- South Korea

- /

- Commercial Services

- /

- KOSDAQ:A043910

Shareholders in Nature & EnvironmentLtd (KOSDAQ:043910) have lost 63%, as stock drops 10% this past week

If you love investing in stocks you're bound to buy some losers. But the last three years have been particularly tough on longer term Nature & Environment Co.,Ltd. (KOSDAQ:043910) shareholders. Unfortunately, they have held through a 69% decline in the share price in that time. And more recent buyers are having a tough time too, with a drop of 44% in the last year. Shareholders have had an even rougher run lately, with the share price down 35% in the last 90 days.

After losing 10% this past week, it's worth investigating the company's fundamentals to see what we can infer from past performance.

Check out our latest analysis for Nature & EnvironmentLtd

While the efficient markets hypothesis continues to be taught by some, it has been proven that markets are over-reactive dynamic systems, and investors are not always rational. One imperfect but simple way to consider how the market perception of a company has shifted is to compare the change in the earnings per share (EPS) with the share price movement.

Nature & EnvironmentLtd became profitable within the last five years. That would generally be considered a positive, so we are surprised to see the share price is down. So given the share price is down it's worth checking some other metrics too.

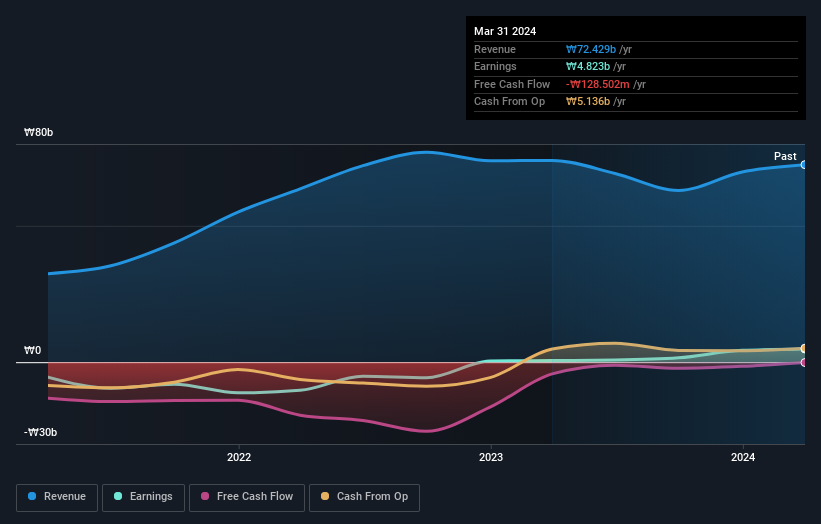

Revenue is actually up 20% over the three years, so the share price drop doesn't seem to hinge on revenue, either. This analysis is just perfunctory, but it might be worth researching Nature & EnvironmentLtd more closely, as sometimes stocks fall unfairly. This could present an opportunity.

You can see how earnings and revenue have changed over time in the image below (click on the chart to see the exact values).

This free interactive report on Nature & EnvironmentLtd's balance sheet strength is a great place to start, if you want to investigate the stock further.

What About The Total Shareholder Return (TSR)?

We'd be remiss not to mention the difference between Nature & EnvironmentLtd's total shareholder return (TSR) and its share price return. Arguably the TSR is a more complete return calculation because it accounts for the value of dividends (as if they were reinvested), along with the hypothetical value of any discounted capital that have been offered to shareholders. We note that Nature & EnvironmentLtd's TSR, at -63% is higher than its share price return of -69%. When you consider it hasn't been paying a dividend, this data suggests shareholders have benefitted from a spin-off, or had the opportunity to acquire attractively priced shares in a discounted capital raising.

A Different Perspective

We regret to report that Nature & EnvironmentLtd shareholders are down 39% for the year. Unfortunately, that's worse than the broader market decline of 2.3%. Having said that, it's inevitable that some stocks will be oversold in a falling market. The key is to keep your eyes on the fundamental developments. Regrettably, last year's performance caps off a bad run, with the shareholders facing a total loss of 4% per year over five years. Generally speaking long term share price weakness can be a bad sign, though contrarian investors might want to research the stock in hope of a turnaround. It's always interesting to track share price performance over the longer term. But to understand Nature & EnvironmentLtd better, we need to consider many other factors. To that end, you should be aware of the 2 warning signs we've spotted with Nature & EnvironmentLtd .

If you would prefer to check out another company -- one with potentially superior financials -- then do not miss this free list of companies that have proven they can grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on South Korean exchanges.

Valuation is complex, but we're here to simplify it.

Discover if Nature & EnvironmentLtd might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KOSDAQ:A043910

Nature & EnvironmentLtd

Engages in the environmental ecological restoration, plant and soil ground water remediation, and water treatment businesses in South Korea.

Solid track record with adequate balance sheet.