- South Korea

- /

- Consumer Durables

- /

- KOSDAQ:A057880

Shareholders In Philosys Healthcare (KOSDAQ:057880) Should Look Beyond Earnings For The Full Story

Despite posting strong earnings, Philosys Healthcare Co., Ltd.'s (KOSDAQ:057880) stock didn't move much over the last week. We looked deeper into the numbers and found that shareholders might be concerned with some underlying weaknesses.

View our latest analysis for Philosys Healthcare

Zooming In On Philosys Healthcare's Earnings

One key financial ratio used to measure how well a company converts its profit to free cash flow (FCF) is the accrual ratio. To get the accrual ratio we first subtract FCF from profit for a period, and then divide that number by the average operating assets for the period. You could think of the accrual ratio from cashflow as the 'non-FCF profit ratio'.

Therefore, it's actually considered a good thing when a company has a negative accrual ratio, but a bad thing if its accrual ratio is positive. That is not intended to imply we should worry about a positive accrual ratio, but it's worth noting where the accrual ratio is rather high. To quote a 2014 paper by Lewellen and Resutek, "firms with higher accruals tend to be less profitable in the future".

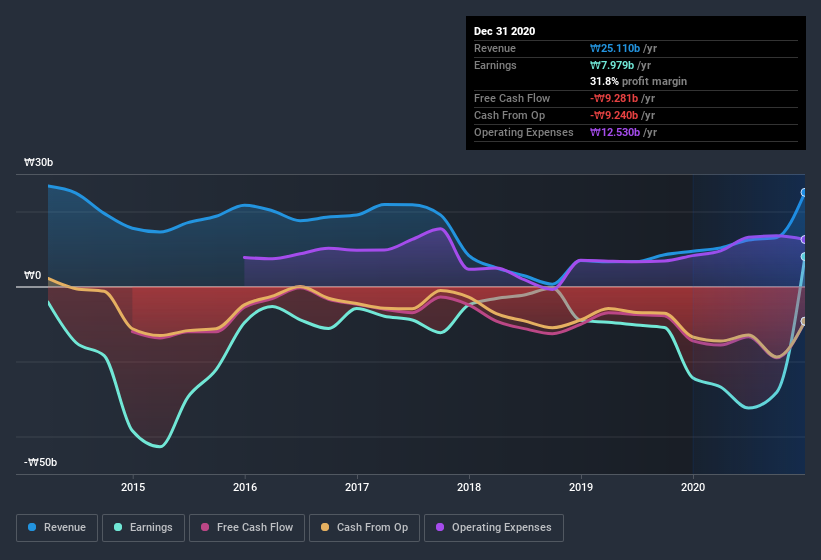

Over the twelve months to December 2020, Philosys Healthcare recorded an accrual ratio of 0.27. We can therefore deduce that its free cash flow fell well short of covering its statutory profit. Over the last year it actually had negative free cash flow of ₩9.3b, in contrast to the aforementioned profit of ₩7.98b. We also note that Philosys Healthcare's free cash flow was actually negative last year as well, so we could understand if shareholders were bothered by its outflow of ₩9.3b. However, that's not the end of the story. We must also consider the impact of unusual items on statutory profit (and thus the accrual ratio), as well as note the ramifications of the company issuing new shares. The good news for shareholders is that Philosys Healthcare's accrual ratio was much better last year, so this year's poor reading might simply be a case of a short term mismatch between profit and FCF. As a result, some shareholders may be looking for stronger cash conversion in the current year.

Note: we always recommend investors check balance sheet strength. Click here to be taken to our balance sheet analysis of Philosys Healthcare.

In order to understand the potential for per share returns, it is essential to consider how much a company is diluting shareholders. In fact, Philosys Healthcare increased the number of shares on issue by 73% over the last twelve months by issuing new shares. Therefore, each share now receives a smaller portion of profit. Per share metrics like EPS help us understand how much actual shareholders are benefitting from the company's profits, while the net income level gives us a better view of the company's absolute size. Check out Philosys Healthcare's historical EPS growth by clicking on this link.

How Is Dilution Impacting Philosys Healthcare's Earnings Per Share? (EPS)

Philosys Healthcare was losing money three years ago. And even focusing only on the last twelve months, we don't have a meaningful growth rate because it made a loss a year ago, too. But mathematics aside, it is always good to see when a formerly unprofitable business come good (though we accept profit would have been higher if dilution had not been required). And so, you can see quite clearly that dilution is having a rather significant impact on shareholders.

In the long term, if Philosys Healthcare's earnings per share can increase, then the share price should too. But on the other hand, we'd be far less excited to learn profit (but not EPS) was improving. For that reason, you could say that EPS is more important that net income in the long run, assuming the goal is to assess whether a company's share price might grow.

The Impact Of Unusual Items On Profit

The fact that the company had unusual items boosting profit by ₩15b, in the last year, probably goes some way to explain why its accrual ratio was so weak. While it's always nice to have higher profit, a large contribution from unusual items sometimes dampens our enthusiasm. When we analysed the vast majority of listed companies worldwide, we found that significant unusual items are often not repeated. And that's as you'd expect, given these boosts are described as 'unusual'. We can see that Philosys Healthcare's positive unusual items were quite significant relative to its profit in the year to December 2020. As a result, we can surmise that the unusual items are making its statutory profit significantly stronger than it would otherwise be.

Our Take On Philosys Healthcare's Profit Performance

Philosys Healthcare didn't back up its earnings with free cashflow, but this isn't too surprising given profits were inflated by unusual items. The dilution means the results are weaker when viewed from a per-share perspective. For all the reasons mentioned above, we think that, at a glance, Philosys Healthcare's statutory profits could be considered to be low quality, because they are likely to give investors an overly positive impression of the company. So if you'd like to dive deeper into this stock, it's crucial to consider any risks it's facing. For example - Philosys Healthcare has 2 warning signs we think you should be aware of.

Our examination of Philosys Healthcare has focussed on certain factors that can make its earnings look better than they are. And, on that basis, we are somewhat skeptical. But there is always more to discover if you are capable of focussing your mind on minutiae. Some people consider a high return on equity to be a good sign of a quality business. While it might take a little research on your behalf, you may find this free collection of companies boasting high return on equity, or this list of stocks that insiders are buying to be useful.

When trading Philosys Healthcare or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About KOSDAQ:A057880

PHCLtd

PHC Co.,Ltd. engages in the medical drug, bio, medical, and distribution businesses in South Korea and internationally.

Flawless balance sheet with weak fundamentals.

Market Insights

Community Narratives