- South Korea

- /

- Entertainment

- /

- KOSDAQ:A225570

Exploring 3 High Growth Tech Stocks in South Korea for Your Portfolio

Reviewed by Simply Wall St

Over the last 7 days, the South Korean market has risen 1.9%, driven by gains in the Financials and Information Technology sectors of 5.7% and 1.4%, respectively. As for the past 12 months, the market is up 3.6%. Looking forward, earnings are forecast to grow by 29% annually. In this context, identifying high-growth tech stocks that align with these trends can be a strategic move for investors looking to capitalize on South Korea's robust market performance and promising earnings outlook.

Top 10 High Growth Tech Companies In South Korea

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| IMLtd | 20.76% | 106.30% | ★★★★★★ |

| Bioneer | 22.49% | 89.69% | ★★★★★★ |

| ALTEOGEN | 64.22% | 99.46% | ★★★★★★ |

| NEXON Games | 31.70% | 66.31% | ★★★★★★ |

| Seojin SystemLtd | 34.20% | 62.10% | ★★★★★★ |

| FLITTO | 32.07% | 100.38% | ★★★★★★ |

| Devsisters | 26.11% | 65.92% | ★★★★★★ |

| AmosenseLtd | 24.29% | 55.45% | ★★★★★★ |

| Park Systems | 22.50% | 37.52% | ★★★★★★ |

| UTI | 103.56% | 122.67% | ★★★★★★ |

Click here to see the full list of 50 stocks from our KRX High Growth Tech and AI Stocks screener.

Here's a peek at a few of the choices from the screener.

WemadeLtd (KOSDAQ:A112040)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Wemade Co., Ltd. develops and publishes games in South Korea and internationally with a market cap of ₩1.05 trillion.

Operations: The company generates revenue primarily from its gaming business, amounting to ₩617.36 billion.

Wemade Ltd. is making significant strides in the blockchain gaming sector, particularly with its WEMIX ecosystem and the recent WEMIX3.0 launch. The company’s revenue is projected to grow at 15.7% annually, outpacing the South Korean market's average of 10.4%. Despite being unprofitable currently, earnings are forecasted to surge by 106.8% per year over the next three years, indicating a robust growth trajectory. Notably, Wemade has invested heavily in R&D to enhance its gaming platforms and blockchain capabilities, with expenditures reaching ₩1B this year alone. The exclusive publishing license agreement with China Crown Technology for MIR M highlights Wemade's strategic expansion into mainland China’s lucrative gaming market. This partnership could potentially boost revenue streams significantly upon commercial launch in early 2025. Additionally, recent initiatives such as revamping the WEMIX PLAY platform and empowering community engagement underscore Wemade's commitment to innovation and user experience enhancement within their ecosystem.

- Get an in-depth perspective on WemadeLtd's performance by reading our health report here.

Review our historical performance report to gain insights into WemadeLtd's's past performance.

Devsisters (KOSDAQ:A194480)

Simply Wall St Growth Rating: ★★★★★★

Overview: Devsisters Corporation develops mobile games in South Korea and internationally, with a market cap of ₩453.63 billion.

Operations: The company generates revenue primarily from its mobile gaming segment, with computer graphics contributing ₩170.33 million.

Devsisters, known for its popular mobile game Cookie Run, has been making waves in the tech industry with a forecasted annual revenue growth of 26.1%, significantly outpacing the South Korean market's average of 10.4%. The company's earnings are projected to surge by 65.9% annually over the next three years, driven by strategic investments in R&D which reached ₩2B this year alone. This focus on innovation is evident as Devsisters continues to expand its gaming portfolio and enhance user engagement across platforms. Recent initiatives include diversifying into new game genres and leveraging AI for personalized gaming experiences, positioning them well within the competitive landscape. Additionally, Devsisters repurchased shares worth ₩500M in 2024, reflecting confidence in their long-term growth prospects. With a robust pipeline of upcoming releases and continuous advancements in technology, they are poised to capitalize on evolving market trends and consumer preferences.

- Click to explore a detailed breakdown of our findings in Devsisters' health report.

Gain insights into Devsisters' historical performance by reviewing our past performance report.

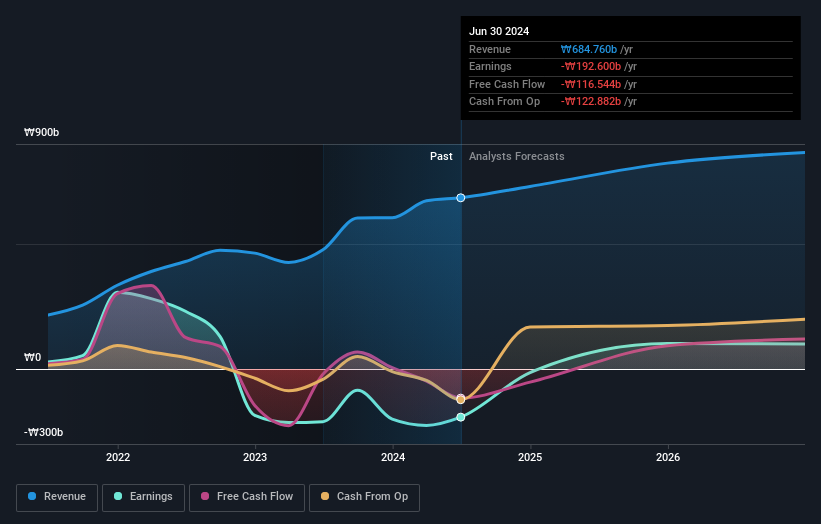

NEXON Games (KOSDAQ:A225570)

Simply Wall St Growth Rating: ★★★★★★

Overview: NEXON Games Co., Ltd. operates as a game developer with a market cap of ₩1.47 trillion.

Operations: NEXON Games Co., Ltd. specializes in developing video games, generating revenue primarily from game sales and in-game purchases. The company has a market capitalization of ₩1.47 trillion.

NEXON Games is experiencing robust growth, with revenue forecasted to increase by 31.7% annually, outpacing the South Korean market's average of 10.4%. Despite being currently unprofitable, earnings are expected to grow by 66.3% per year and become profitable within three years. The company has significantly invested in R&D, spending ₩2B this year alone to enhance its gaming portfolio and leverage AI for personalized experiences. This strategic focus on innovation positions NEXON Games favorably in the competitive landscape as they continue expanding their offerings and engaging users across platforms.

Summing It All Up

- Discover the full array of 50 KRX High Growth Tech and AI Stocks right here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if NEXON Games might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About KOSDAQ:A225570

Exceptional growth potential with flawless balance sheet.