- South Korea

- /

- Insurance

- /

- KOSE:A003690

Top Dividend Stocks On KRX To Boost Your Portfolio

Reviewed by Simply Wall St

In the last week, the South Korean market has been flat, with the Information Technology sector experiencing a 3.3% drop. Despite this stagnation over the past 12 months, earnings are forecast to grow by 29% annually. In such conditions, identifying strong dividend stocks can provide stability and consistent returns for your portfolio.

Top 10 Dividend Stocks In South Korea

| Name | Dividend Yield | Dividend Rating |

| Kia (KOSE:A000270) | 5.59% | ★★★★★★ |

| NH Investment & Securities (KOSE:A005940) | 5.76% | ★★★★★☆ |

| Shinhan Financial Group (KOSE:A055550) | 3.78% | ★★★★★☆ |

| Hansae (KOSE:A105630) | 3.32% | ★★★★★☆ |

| Industrial Bank of Korea (KOSE:A024110) | 7.09% | ★★★★★☆ |

| KT (KOSE:A030200) | 5.03% | ★★★★★☆ |

| HANYANG ENGLtd (KOSDAQ:A045100) | 3.49% | ★★★★★☆ |

| Kyung Nong (KOSE:A002100) | 7.19% | ★★★★★☆ |

| JW Holdings (KOSE:A096760) | 3.43% | ★★★★★☆ |

| iMarketKorea (KOSE:A122900) | 7.01% | ★★★★☆☆ |

Click here to see the full list of 78 stocks from our Top KRX Dividend Stocks screener.

We'll examine a selection from our screener results.

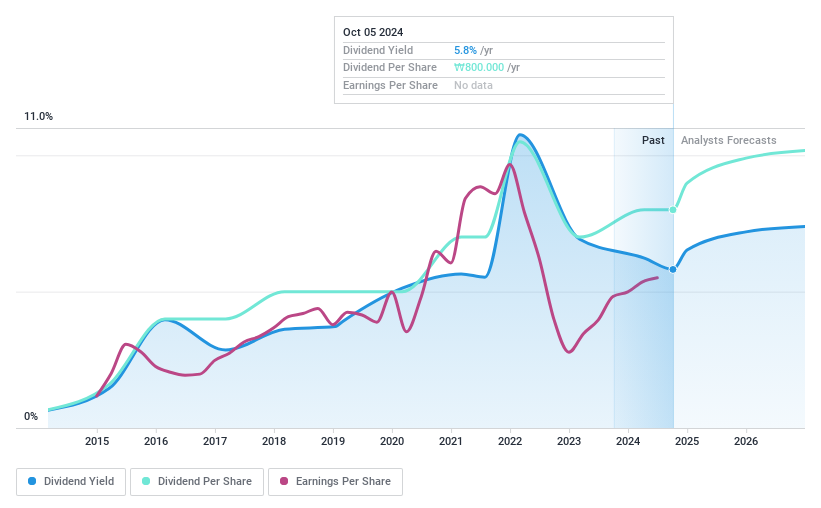

Hyundai Marine & Fire Insurance (KOSE:A001450)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Hyundai Marine & Fire Insurance Co., Ltd. operates in the insurance industry, providing a range of insurance products and services, with a market cap of ₩2.78 trillion.

Operations: Hyundai Marine & Fire Insurance Co., Ltd. generates revenue primarily from the financial industry, amounting to ₩1.36 trillion, and additionally from the non-financial industry, contributing ₩17.52 billion.

Dividend Yield: 5.8%

Hyundai Marine & Fire Insurance's dividend payments, while covered by both earnings (21.6% payout ratio) and cash flows (7.5% cash payout ratio), have been volatile over the past five years, reflecting an unstable track record. Despite this volatility, the company's current dividend yield of 5.83% places it in the top 25% of dividend payers in South Korea. Additionally, it trades at good value compared to peers and industry standards.

- Get an in-depth perspective on Hyundai Marine & Fire Insurance's performance by reading our dividend report here.

- According our valuation report, there's an indication that Hyundai Marine & Fire Insurance's share price might be on the cheaper side.

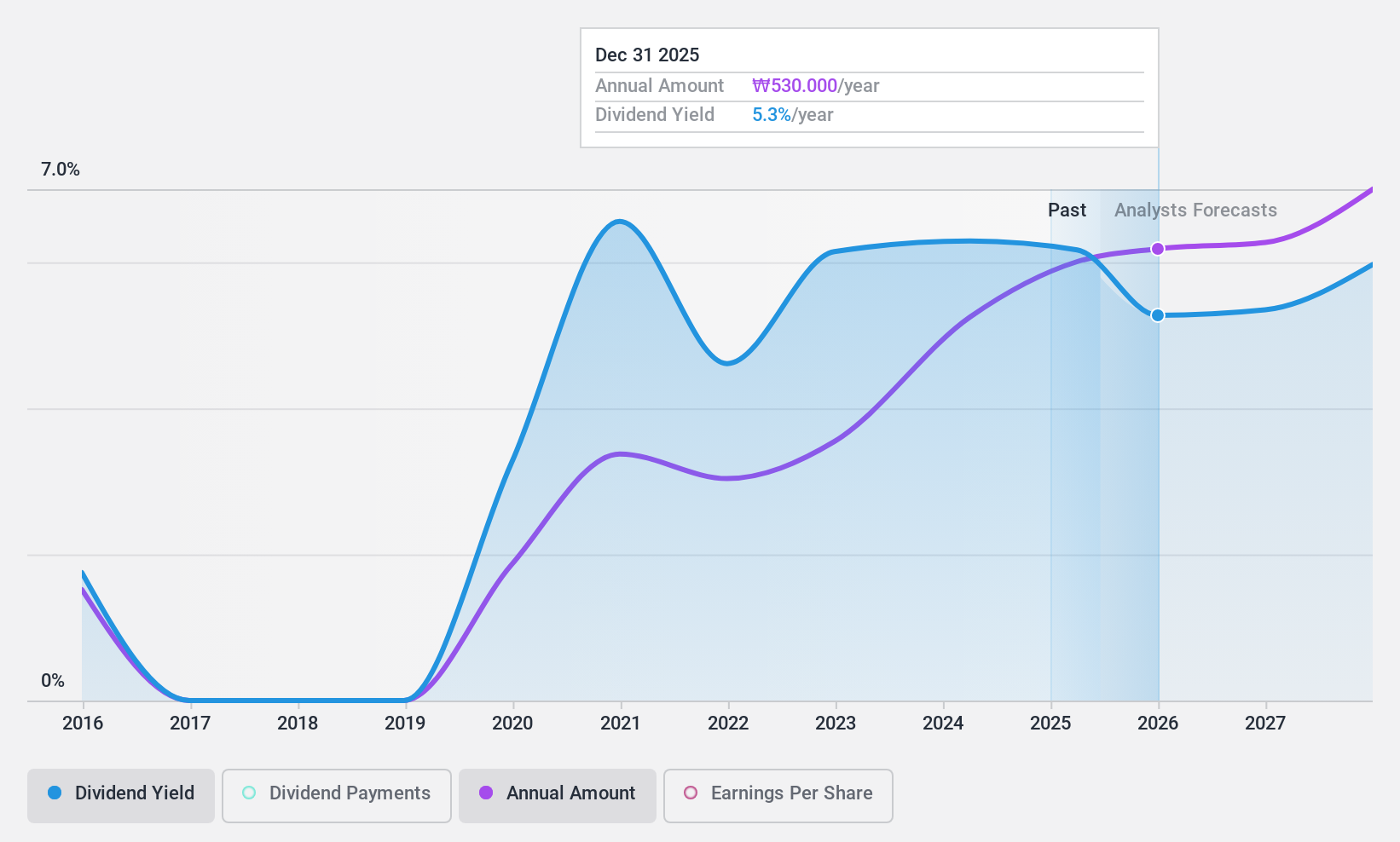

Korean Reinsurance (KOSE:A003690)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Korean Reinsurance Company offers life and non-life reinsurance products both in Korea and internationally, with a market cap of ₩1.28 trillion.

Operations: Korean Reinsurance Company generates ₩4.14 billion from its reinsurance segment.

Dividend Yield: 6.2%

Korean Reinsurance's dividend payments, covered by earnings (37.6% payout ratio) and cash flows (7.2% cash payout ratio), have been stable but the company has only a 9-year track record of paying dividends. Trading at 77.2% below its estimated fair value, it offers a high dividend yield of 6.23%, placing it in the top 25% of South Korean dividend payers. Earnings are forecasted to grow annually by 14.75%, supporting future payouts despite some large one-off items affecting financial results recently.

- Delve into the full analysis dividend report here for a deeper understanding of Korean Reinsurance.

- The valuation report we've compiled suggests that Korean Reinsurance's current price could be quite moderate.

NH Investment & Securities (KOSE:A005940)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: NH Investment & Securities Co., Ltd. operates in wealth management, investment banking, trading, and equity sales both in South Korea and internationally with a market cap of ₩4.77 trillion.

Operations: NH Investment & Securities Co., Ltd. generates revenue from various segments, including ₩2.83 billion from sales, ₩3.26 billion from trading, and ₩867.11 million from investment banking (IB).

Dividend Yield: 5.8%

NH Investment & Securities offers a high dividend yield of 5.76%, placing it in the top 25% of South Korean dividend payers. The company's dividends are well-covered by earnings (46.9% payout ratio) and cash flows (31.1% cash payout ratio). However, its dividend track record has been unstable over the past decade, with payments being volatile. Currently trading at 48.2% below its estimated fair value, it presents good value compared to peers and industry standards.

- Dive into the specifics of NH Investment & Securities here with our thorough dividend report.

- The analysis detailed in our NH Investment & Securities valuation report hints at an deflated share price compared to its estimated value.

Seize The Opportunity

- Click through to start exploring the rest of the 75 Top KRX Dividend Stocks now.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Korean Reinsurance might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About KOSE:A003690

Korean Reinsurance

A reinsurance company, provides life and non-life reinsurance products in Korea and internationally.

Undervalued with excellent balance sheet and pays a dividend.