- South Korea

- /

- Electrical

- /

- KOSDAQ:A043220

Shareholders in TS Nexgen (KOSDAQ:043220) have lost 66%, as stock drops 10% this past week

Investing in stocks inevitably means buying into some companies that perform poorly. But the long term shareholders of TS Nexgen Co., Ltd. (KOSDAQ:043220) have had an unfortunate run in the last three years. Unfortunately, they have held through a 66% decline in the share price in that time. The falls have accelerated recently, with the share price down 23% in the last three months. We note that the company has reported results fairly recently; and the market is hardly delighted. You can check out the latest numbers in our company report.

If the past week is anything to go by, investor sentiment for TS Nexgen isn't positive, so let's see if there's a mismatch between fundamentals and the share price.

See our latest analysis for TS Nexgen

Given that TS Nexgen only made minimal earnings in the last twelve months, we'll focus on revenue to gauge its business development. As a general rule, we think this kind of company is more comparable to loss-making stocks, since the actual profit is so low. For shareholders to have confidence a company will grow profits significantly, it must grow revenue.

In the last three years, TS Nexgen saw its revenue grow by 19% per year, compound. That's a pretty good rate of top-line growth. That contrasts with the weak share price, which has fallen 18% compounded, over three years. To be frank we're surprised to see revenue growth and share price growth diverge so strongly. It would be well worth taking a closer look at the company, to determine growth trends (and balance sheet strength).

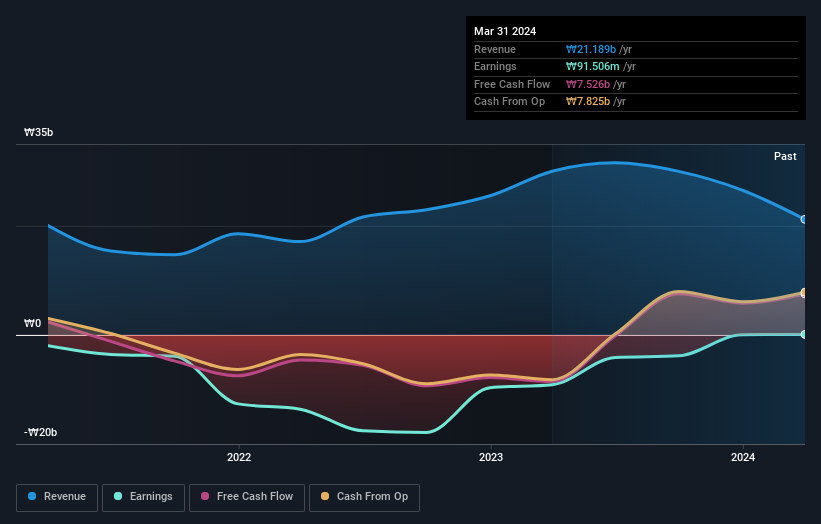

You can see below how earnings and revenue have changed over time (discover the exact values by clicking on the image).

This free interactive report on TS Nexgen's balance sheet strength is a great place to start, if you want to investigate the stock further.

A Different Perspective

While the broader market gained around 3.4% in the last year, TS Nexgen shareholders lost 8.6%. Even the share prices of good stocks drop sometimes, but we want to see improvements in the fundamental metrics of a business, before getting too interested. Regrettably, last year's performance caps off a bad run, with the shareholders facing a total loss of 5% per year over five years. We realise that Baron Rothschild has said investors should "buy when there is blood on the streets", but we caution that investors should first be sure they are buying a high quality business. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. Even so, be aware that TS Nexgen is showing 4 warning signs in our investment analysis , you should know about...

But note: TS Nexgen may not be the best stock to buy. So take a peek at this free list of interesting companies with past earnings growth (and further growth forecast).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on South Korean exchanges.

Valuation is complex, but we're here to simplify it.

Discover if TS Nexgen might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KOSDAQ:A043220

TS Nexgen

Manufactures and sells power plant dampers and busways in South Korea.

Flawless balance sheet slight.