- South Korea

- /

- Aerospace & Defense

- /

- KOSE:A003570

Undiscovered Gems Boditech Med And 2 Other Promising Small Caps In South Korea

Reviewed by Simply Wall St

The South Korea stock market recently paused its upward momentum, with the KOSPI index slightly declining after a two-day rally. Despite this, broader market sentiment remains optimistic, buoyed by positive developments in the U.S. and mixed but stable performances in European markets. In this dynamic environment, identifying promising small-cap stocks can offer unique opportunities for investors. This article highlights three such undiscovered gems in South Korea, starting with Boditech Med.

Top 10 Undiscovered Gems With Strong Fundamentals In South Korea

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Samyang | 47.03% | 6.61% | 22.07% | ★★★★★★ |

| Korea Ratings | NA | 1.74% | 0.87% | ★★★★★★ |

| Kyung Dong Navien | 26.97% | 11.54% | 19.49% | ★★★★★★ |

| Oriental Precision & EngineeringLtd | 59.19% | 3.54% | 5.92% | ★★★★★★ |

| Hansae Yes24 Holdings | 97.82% | 2.74% | 18.89% | ★★★★★☆ |

| KG Chemical | 43.62% | 33.46% | 8.39% | ★★★★★☆ |

| Daewon Cable | 24.70% | 8.50% | 62.14% | ★★★★★☆ |

| Ubiquoss Holdings | 2.69% | 9.93% | 14.22% | ★★★★★☆ |

| Kwang Dong Pharmaceutical | 40.57% | 5.48% | 4.75% | ★★★★☆☆ |

| EASY BIOInc | 188.46% | 15.71% | 55.75% | ★★★★☆☆ |

We're going to check out a few of the best picks from our screener tool.

Boditech Med (KOSDAQ:A206640)

Simply Wall St Value Rating: ★★★★★★

Overview: Boditech Med Inc. provides instruments and diagnostic reagents both in South Korea and internationally, with a market cap of ₩411.82 billion.

Operations: Boditech Med Inc. generates revenue primarily from diagnostic kits and equipment, amounting to ₩137.84 billion.

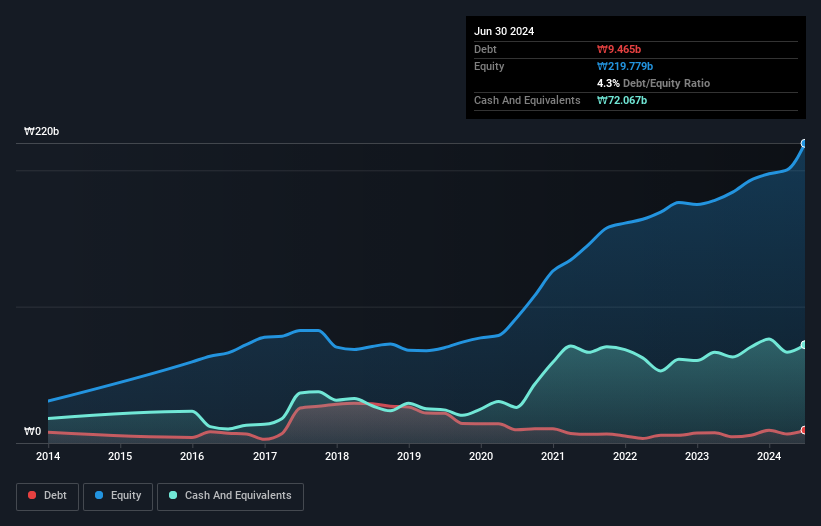

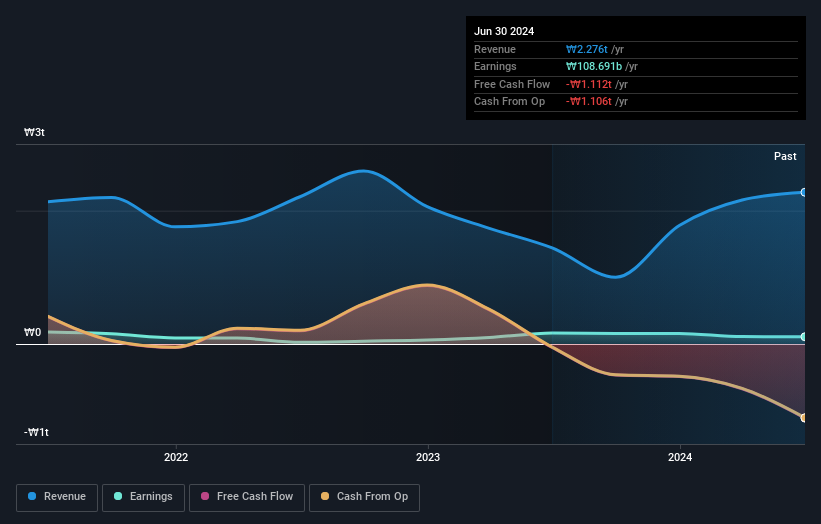

Boditech Med, a promising player in the medical equipment sector, saw its earnings grow by 28.1% last year, outpacing the industry average of 4.1%. Trading at 39.8% below its estimated fair value and with a debt-to-equity ratio reduced from 32.4% to 3.3% over five years, it presents an attractive valuation proposition. Recent collaborations like the penKid biomarker launch for kidney function assessment further underscore its innovative edge and potential for sustained growth in healthcare diagnostics.

Shinyoung Securities (KOSE:A001720)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Shinyoung Securities Co., Ltd. offers brokerage, wealth management, investment banking, and capital market services in South Korea with a market cap of ₩981.46 billion.

Operations: Shinyoung Securities generates revenue primarily from brokerage (₩1.54 billion) and self-selling activities (₩998.12 million), with additional contributions from corporate finance and its subsidiaries, Shinyoung Asset Management and Shinyoung Real Estate Trust.

Shinyoung Securities, a lesser-known financial company in South Korea, has seen its debt to equity ratio improve from 320.6% to 314.6% over the past five years. Despite a notable one-off loss of ₩534.2B impacting recent results, earnings grew by 15% last year, outpacing the Capital Markets industry average of 0.3%. The company repurchased shares recently and is trading at a significant discount of 73.4% below estimated fair value.

- Click here to discover the nuances of Shinyoung Securities with our detailed analytical health report.

Evaluate Shinyoung Securities' historical performance by accessing our past performance report.

Snt DynamicsLtd (KOSE:A003570)

Simply Wall St Value Rating: ★★★★★★

Overview: Snt Dynamics Co., Ltd. manufactures and sells precision machinery with a market cap of ₩531.85 billion.

Operations: Snt Dynamics Ltd. generates revenue primarily from its Machinery Business and Transportation Equipment Business, with the latter contributing ₩508.92 billion. The company also incurs consolidated adjustments amounting to -₩17.41 billion.

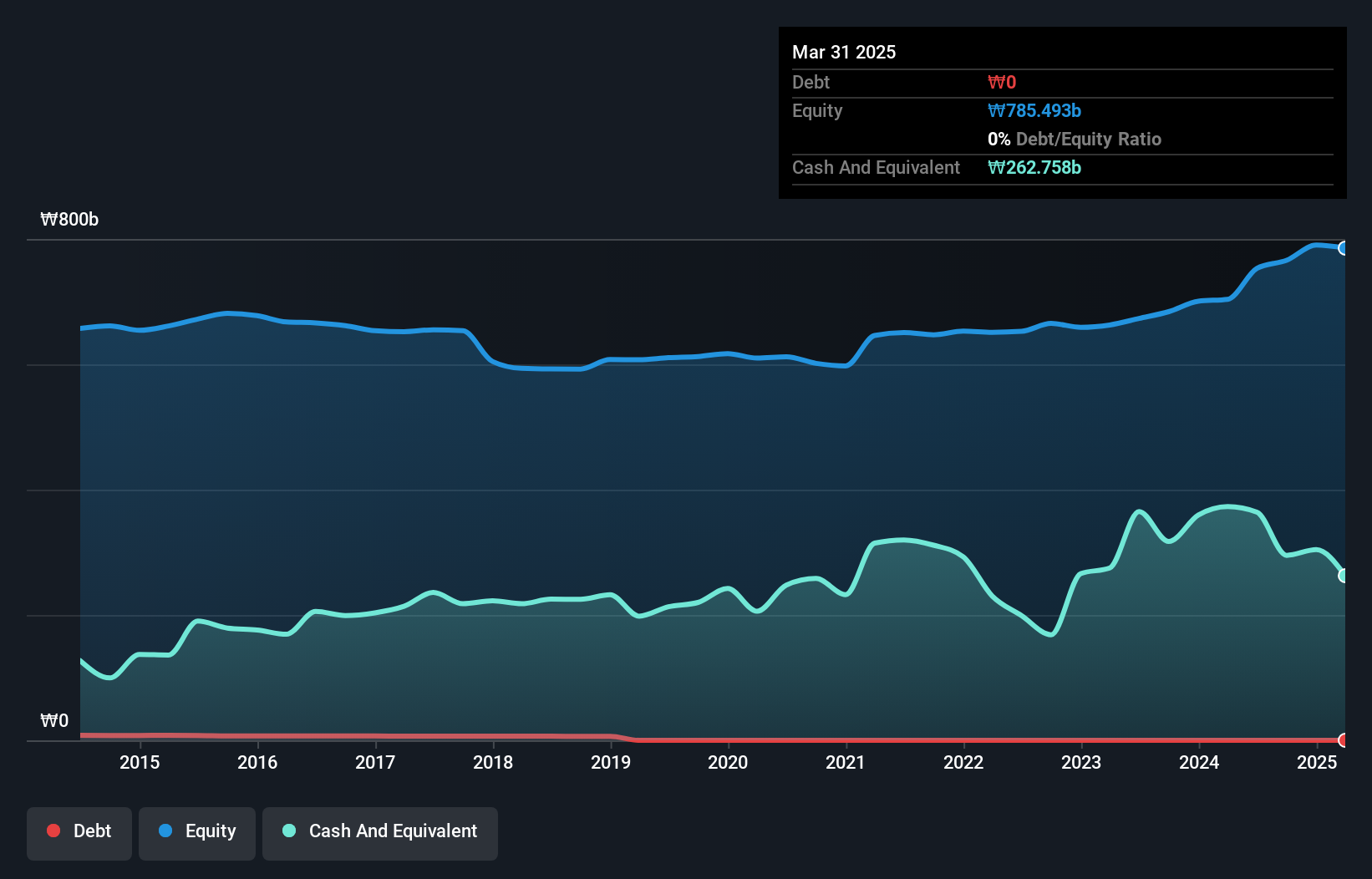

Snt Dynamics Ltd. has shown impressive growth, with earnings increasing by 79.1% over the past year, outpacing the Aerospace & Defense sector's average. The company reported Q1 2024 net income of KRW 12.88 million compared to KRW 10.87 million a year earlier, reflecting robust financial health. Trading at half its estimated fair value and being debt-free for five years underscores its solid foundation and potential for continued profitability, with earnings projected to grow annually by 4.79%.

Taking Advantage

- Reveal the 193 hidden gems among our KRX Undiscovered Gems With Strong Fundamentals screener with a single click here.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About KOSE:A003570

Flawless balance sheet with solid track record.