- South Korea

- /

- Capital Markets

- /

- KOSE:A023590

Uncovering Three Undiscovered Gems in Global Markets

Reviewed by Simply Wall St

As global markets navigate the anticipation of Federal Reserve rate cuts and the enthusiasm surrounding artificial intelligence, major U.S. stock indexes have reached new record highs, with small-cap stocks represented by the Russell 2000 Index also experiencing a notable sixth consecutive week of gains. Amid these dynamic conditions, identifying undiscovered gems in global markets requires a keen understanding of economic indicators and market sentiment that can reveal promising opportunities for growth.

Top 10 Undiscovered Gems With Strong Fundamentals Globally

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Tsubakimoto Kogyo | NA | 7.01% | 11.34% | ★★★★★★ |

| Zhejiang Wanfeng ChemicalLtd | 11.75% | 18.70% | -24.16% | ★★★★★★ |

| ManpowerGroup Greater China | NA | 15.48% | -0.30% | ★★★★★★ |

| OpenWork | NA | 30.11% | 29.99% | ★★★★★★ |

| Guangdong Green Precision Components | NA | -9.65% | -38.41% | ★★★★★★ |

| Quality Reliability Technology | 8.30% | 1.20% | -45.53% | ★★★★★★ |

| SEC Electric Machinery | NA | -4.45% | -54.43% | ★★★★★★ |

| E J Holdings | 21.62% | 4.30% | 3.77% | ★★★★★☆ |

| Shanghai Material Trading | 1.95% | -9.84% | -12.61% | ★★★★★☆ |

| SEMCNS | 44.41% | 8.15% | -29.17% | ★★★★★☆ |

Let's review some notable picks from our screened stocks.

Daou Technology (KOSE:A023590)

Simply Wall St Value Rating: ★★★★★☆

Overview: Daou Technology Inc., along with its subsidiaries, offers IT and finance services and has a market capitalization of ₩1.59 trillion.

Operations: Daou Technology's primary revenue streams are from its Finance - Wholesale General Manager and Finance - Retail General Manager segments, generating ₩9.81 billion and ₩2.96 billion respectively. The company also earns from Finance - Other and Non-Financial segments like System Construction, contributing smaller amounts to total revenue.

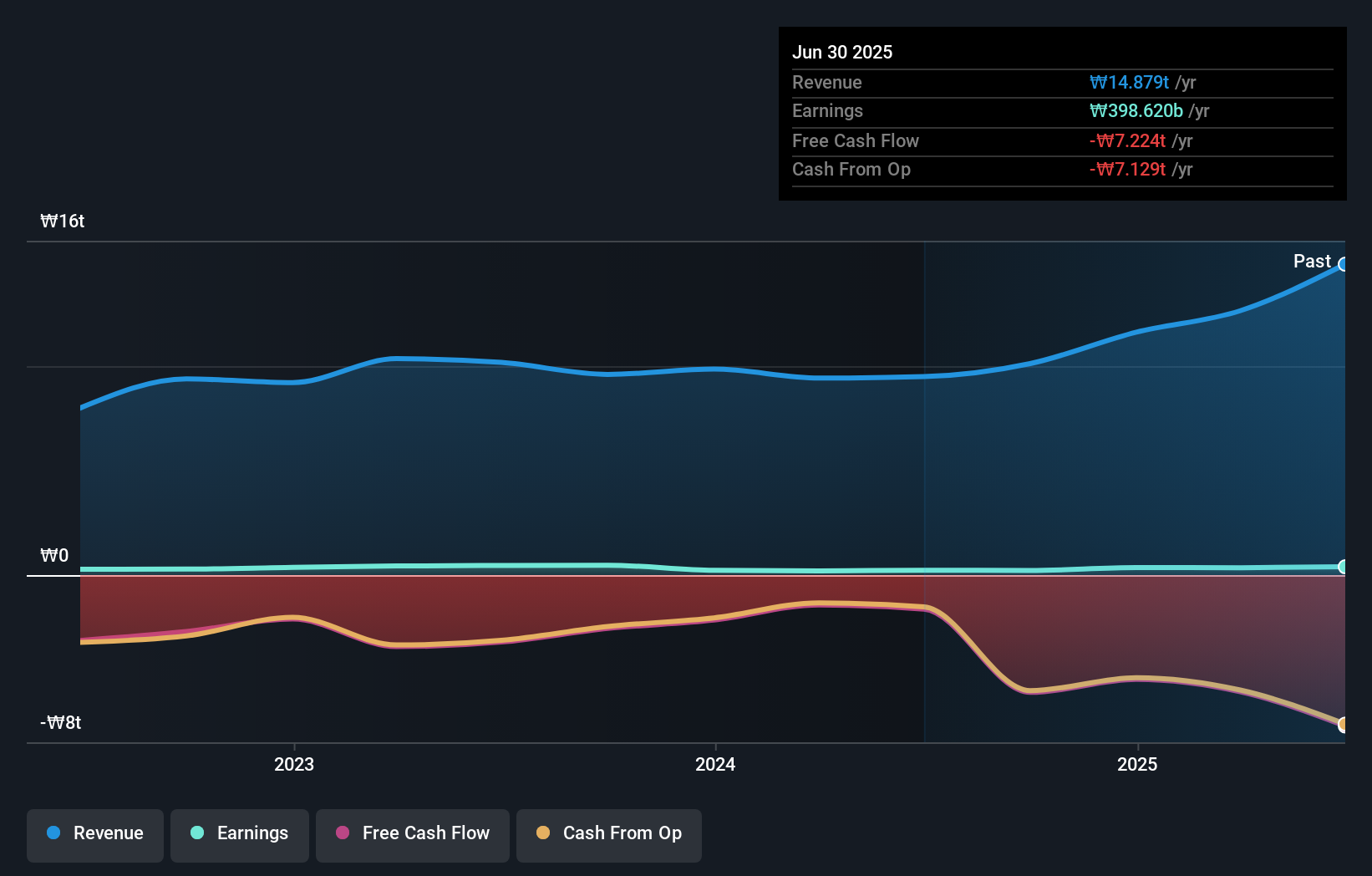

Daou Technology, a notable player in the tech sector, showcases impressive earnings growth of 69.8% over the past year, outpacing the Capital Markets industry average of 25.5%. Its recent quarterly sales reached KRW 4.60 trillion compared to KRW 2.37 trillion last year, with net income rising to KRW 146.63 billion from KRW 102.84 billion a year ago. Despite trading at a significant discount of about 50% below estimated fair value, Daou's debt-to-equity ratio improved from 544% to around 525% over five years, indicating better financial health amidst robust earnings coverage for interest payments at an impressive multiple of approximately 106 times EBIT.

- Get an in-depth perspective on Daou Technology's performance by reading our health report here.

Gain insights into Daou Technology's past trends and performance with our Past report.

Guangdong Brandmax MarketingLtd (SZSE:300805)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Guangdong Brandmax Marketing Co., Ltd. offers technology-driven new scene experience marketing services both in China and internationally, with a market cap of CN¥5.29 billion.

Operations: The company generates revenue primarily through its technology-driven marketing services. It has reported a net profit margin of 14.5%, indicating efficiency in converting sales into actual profit.

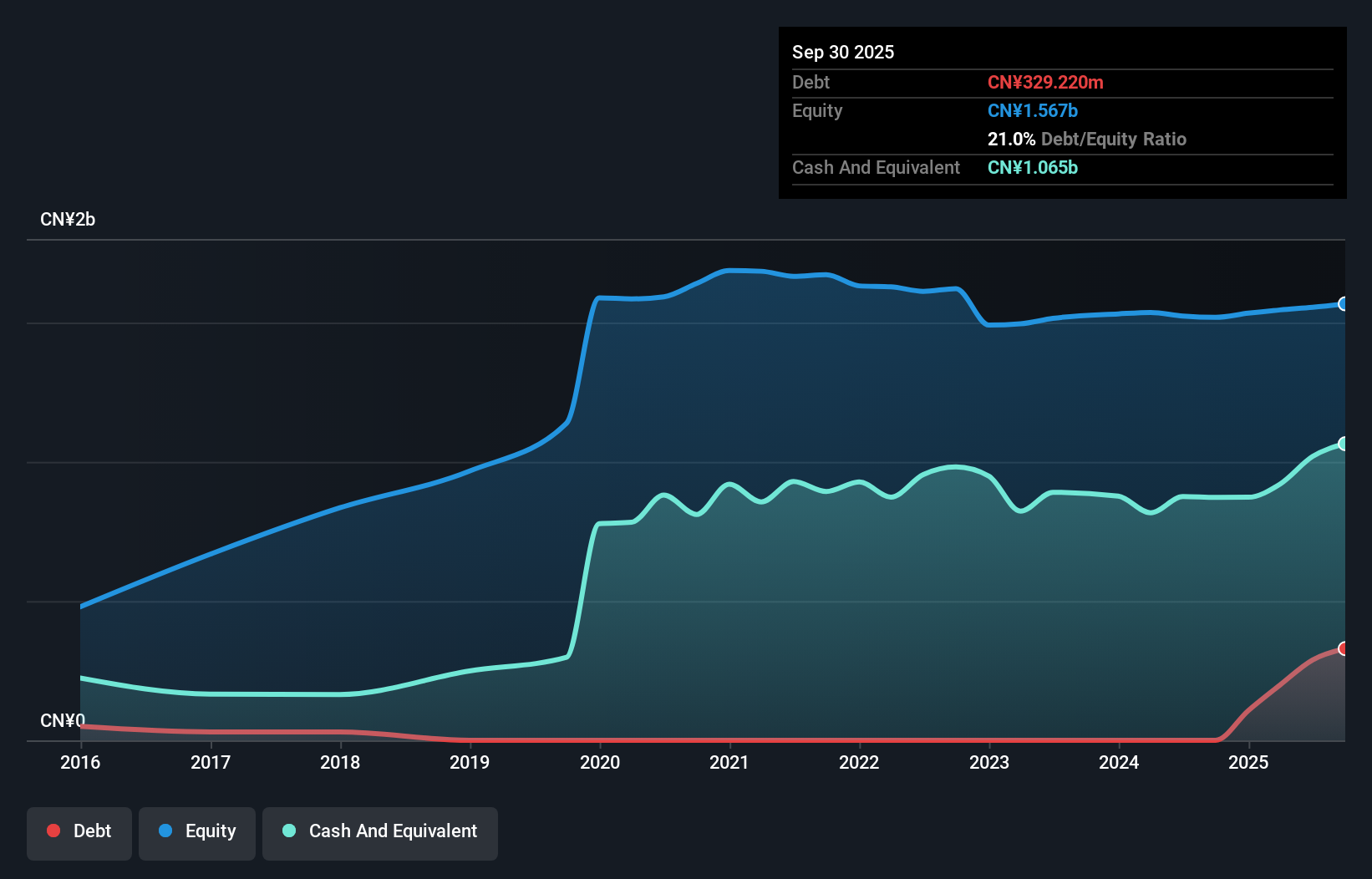

Guangdong Brandmax Marketing, a nimble player in its sector, has shown notable progress with a recent half-year revenue of CNY 1.22 billion, up from CNY 1.09 billion the previous year. Net income also climbed to CNY 22.88 million from CNY 10.64 million, reflecting strong operational performance despite past challenges where earnings declined by 37% annually over five years. The company's earnings growth of 23% last year outpaced the media industry's -9.5%, indicating robust recovery potential and resilience against industry trends while maintaining more cash than total debt suggests sound financial health amidst rising debt levels to equity at 18.5%.

Wuxi Online Offline Communication Information Technology (SZSE:300959)

Simply Wall St Value Rating: ★★★★★★

Overview: Wuxi Online Offline Communication Information Technology Co., Ltd. is a company with a market cap of CN¥3.82 billion, focusing on providing communication technology solutions that integrate both online and offline platforms.

Operations: The company generates revenue primarily from its communication technology solutions, which integrate online and offline platforms. It has a market cap of CN¥3.82 billion.

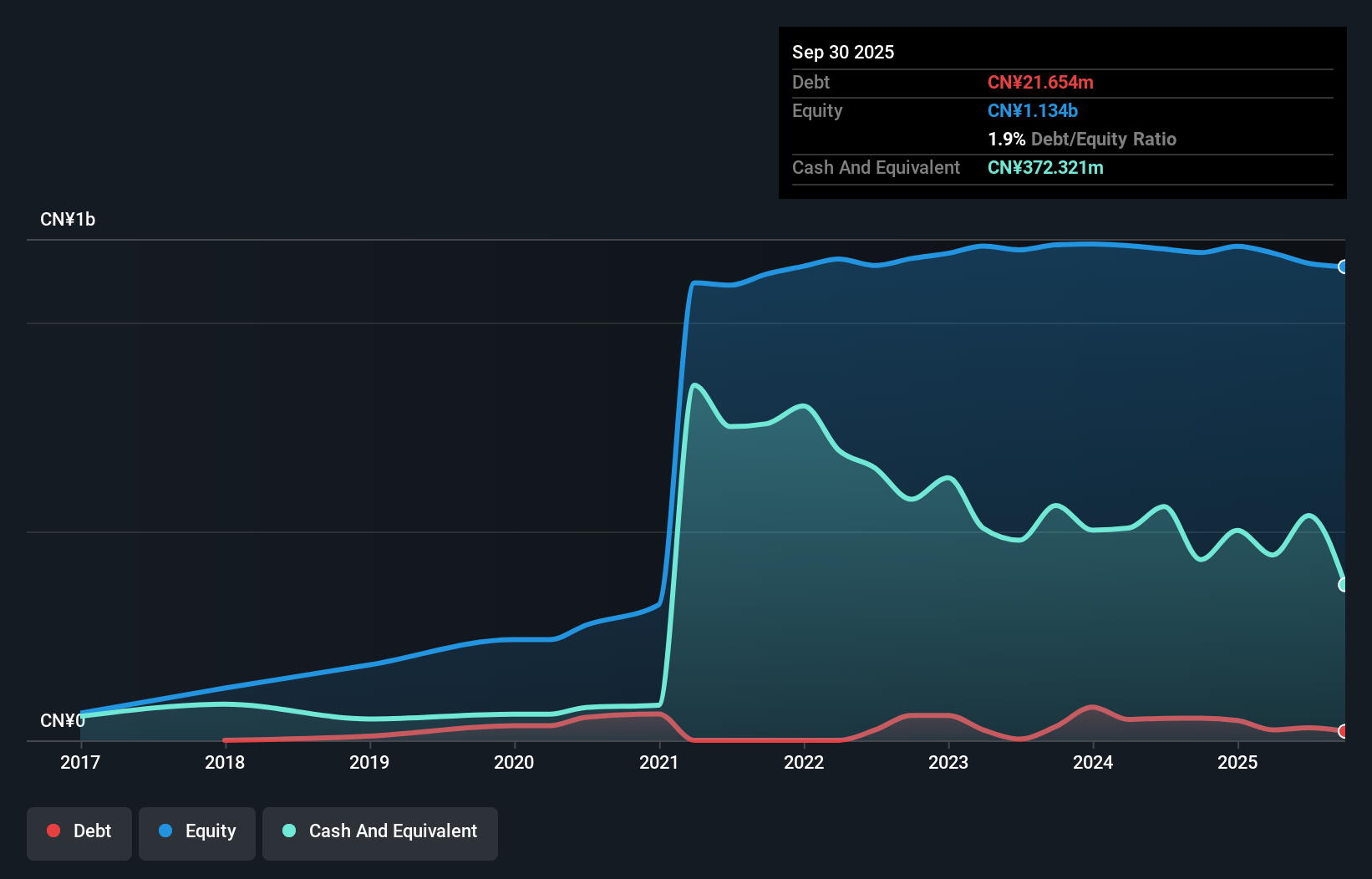

Wuxi Online has been making waves with its recent financial performance and strategic moves. Over the past year, earnings skyrocketed by 571.5%, significantly outpacing the Wireless Telecom industry's growth of 8%. Despite a revenue drop to CN¥333.7M from CN¥528.57M last year, net income improved to CN¥10.72M from CN¥2.14M, reflecting strong operational efficiency and a notable gain of CN¥27.3M from one-off items in their results up to June 2025. A significant development is Senary Technology's acquisition of a 13.32% stake for approximately CNY470 million, positioning them as Wuxi's controlling shareholder and indicating potential strategic shifts ahead.

Summing It All Up

- Unlock more gems! Our Global Undiscovered Gems With Strong Fundamentals screener has unearthed 2954 more companies for you to explore.Click here to unveil our expertly curated list of 2957 Global Undiscovered Gems With Strong Fundamentals.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About KOSE:A023590

Solid track record with excellent balance sheet.

Market Insights

Community Narratives