Stock Analysis

- South Korea

- /

- Trade Distributors

- /

- KOSE:A005440

Hyundai G.F. Holdings' (KRX:005440) Conservative Accounting Might Explain Soft Earnings

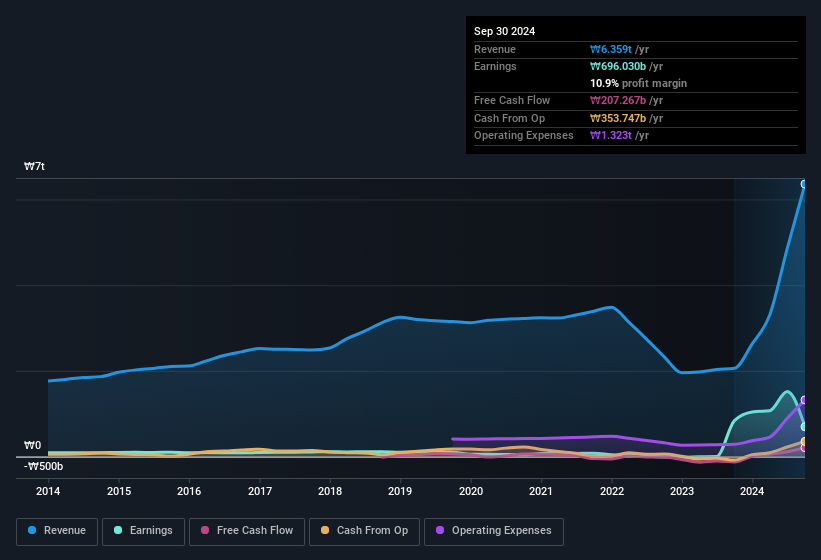

Hyundai G.F. Holdings Co., Ltd.'s (KRX:005440) recent weak earnings report didn't cause a big stock movement. Our analysis suggests that along with soft profit numbers, investors should be aware of some other underlying weaknesses in the numbers.

See our latest analysis for Hyundai G.F. Holdings

How Do Unusual Items Influence Profit?

To properly understand Hyundai G.F. Holdings' profit results, we need to consider the ₩880b expense attributed to unusual items. While deductions due to unusual items are disappointing in the first instance, there is a silver lining. When we analysed the vast majority of listed companies worldwide, we found that significant unusual items are often not repeated. And that's hardly a surprise given these line items are considered unusual. Hyundai G.F. Holdings took a rather significant hit from unusual items in the year to September 2024. All else being equal, this would likely have the effect of making the statutory profit look worse than its underlying earnings power.

That might leave you wondering what analysts are forecasting in terms of future profitability. Luckily, you can click here to see an interactive graph depicting future profitability, based on their estimates.

An Unusual Tax Situation

Just as we noted the unusual items, we must inform you that Hyundai G.F. Holdings received a tax benefit which contributed ₩329b to the bottom line. It's always a bit noteworthy when a company is paid by the tax man, rather than paying the tax man. The receipt of a tax benefit is obviously a good thing, on its own. However, the devil in the detail is that these kind of benefits only impact in the year they are booked, and are often one-off in nature. Assuming the tax benefit is not repeated every year, we could see its profitability drop noticeably, all else being equal.

Our Take On Hyundai G.F. Holdings' Profit Performance

In the last year Hyundai G.F. Holdings received a tax benefit, which boosted its profit in a way that might not be much more sustainable than turning prime farmland into gas fields. Having said that, it also had a unusual item reducing its profit. Given the contrasting considerations, we don't have a strong view as to whether Hyundai G.F. Holdings's profits are an apt reflection of its underlying potential for profit. With this in mind, we wouldn't consider investing in a stock unless we had a thorough understanding of the risks. At Simply Wall St, we found 3 warning signs for Hyundai G.F. Holdings and we think they deserve your attention.

In this article we've looked at a number of factors that can impair the utility of profit numbers, as a guide to a business. But there is always more to discover if you are capable of focussing your mind on minutiae. Some people consider a high return on equity to be a good sign of a quality business. While it might take a little research on your behalf, you may find this free collection of companies boasting high return on equity, or this list of stocks with significant insider holdings to be useful.

Valuation is complex, but we're here to simplify it.

Discover if Hyundai G.F. Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KOSE:A005440

Hyundai G.F. Holdings

Engages in the departmental store businesses in the South Korea.