- South Korea

- /

- Metals and Mining

- /

- KOSE:A084010

3 KRX Dividend Stocks To Watch Yielding Up To 4.2%

Reviewed by Simply Wall St

The South Korea stock market has experienced recent fluctuations, with the KOSPI index showing mixed performances across various sectors. As investors navigate these uncertain times, dividend stocks can offer a stable income stream and potential for long-term growth. In this article, we will explore three promising KRX dividend stocks yielding up to 4.2%, highlighting their potential benefits in the current market landscape.

Top 10 Dividend Stocks In South Korea

| Name | Dividend Yield | Dividend Rating |

| Kia (KOSE:A000270) | 5.28% | ★★★★★★ |

| NH Investment & Securities (KOSE:A005940) | 5.86% | ★★★★★☆ |

| KT (KOSE:A030200) | 5.18% | ★★★★★☆ |

| Hansae (KOSE:A105630) | 3.04% | ★★★★★☆ |

| Industrial Bank of Korea (KOSE:A024110) | 7.13% | ★★★★★☆ |

| HANYANG ENGLtd (KOSDAQ:A045100) | 3.22% | ★★★★★☆ |

| Kyung Nong (KOSE:A002100) | 7.01% | ★★★★★☆ |

| JW Holdings (KOSE:A096760) | 3.12% | ★★★★★☆ |

| Samyang (KOSE:A145990) | 3.54% | ★★★★☆☆ |

| iMarketKorea (KOSE:A122900) | 6.95% | ★★★★☆☆ |

Click here to see the full list of 74 stocks from our Top KRX Dividend Stocks screener.

Let's review some notable picks from our screened stocks.

HANYANG ENGLtd (KOSDAQ:A045100)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Hanyang ENG Co., Ltd specializes in constructing semiconductor facilities both in South Korea and internationally, with a market cap of ₩315.38 billion.

Operations: Hanyang ENG Co., Ltd generates revenue primarily from the construction of semiconductor facilities in both domestic and international markets.

Dividend Yield: 3.2%

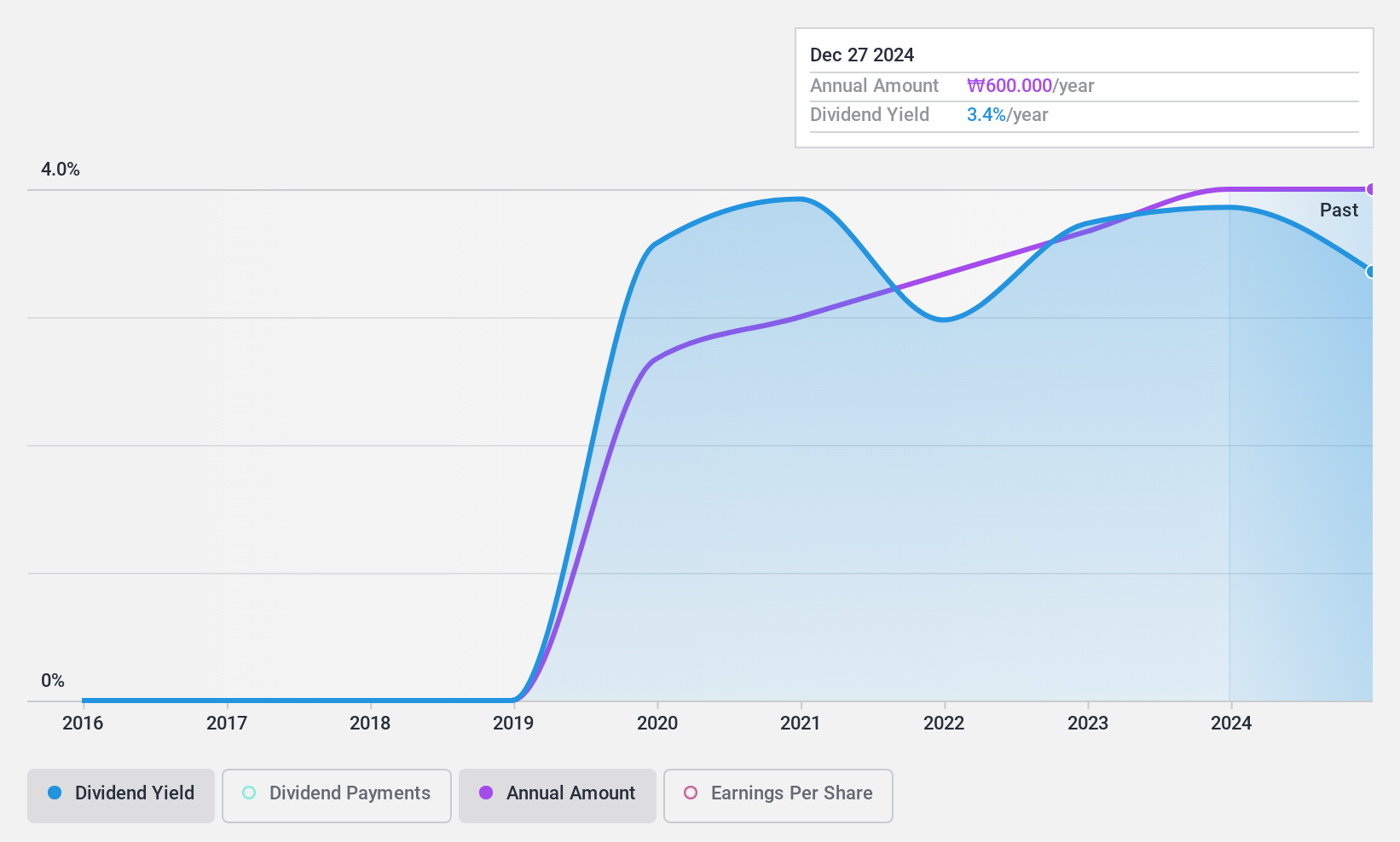

HANYANG ENG Ltd. offers a reliable dividend yield of 3.22%, backed by strong earnings and cash flow coverage with payout ratios of 12.1% and 8.8%, respectively. The company has consistently increased its dividends over the past decade, maintaining stability without significant volatility. Recent earnings reports show robust growth, with net income rising to ₩16,967.77 million for Q2 2024 from ₩14,371.49 million a year ago, reinforcing its capacity for sustainable dividend payments.

- Get an in-depth perspective on HANYANG ENGLtd's performance by reading our dividend report here.

- Our expertly prepared valuation report HANYANG ENGLtd implies its share price may be too high.

Daehan Steel (KOSE:A084010)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Daehan Steel Co., Ltd. manufactures and sells steel products both in South Korea and internationally, with a market cap of ₩218.92 billion.

Operations: Daehan Steel Co., Ltd. generates revenue primarily from its steelmaking sector, which accounts for ₩1.46 trillion, and transportation services, contributing ₩11.71 billion.

Dividend Yield: 4.3%

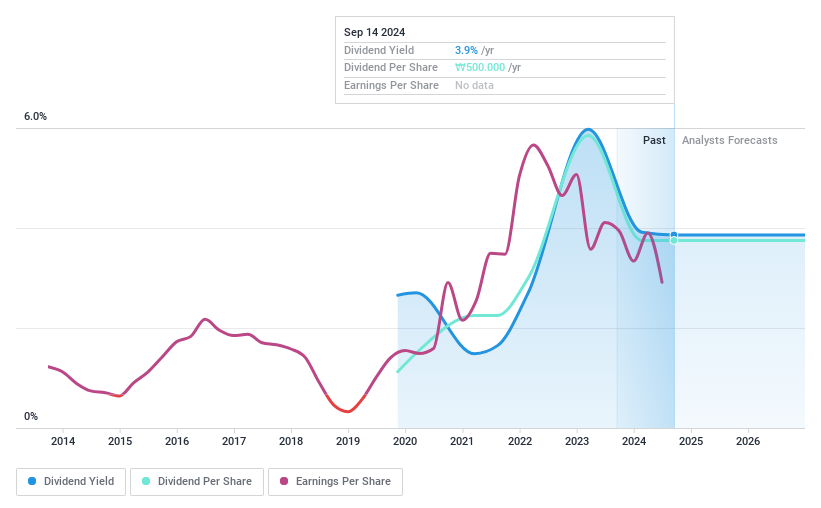

Daehan Steel's dividend payments are well-covered by earnings (14.8% payout ratio) and cash flows (15.6% cash payout ratio), but the company has an unstable track record with volatile dividends over the past five years. Recent earnings for Q2 2024 showed a decline, with net income dropping to ₩15.26 billion from ₩42.61 billion a year ago, raising concerns about future dividend stability despite its high yield of 4.27%.

- Dive into the specifics of Daehan Steel here with our thorough dividend report.

- The analysis detailed in our Daehan Steel valuation report hints at an deflated share price compared to its estimated value.

Doosan Bobcat (KOSE:A241560)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Doosan Bobcat Inc. designs, manufactures, markets, and distributes compact construction equipment for various industries across multiple regions globally and has a market cap of ₩3.98 trillion.

Operations: Doosan Bobcat Inc.'s revenue from construction equipment is $6.99 billion.

Dividend Yield: 3.9%

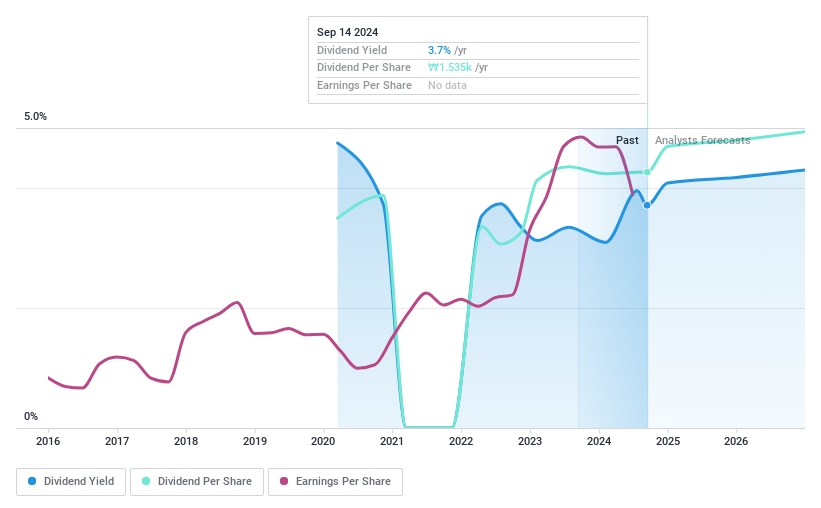

Doosan Bobcat’s dividend payments have been volatile over the past four years, despite a relatively high yield of 3.88%. The company's dividends are well-covered by earnings (31% payout ratio) and cash flows (25.9% cash payout ratio). However, recent earnings showed a significant decline, with Q2 2024 net income falling to US$114.47 million from US$235.39 million a year ago, potentially impacting future dividend stability.

- Unlock comprehensive insights into our analysis of Doosan Bobcat stock in this dividend report.

- In light of our recent valuation report, it seems possible that Doosan Bobcat is trading behind its estimated value.

Turning Ideas Into Actions

- Discover the full array of 74 Top KRX Dividend Stocks right here.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About KOSE:A084010

Daehan Steel

Engages in the manufacture and sale of steel products in South Korea and internationally.

Flawless balance sheet, undervalued and pays a dividend.