- South Korea

- /

- Commercial Services

- /

- KOSE:A012750

KISCO Holdings And 2 Other KRX Dividend Stocks To Consider

Reviewed by Simply Wall St

Over the last 7 days, the South Korean market has remained flat, yet it has seen a notable increase of 9.5% over the past year with earnings anticipated to grow by 30% annually in the coming years. In this context, identifying dividend stocks that offer stability and consistent returns can be an attractive strategy for investors looking to capitalize on these favorable market conditions.

Top 10 Dividend Stocks In South Korea

| Name | Dividend Yield | Dividend Rating |

| Kia (KOSE:A000270) | 5.86% | ★★★★★★ |

| Kangwon Land (KOSE:A035250) | 5.54% | ★★★★★☆ |

| Woori Financial Group (KOSE:A316140) | 4.48% | ★★★★★☆ |

| HANYANG ENGLtd (KOSDAQ:A045100) | 3.50% | ★★★★★☆ |

| Hansae (KOSE:A105630) | 3.22% | ★★★★★☆ |

| KT (KOSE:A030200) | 4.57% | ★★★★★☆ |

| JW Holdings (KOSE:A096760) | 3.53% | ★★★★★☆ |

| Kyung Nong (KOSE:A002100) | 7.07% | ★★★★★☆ |

| ORION Holdings (KOSE:A001800) | 4.55% | ★★★★★☆ |

| Samsung Fire & Marine Insurance (KOSE:A000810) | 4.53% | ★★★★★☆ |

Click here to see the full list of 74 stocks from our Top KRX Dividend Stocks screener.

Underneath we present a selection of stocks filtered out by our screen.

KISCO Holdings (KOSE:A001940)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: KISCO Holdings Corp., with a market cap of ₩250.06 billion, operates through its subsidiaries to develop, produce, and sell steel products primarily in South Korea.

Operations: KISCO Holdings Corp.'s revenue is primarily derived from its Steel Manufacturing segment, which accounts for ₩1.26 trillion.

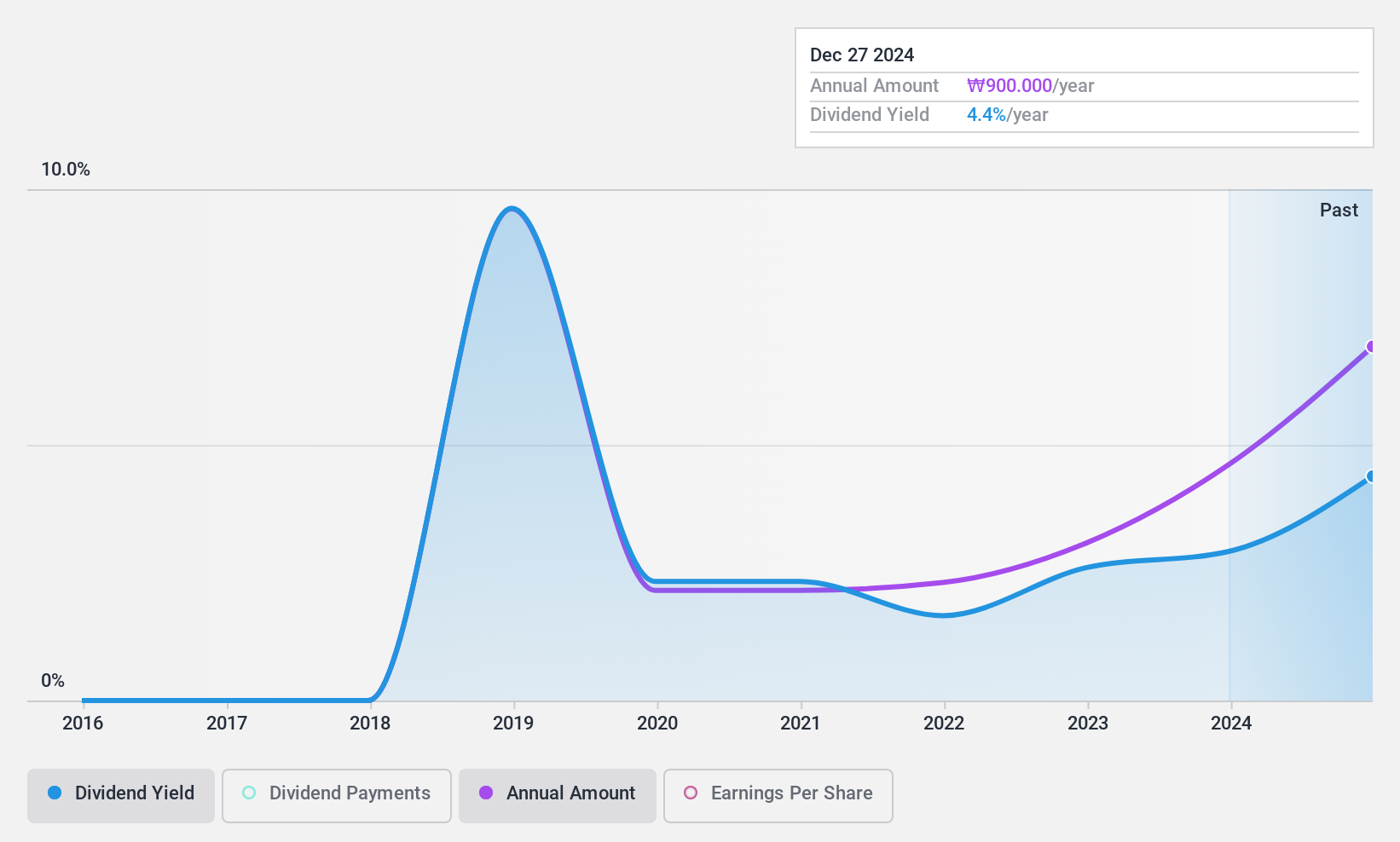

Dividend Yield: 4.5%

KISCO Holdings, despite its relatively high dividend yield of 4.55%, has a volatile and unreliable dividend history, with payments falling over the past six years. However, dividends are well-covered by earnings and cash flows, with payout ratios of 20% and 11.2%, respectively. The stock trades at a significant discount to estimated fair value, potentially offering value to investors seeking high yield in South Korea's market despite the unstable track record.

- Take a closer look at KISCO Holdings' potential here in our dividend report.

- Upon reviewing our latest valuation report, KISCO Holdings' share price might be too pessimistic.

S-1 (KOSE:A012750)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: S-1 Corporation offers safety and security services both in South Korea and internationally, with a market cap of ₩2.16 trillion.

Operations: S-1 Corporation's revenue primarily comes from its Security Service Sector, generating ₩1.35 trillion, and its Infrastructure Service Sector, contributing ₩1.53 trillion.

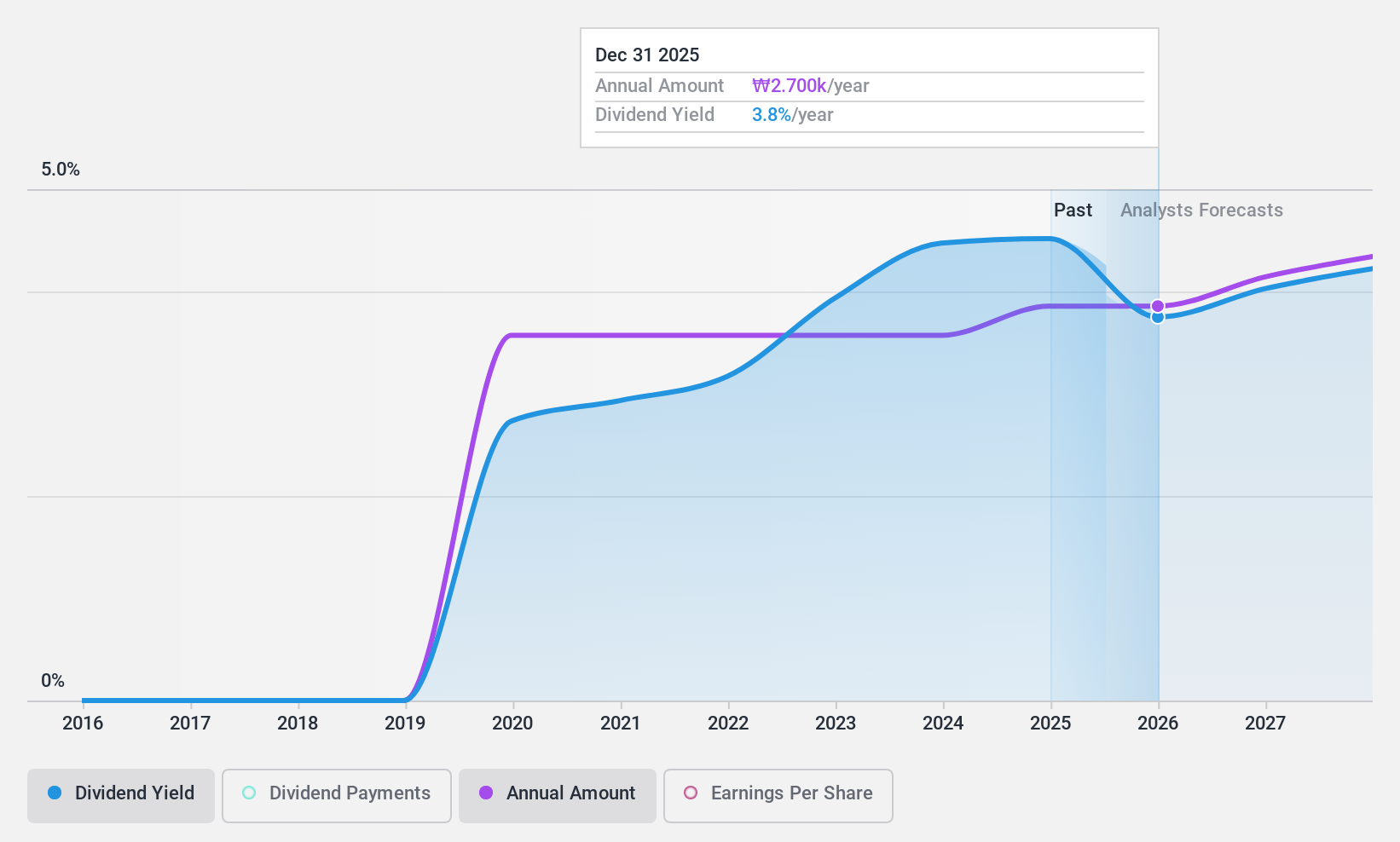

Dividend Yield: 4.2%

S-1 Corporation's dividend yield ranks in the top 25% of South Korea's market, supported by a low payout ratio of 49.5%, indicating dividends are well-covered by earnings. Cash flow coverage is also strong with a cash payout ratio of 38.7%. Despite only five years of dividend history, payments have been stable and growing without volatility. Recent earnings growth and trading below estimated fair value suggest potential appeal for investors prioritizing yield and value.

- Click here to discover the nuances of S-1 with our detailed analytical dividend report.

- Our valuation report here indicates S-1 may be undervalued.

BNK Financial Group (KOSE:A138930)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: BNK Financial Group Inc., along with its subsidiaries, offers a range of financial products and services both in South Korea and internationally, with a market cap of ₩3.13 trillion.

Operations: BNK Financial Group Inc.'s revenue primarily comes from Busan Bank with ₩1.30 trillion, followed by Gyeongnam Bank at ₩974.64 billion, BNK Capital at ₩206.99 billion, BNK Investments Securities at ₩155.86 billion, and BNK Savings Bank contributing ₩38.85 billion.

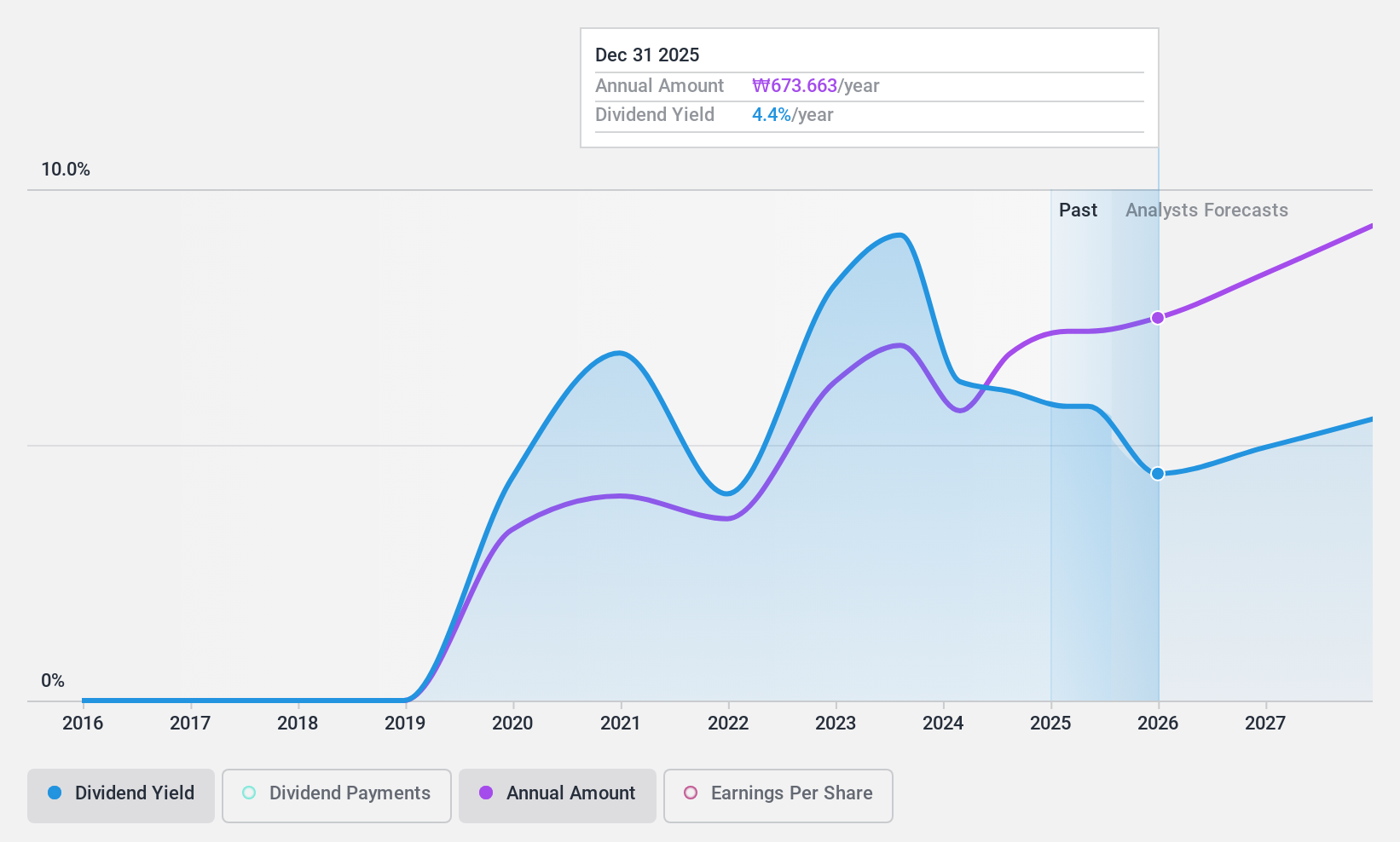

Dividend Yield: 8.4%

BNK Financial Group's dividend yield is among the top 25% in South Korea, with a low payout ratio of 25.5%, indicating strong earnings coverage. Despite only five years of dividend history, payments have been stable and growing. Recent earnings results show increased profitability, enhancing its ability to sustain dividends. The company trades at a significant discount to estimated fair value and has completed a share buyback program worth KRW 12.99 billion to enhance shareholder value.

- Dive into the specifics of BNK Financial Group here with our thorough dividend report.

- Our comprehensive valuation report raises the possibility that BNK Financial Group is priced lower than what may be justified by its financials.

Make It Happen

- Click here to access our complete index of 74 Top KRX Dividend Stocks.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About KOSE:A012750

S-1

Provides safety and security services in South Korea and internationally.

Very undervalued with flawless balance sheet and pays a dividend.