- South Korea

- /

- Diversified Financial

- /

- KOSDAQ:A950110

SBI FinTech Solutions Co., Ltd. (KOSDAQ:950110) Looks Just Right With A 44% Price Jump

SBI FinTech Solutions Co., Ltd. (KOSDAQ:950110) shares have had a really impressive month, gaining 44% after a shaky period beforehand. Not all shareholders will be feeling jubilant, since the share price is still down a very disappointing 25% in the last twelve months.

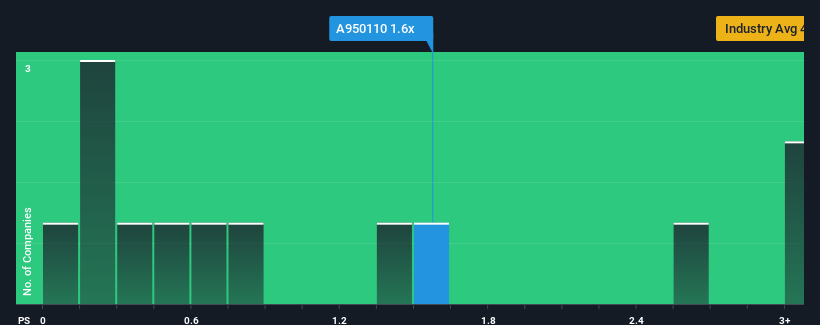

Following the firm bounce in price, given close to half the companies operating in Korea's Diversified Financial industry have price-to-sales ratios (or "P/S") below 0.8x, you may consider SBI FinTech Solutions as a stock to potentially avoid with its 1.6x P/S ratio. However, the P/S might be high for a reason and it requires further investigation to determine if it's justified.

See our latest analysis for SBI FinTech Solutions

What Does SBI FinTech Solutions' Recent Performance Look Like?

For example, consider that SBI FinTech Solutions' financial performance has been poor lately as its revenue has been in decline. It might be that many expect the company to still outplay most other companies over the coming period, which has kept the P/S from collapsing. If not, then existing shareholders may be quite nervous about the viability of the share price.

Want the full picture on earnings, revenue and cash flow for the company? Then our free report on SBI FinTech Solutions will help you shine a light on its historical performance.Is There Enough Revenue Growth Forecasted For SBI FinTech Solutions?

The only time you'd be truly comfortable seeing a P/S as high as SBI FinTech Solutions' is when the company's growth is on track to outshine the industry.

Retrospectively, the last year delivered a frustrating 5.2% decrease to the company's top line. This means it has also seen a slide in revenue over the longer-term as revenue is down 50% in total over the last three years. So unfortunately, we have to acknowledge that the company has not done a great job of growing revenue over that time.

Weighing that medium-term revenue trajectory against the broader industry's one-year forecast for a contraction of 56% shows the industry is even less attractive on an annualised basis.

In light of this, it's understandable that SBI FinTech Solutions' P/S sits above the majority of other companies. However, even if the company's recent growth rates were to continue outperforming the industry, shrinking revenues are unlikely to make the P/S premium sustainable over the longer term. Maintaining these prices will be difficult to achieve as a continuation of recent revenue trends is likely to weigh down the shares eventually.

What Does SBI FinTech Solutions' P/S Mean For Investors?

SBI FinTech Solutions' P/S is on the rise since its shares have risen strongly. Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

Despite experiencing declining revenues, SBI FinTech Solutions has been able to maintain its high P/S off the back of its recentthree-year revenue not being as bad as the forecasts for a struggling industry, as expected. At this stage investors feel the potential for outperformance relative to the industry justifies a premium on the P/S ratio. Our only concern is whether its revenue trajectory can keep outperforming under these tough industry conditions. Otherwise, it's hard to see the share price falling strongly in the near future if its outlook remains more positive than the rest of its peers.

And what about other risks? Every company has them, and we've spotted 2 warning signs for SBI FinTech Solutions (of which 1 is significant!) you should know about.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KOSDAQ:A950110

SBI FinTech Solutions

A fintech solution company, payment agency service and international remittance services in Japan.

Acceptable track record with mediocre balance sheet.

Market Insights

Community Narratives