Stock Analysis

- South Korea

- /

- Machinery

- /

- KOSDAQ:A117730

Even though T-Robotics.Co.Ltd (KOSDAQ:117730) has lost ₩48b market cap in last 7 days, shareholders are still up 177% over 5 years

It hasn't been the best quarter for T-Robotics.Co.,Ltd. (KOSDAQ:117730) shareholders, since the share price has fallen 22% in that time. But that doesn't change the fact that the returns over the last five years have been very strong. We think most investors would be happy with the 177% return, over that period. To some, the recent pullback wouldn't be surprising after such a fast rise. Only time will tell if there is still too much optimism currently reflected in the share price.

In light of the stock dropping 13% in the past week, we want to investigate the longer term story, and see if fundamentals have been the driver of the company's positive five-year return.

See our latest analysis for T-Robotics.Co.Ltd

T-Robotics.Co.Ltd isn't currently profitable, so most analysts would look to revenue growth to get an idea of how fast the underlying business is growing. Shareholders of unprofitable companies usually desire strong revenue growth. That's because it's hard to be confident a company will be sustainable if revenue growth is negligible, and it never makes a profit.

In the last 5 years T-Robotics.Co.Ltd saw its revenue shrink by 5.1% per year. On the other hand, the share price done the opposite, gaining 23%, compound, each year. It just goes to show tht the market is forward looking, and it's not always easy to predict the future based on past trends. Still, this situation makes us a little wary of the stock.

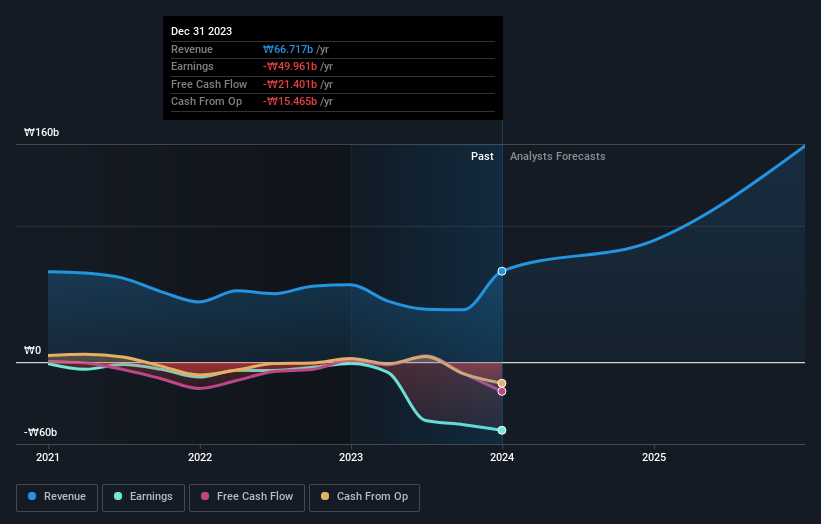

You can see below how earnings and revenue have changed over time (discover the exact values by clicking on the image).

Balance sheet strength is crucial. It might be well worthwhile taking a look at our free report on how its financial position has changed over time.

A Different Perspective

It's nice to see that T-Robotics.Co.Ltd shareholders have received a total shareholder return of 14% over the last year. However, that falls short of the 23% TSR per annum it has made for shareholders, each year, over five years. Potential buyers might understandably feel they've missed the opportunity, but it's always possible business is still firing on all cylinders. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. For instance, we've identified 2 warning signs for T-Robotics.Co.Ltd (1 is a bit unpleasant) that you should be aware of.

If you are like me, then you will not want to miss this free list of growing companies that insiders are buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on South Korean exchanges.

Valuation is complex, but we're helping make it simple.

Find out whether T-Robotics.Co.Ltd is potentially over or undervalued by checking out our comprehensive analysis, which includes fair value estimates, risks and warnings, dividends, insider transactions and financial health.

View the Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KOSDAQ:A117730

T-Robotics.Co.Ltd

T-Robotics.Co., Ltd. operates as a robot technology company in South Korea.

Adequate balance sheet with moderate growth potential.