Stock Analysis

- South Korea

- /

- Construction

- /

- KOSE:A013580

Kyeryong Construction Industrial's (KRX:013580) earnings have declined over three years, contributing to shareholders 52% loss

While it may not be enough for some shareholders, we think it is good to see the Kyeryong Construction Industrial Co., Ltd. (KRX:013580) share price up 18% in a single quarter. But over the last three years we've seen a quite serious decline. In that time, the share price dropped 55%. So it's good to see it climbing back up. While many would remain nervous, there could be further gains if the business can put its best foot forward.

Although the past week has been more reassuring for shareholders, they're still in the red over the last three years, so let's see if the underlying business has been responsible for the decline.

See our latest analysis for Kyeryong Construction Industrial

To paraphrase Benjamin Graham: Over the short term the market is a voting machine, but over the long term it's a weighing machine. One imperfect but simple way to consider how the market perception of a company has shifted is to compare the change in the earnings per share (EPS) with the share price movement.

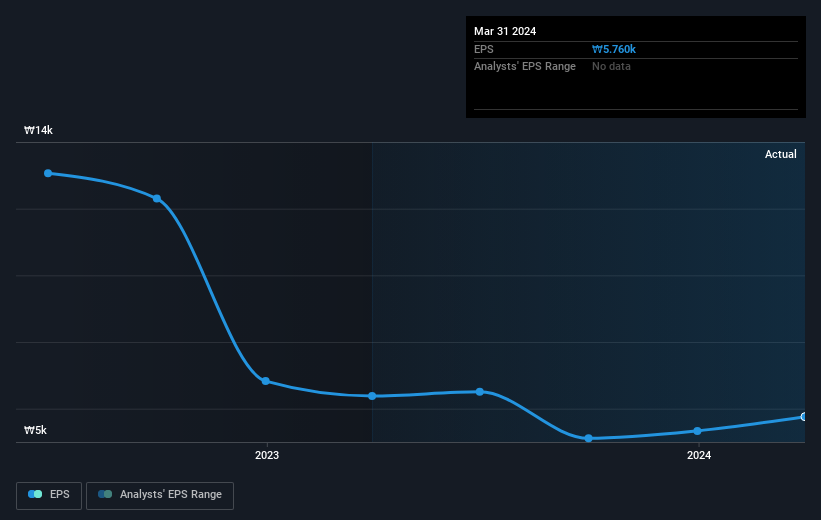

During the three years that the share price fell, Kyeryong Construction Industrial's earnings per share (EPS) dropped by 21% each year. This change in EPS is reasonably close to the 24% average annual decrease in the share price. So it seems that investor expectations of the company are staying pretty steady, despite the disappointment. It seems like the share price is reflecting the declining earnings per share.

You can see below how EPS has changed over time (discover the exact values by clicking on the image).

Before buying or selling a stock, we always recommend a close examination of historic growth trends, available here.

What About Dividends?

When looking at investment returns, it is important to consider the difference between total shareholder return (TSR) and share price return. Whereas the share price return only reflects the change in the share price, the TSR includes the value of dividends (assuming they were reinvested) and the benefit of any discounted capital raising or spin-off. So for companies that pay a generous dividend, the TSR is often a lot higher than the share price return. We note that for Kyeryong Construction Industrial the TSR over the last 3 years was -52%, which is better than the share price return mentioned above. The dividends paid by the company have thusly boosted the total shareholder return.

A Different Perspective

Kyeryong Construction Industrial shareholders are down 1.7% for the year (even including dividends), but the market itself is up 9.2%. Even the share prices of good stocks drop sometimes, but we want to see improvements in the fundamental metrics of a business, before getting too interested. However, the loss over the last year isn't as bad as the 6% per annum loss investors have suffered over the last half decade. We'd need to see some sustained improvements in the key metrics before we could muster much enthusiasm. It's always interesting to track share price performance over the longer term. But to understand Kyeryong Construction Industrial better, we need to consider many other factors. Like risks, for instance. Every company has them, and we've spotted 4 warning signs for Kyeryong Construction Industrial (of which 2 don't sit too well with us!) you should know about.

If you would prefer to check out another company -- one with potentially superior financials -- then do not miss this free list of companies that have proven they can grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on South Korean exchanges.

Valuation is complex, but we're helping make it simple.

Find out whether Kyeryong Construction Industrial is potentially over or undervalued by checking out our comprehensive analysis, which includes fair value estimates, risks and warnings, dividends, insider transactions and financial health.

View the Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're helping make it simple.

Find out whether Kyeryong Construction Industrial is potentially over or undervalued by checking out our comprehensive analysis, which includes fair value estimates, risks and warnings, dividends, insider transactions and financial health.

View the Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About KOSE:A013580

Kyeryong Construction Industrial

Kyeryong Construction Industrial Co., Ltd.

Adequate balance sheet low.