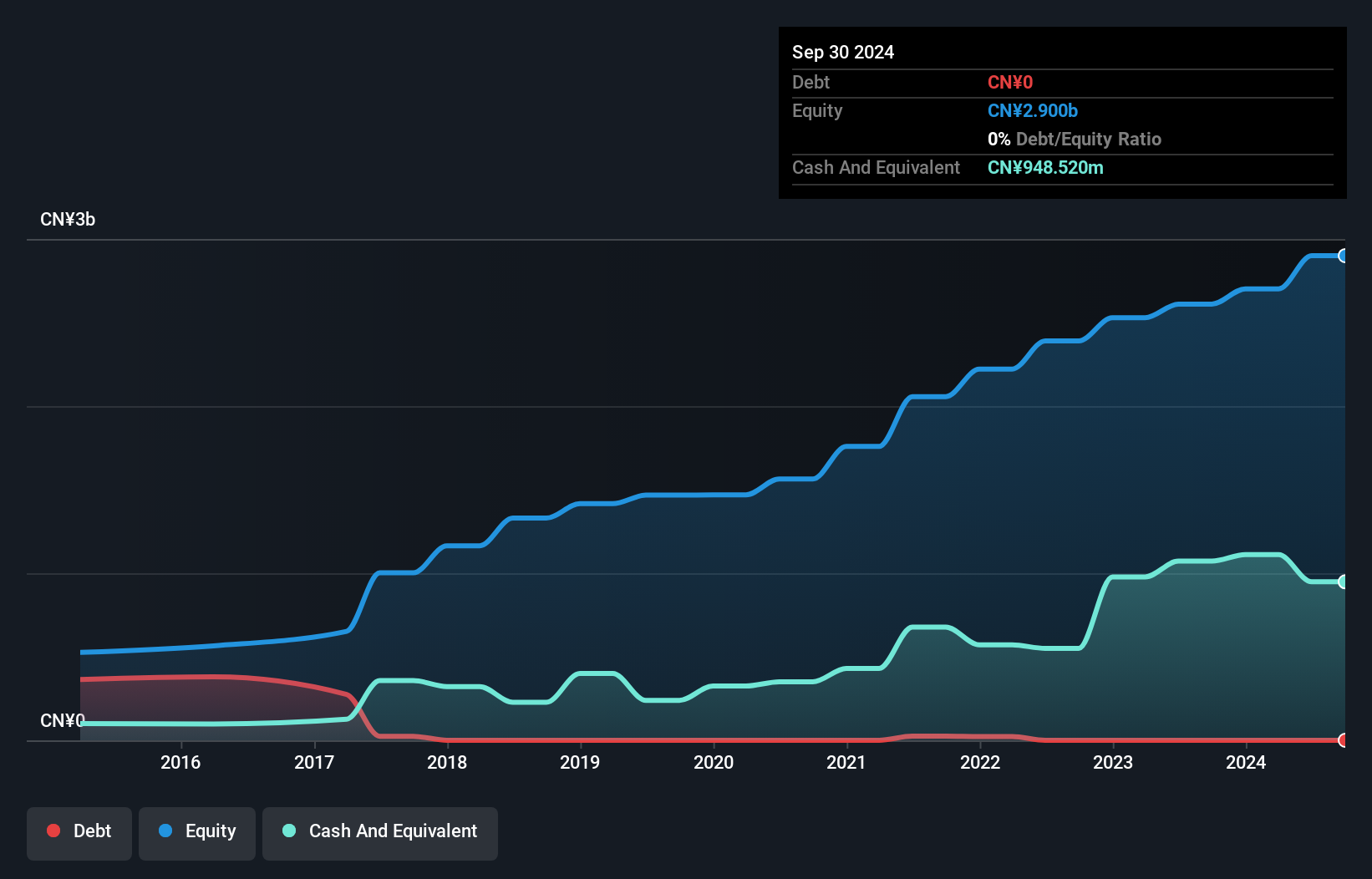

Precision Tsugami (China) has been making waves with its impressive financial performance. Over the past year, earnings grew by 19.8%, outpacing the Machinery industry's 7.2% growth, and are forecasted to rise by 25.9% annually. The company is debt-free, trading at a significant discount of 73% below estimated fair value, and offers high-quality earnings. Recent results for the half-year ending September 30, 2024, showed sales climbing to CNY1.98 billion from CNY1.49 billion in the previous year, with net income reaching CNY340 million compared to CNY221 million last year—an encouraging sign amidst cyclical industry changes and domestic economic recovery boosting demand for CNC precision tools.

- Click here and access our complete health analysis report to understand the dynamics of Precision Tsugami (China).

Gain insights into Precision Tsugami (China)'s past trends and performance with our Past report.

Summing It All Up

- Click through to start exploring the rest of the 4637 Undiscovered Gems With Strong Fundamentals now.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Hanil Cement might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About KOSE:A300720

Hanil Cement

Produces and sells cements, ready-mixed concretes, and admixtures.

Solid track record with excellent balance sheet.