- South Korea

- /

- Auto Components

- /

- KOSE:A004490

Three Undiscovered Gems In South Korea For Savvy Investors

Reviewed by Simply Wall St

The South Korean market has shown promising signs, increasing 1.9% over the last week and up 3.6% over the past year, with earnings forecasted to grow by 29% annually. In this favorable environment, identifying stocks with strong fundamentals and growth potential can offer significant opportunities for investors.

Top 10 Undiscovered Gems With Strong Fundamentals In South Korea

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Korea Airport ServiceLtd | NA | 3.97% | 42.22% | ★★★★★★ |

| Miwon Chemicals | 0.08% | 11.70% | 14.38% | ★★★★★★ |

| ASIA Holdings | 34.13% | 8.28% | 15.67% | ★★★★★★ |

| Woori Technology Investment | NA | 22.60% | -1.67% | ★★★★★★ |

| Kyung Dong Navien | 22.40% | 11.19% | 18.84% | ★★★★★★ |

| SELVAS Healthcare | 13.58% | 10.16% | 77.14% | ★★★★★★ |

| Synergy Innovation | 12.39% | 12.87% | 28.82% | ★★★★★★ |

| KG Chemical | 43.62% | 33.46% | 8.39% | ★★★★★☆ |

| Daewon Cable | 30.50% | 8.72% | 60.38% | ★★★★★☆ |

| Ubiquoss Holdings | 2.69% | 9.93% | 14.22% | ★★★★★☆ |

Let's review some notable picks from our screened stocks.

T&L (KOSDAQ:A340570)

Simply Wall St Value Rating: ★★★★★★

Overview: T&L Co., Ltd. manufactures and sells medical and polymer material products in South Korea, with a market cap of ₩589.26 billion.

Operations: T&L Co., Ltd. generates revenue primarily from its medical products segment, which reported ₩113.23 billion in sales. The company has a market cap of ₩589.26 billion.

T&L, a promising small-cap stock in South Korea, showcases strong financial health with high-quality earnings and no debt. Over the past year, earnings grew by 7.7%, outpacing the Medical Equipment industry's 3.1% growth rate. Trading at 76.7% below its estimated fair value, T&L's future looks bright with forecasted annual earnings growth of 32%. The company repurchased shares recently, indicating confidence in its performance and potential for further growth.

- Get an in-depth perspective on T&L's performance by reading our health report here.

Explore historical data to track T&L's performance over time in our Past section.

Gaonchips (KOSDAQ:A399720)

Simply Wall St Value Rating: ★★★★★☆

Overview: Gaonchips Co., Ltd. manufactures semiconductors and has a market cap of ₩604.29 billion.

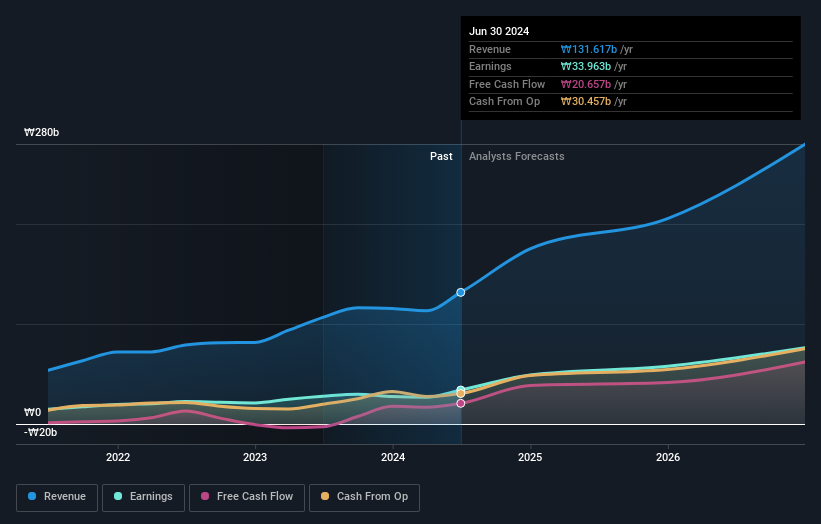

Operations: Gaonchips generates revenue primarily from its semiconductor segment, amounting to ₩68.88 billion.

Gaonchips, a notable player in the semiconductor sector, experienced significant earnings growth of 111.2% over the past year, far outpacing the industry average of -20.1%. The company has more cash than its total debt, reflecting a strong balance sheet. Despite recent volatility in its share price, Gaonchips remains profitable with high-quality earnings and forecasts suggest an annual growth rate of 69.13%, highlighting its potential for future expansion within the industry.

- Delve into the full analysis health report here for a deeper understanding of Gaonchips.

Evaluate Gaonchips' historical performance by accessing our past performance report.

Sebang Global Battery (KOSE:A004490)

Simply Wall St Value Rating: ★★★★★☆

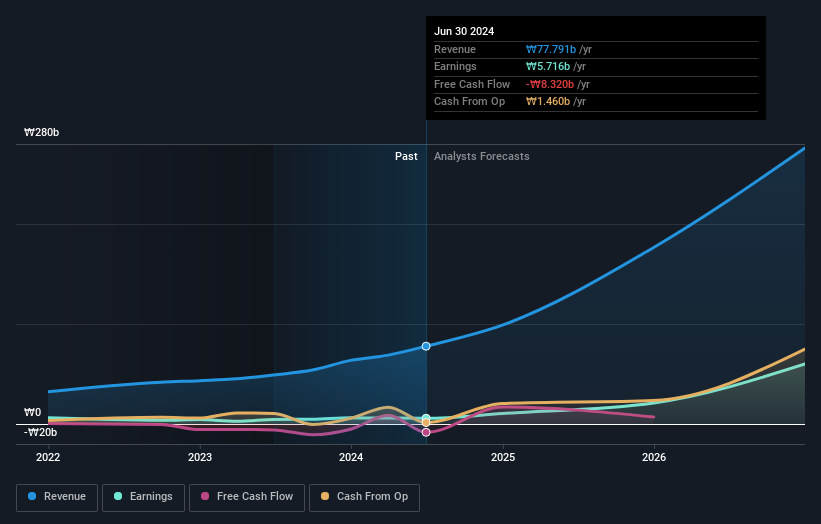

Overview: Sebang Global Battery Co., Ltd., along with its subsidiaries, manufactures and sells lead acid batteries in South Korea and internationally, with a market cap of ₩1.36 billion.

Operations: Sebang Global Battery generates revenue primarily from the sale of lead acid batteries both domestically and internationally. The company reported a market cap of ₩1.36 billion.

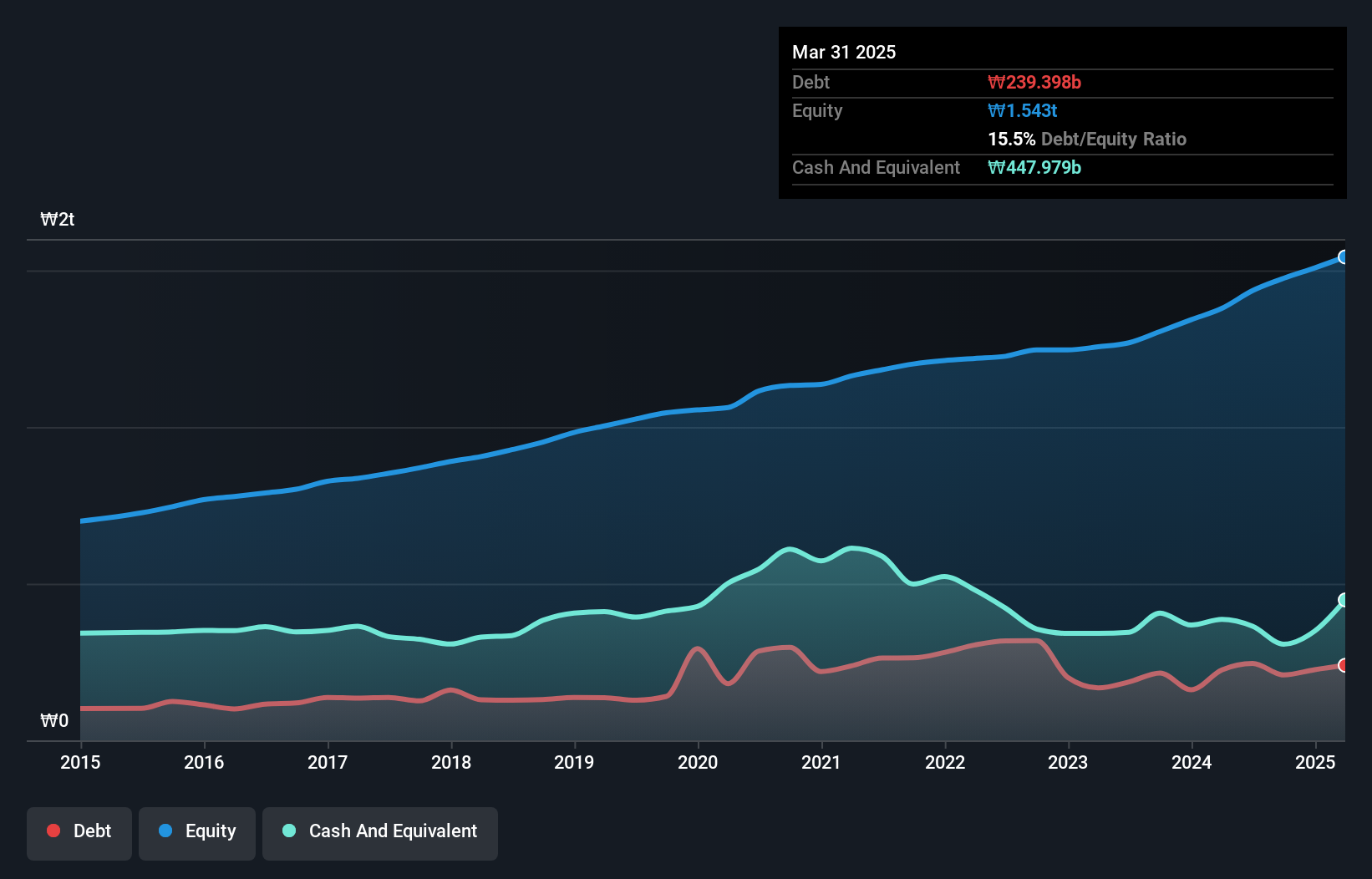

Sebang Global Battery's earnings skyrocketed 190.8% last year, outpacing the Auto Components industry’s 17.5%. The firm has a debt-to-equity ratio that rose from 12.5% to 17.1% over five years, indicating careful leverage use while still having more cash than total debt. Trading at a significant discount of 31% below its estimated fair value, Sebang also boasts high-quality earnings and positive free cash flow, making it an intriguing prospect in South Korea’s market landscape.

- Take a closer look at Sebang Global Battery's potential here in our health report.

Assess Sebang Global Battery's past performance with our detailed historical performance reports.

Turning Ideas Into Actions

- Click this link to deep-dive into the 195 companies within our KRX Undiscovered Gems With Strong Fundamentals screener.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About KOSE:A004490

Sebang Global Battery

Manufactures and sells lead acid batteries in South Korea and internationally.

Solid track record with excellent balance sheet.