- South Korea

- /

- Capital Markets

- /

- KOSE:A001200

Eugene Investment & Securities Co.,Ltd. (KRX:001200) Held Back By Insufficient Growth Even After Shares Climb 27%

Eugene Investment & Securities Co.,Ltd. (KRX:001200) shareholders would be excited to see that the share price has had a great month, posting a 27% gain and recovering from prior weakness. Not all shareholders will be feeling jubilant, since the share price is still down a very disappointing 35% in the last twelve months.

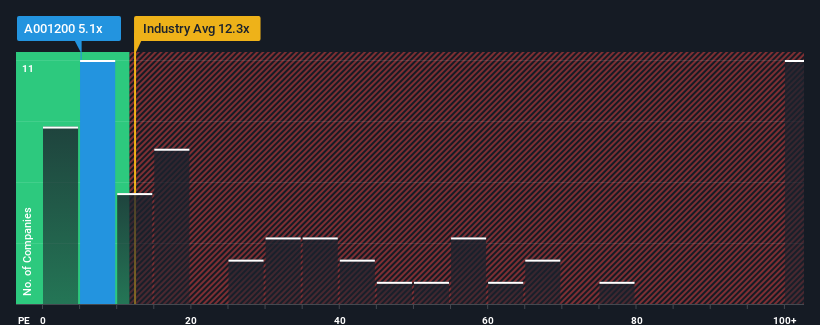

Even after such a large jump in price, given about half the companies in Korea have price-to-earnings ratios (or "P/E's") above 12x, you may still consider Eugene Investment & SecuritiesLtd as a highly attractive investment with its 5.1x P/E ratio. Although, it's not wise to just take the P/E at face value as there may be an explanation why it's so limited.

We've discovered 3 warning signs about Eugene Investment & SecuritiesLtd. View them for free.With earnings growth that's exceedingly strong of late, Eugene Investment & SecuritiesLtd has been doing very well. One possibility is that the P/E is low because investors think this strong earnings growth might actually underperform the broader market in the near future. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's out of favour.

View our latest analysis for Eugene Investment & SecuritiesLtd

Does Growth Match The Low P/E?

The only time you'd be truly comfortable seeing a P/E as depressed as Eugene Investment & SecuritiesLtd's is when the company's growth is on track to lag the market decidedly.

If we review the last year of earnings growth, the company posted a terrific increase of 62%. However, this wasn't enough as the latest three year period has seen a very unpleasant 44% drop in EPS in aggregate. Accordingly, shareholders would have felt downbeat about the medium-term rates of earnings growth.

Weighing that medium-term earnings trajectory against the broader market's one-year forecast for expansion of 20% shows it's an unpleasant look.

In light of this, it's understandable that Eugene Investment & SecuritiesLtd's P/E would sit below the majority of other companies. Nonetheless, there's no guarantee the P/E has reached a floor yet with earnings going in reverse. There's potential for the P/E to fall to even lower levels if the company doesn't improve its profitability.

The Final Word

Even after such a strong price move, Eugene Investment & SecuritiesLtd's P/E still trails the rest of the market significantly. Generally, our preference is to limit the use of the price-to-earnings ratio to establishing what the market thinks about the overall health of a company.

We've established that Eugene Investment & SecuritiesLtd maintains its low P/E on the weakness of its sliding earnings over the medium-term, as expected. Right now shareholders are accepting the low P/E as they concede future earnings probably won't provide any pleasant surprises. If recent medium-term earnings trends continue, it's hard to see the share price moving strongly in either direction in the near future under these circumstances.

Plus, you should also learn about these 3 warning signs we've spotted with Eugene Investment & SecuritiesLtd (including 1 which is a bit unpleasant).

Of course, you might find a fantastic investment by looking at a few good candidates. So take a peek at this free list of companies with a strong growth track record, trading on a low P/E.

Valuation is complex, but we're here to simplify it.

Discover if Eugene Investment & SecuritiesLtd might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KOSE:A001200

Eugene Investment & SecuritiesLtd

Provides various financial products and services to individuals, corporates, and institutional investors.

Acceptable track record with mediocre balance sheet.

Market Insights

Community Narratives