- South Korea

- /

- Chemicals

- /

- KOSDAQ:A121600

High Insider Ownership Growth Companies On KRX To Watch In June 2024

Reviewed by Simply Wall St

Following a period of fluctuation, the South Korean stock market has shown signs of both resilience and volatility, as evidenced by recent movements in the KOSPI index. In such a landscape, growth companies with high insider ownership can be particularly compelling to watch, as these firms often demonstrate alignment between management's interests and those of shareholders, potentially offering stability amidst market shifts.

Top 10 Growth Companies With High Insider Ownership In South Korea

| Name | Insider Ownership | Earnings Growth |

| SamyoungLtd (KOSE:A003720) | 25% | 30.4% |

| ALTEOGEN (KOSDAQ:A196170) | 26.6% | 73.1% |

| Global Tax Free (KOSDAQ:A204620) | 18.1% | 72.4% |

| Fine M-TecLTD (KOSDAQ:A441270) | 17.3% | 36.4% |

| Park Systems (KOSDAQ:A140860) | 33.1% | 35.8% |

| Seojin SystemLtd (KOSDAQ:A178320) | 26.4% | 48.1% |

| UTI (KOSDAQ:A179900) | 34.1% | 122.7% |

| HANA Micron (KOSDAQ:A067310) | 19.8% | 76.8% |

| INTEKPLUS (KOSDAQ:A064290) | 16.3% | 77.4% |

| Techwing (KOSDAQ:A089030) | 18.7% | 118.2% |

Underneath we present a selection of stocks filtered out by our screen.

Advanced Nano Products (KOSDAQ:A121600)

Simply Wall St Growth Rating: ★★★★☆☆

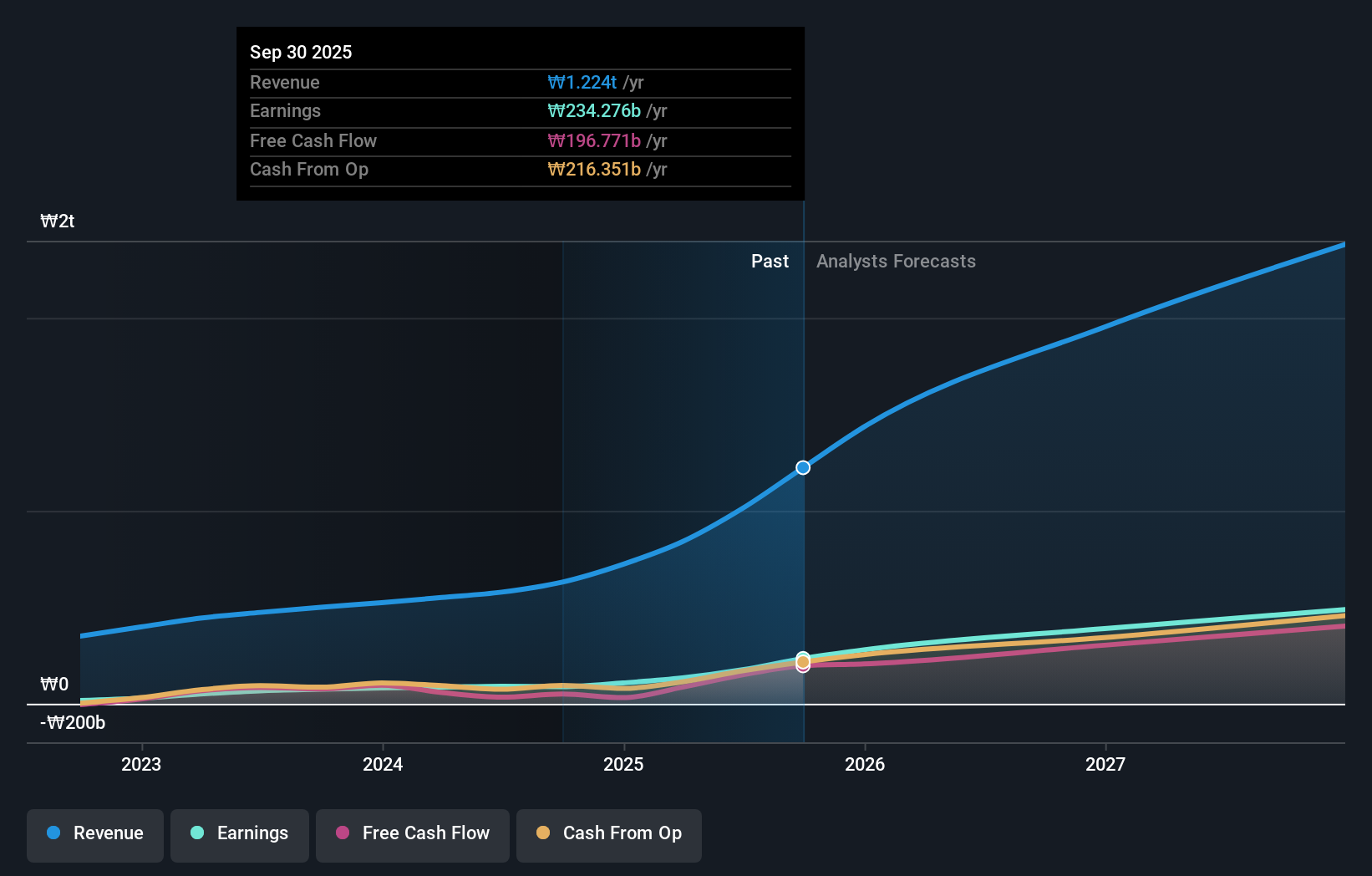

Overview: Advanced Nano Products Co., Ltd. is a company based in South Korea that manufactures and sells high-tech materials for displays, semiconductors, secondary batteries, and solar cells globally, with a market capitalization of approximately ₩1.44 billion.

Operations: The company generates revenue from the sale of high-tech materials for various applications including displays, semiconductors, secondary batteries, and solar cells.

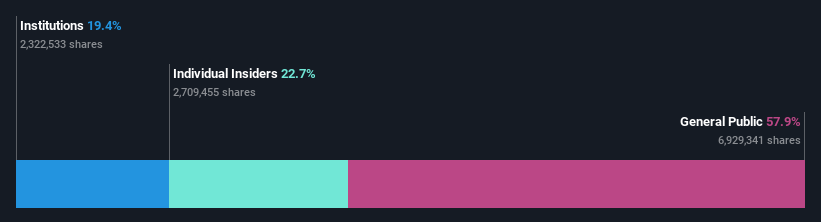

Insider Ownership: 23.9%

Revenue Growth Forecast: 54.2% p.a.

Advanced Nano Products, a growth-oriented company with high insider ownership in South Korea, is experiencing mixed financial trends. While the company's revenue is expected to grow at 54.2% annually, surpassing the Korean market average of 10.3%, its earnings growth forecast of 22.2% lags behind the market's 29.1%. Recent reports indicate a significant drop in net income from KRW 4.48 billion to KRW 1.15 billion and a decrease in profit margins from last year's 25.1% to this year's 15.3%. Despite these challenges, shareholder dilution has occurred over the past year, impacting investor returns negatively.

- Unlock comprehensive insights into our analysis of Advanced Nano Products stock in this growth report.

- The analysis detailed in our Advanced Nano Products valuation report hints at an inflated share price compared to its estimated value.

ALTEOGEN (KOSDAQ:A196170)

Simply Wall St Growth Rating: ★★★★★★

Overview: ALTEOGEN Inc. is a biopharmaceutical company engaged in developing long-acting biobetters, proprietary antibody-drug conjugates, and antibody biosimilars, with a market capitalization of approximately ₩13.44 billion.

Operations: The company generates revenue primarily from its biopharmaceutical products, including long-acting biobetters and proprietary antibody-drug conjugates.

Insider Ownership: 26.6%

Revenue Growth Forecast: 48.3% p.a.

ALTEOGEN, a South Korean biotech firm with substantial insider ownership, is trading significantly below its estimated fair value. Despite recent share price volatility and shareholder dilution over the past year, ALTEOGEN's financial outlook appears robust. The company's earnings and revenue are both expected to outpace the market substantially, with earnings projected to grow at 73.06% annually and revenue at 48.3%. Additionally, its Return on Equity is anticipated to be very high in three years at 45.2%.

- Dive into the specifics of ALTEOGEN here with our thorough growth forecast report.

- Our comprehensive valuation report raises the possibility that ALTEOGEN is priced higher than what may be justified by its financials.

APR (KOSE:A278470)

Simply Wall St Growth Rating: ★★★★★☆

Overview: APR Co., Ltd. is a company that manufactures and sells cosmetics for both men and women, with a market capitalization of approximately ₩2.55 billion.

Operations: The company generates revenue through the manufacture and sale of cosmetics for both genders.

Insider Ownership: 34.2%

Revenue Growth Forecast: 23.2% p.a.

APR Co., Ltd., a South Korean company, is poised for substantial growth with earnings forecasted to increase by 26.21% annually, outpacing its revenue growth at 23.2% per year—faster than the national market average of 10.3%. Despite trading 20.5% below its estimated fair value and facing high share price volatility recently, analysts predict a potential price rise of 20.4%. The firm's projected Return on Equity is impressively high at 34.5%, indicating robust future profitability.

- Get an in-depth perspective on APR's performance by reading our analyst estimates report here.

- Our valuation report here indicates APR may be undervalued.

Taking Advantage

- Unlock more gems! Our Fast Growing KRX Companies With High Insider Ownership screener has unearthed 79 more companies for you to explore.Click here to unveil our expertly curated list of 82 Fast Growing KRX Companies With High Insider Ownership.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About KOSDAQ:A121600

Advanced Nano Products

Manufactures and sells high-tech materials, such as displays, semiconductors, secondary batteries, and solar cells in South Korea and internationally.

High growth potential with adequate balance sheet.