- South Korea

- /

- Machinery

- /

- KOSDAQ:A013030

Hy-Lok And 2 Other Leading Dividend Stocks

Reviewed by Simply Wall St

In a week marked by busy earnings reports and economic data, global markets have shown mixed performance, with major indices like the Nasdaq Composite and S&P MidCap 400 reaching record highs before retreating. Amidst this backdrop of fluctuating market dynamics, investors often turn to dividend stocks as a reliable source of income and potential stability. In the current environment where growth stocks lag behind value shares, strong dividend-paying companies can offer attractive returns through consistent payouts while navigating economic uncertainties.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Tsubakimoto Chain (TSE:6371) | 4.18% | ★★★★★★ |

| Mitsubishi Shokuhin (TSE:7451) | 3.82% | ★★★★★★ |

| Globeride (TSE:7990) | 4.11% | ★★★★★★ |

| Guangxi LiuYao Group (SHSE:603368) | 3.23% | ★★★★★★ |

| CAC Holdings (TSE:4725) | 4.61% | ★★★★★★ |

| Business Brain Showa-Ota (TSE:9658) | 4.19% | ★★★★★★ |

| FALCO HOLDINGS (TSE:4671) | 6.52% | ★★★★★★ |

| Kwong Lung Enterprise (TPEX:8916) | 6.35% | ★★★★★★ |

| GakkyushaLtd (TSE:9769) | 4.62% | ★★★★★★ |

| KurimotoLtd (TSE:5602) | 4.99% | ★★★★★★ |

Click here to see the full list of 1960 stocks from our Top Dividend Stocks screener.

Here we highlight a subset of our preferred stocks from the screener.

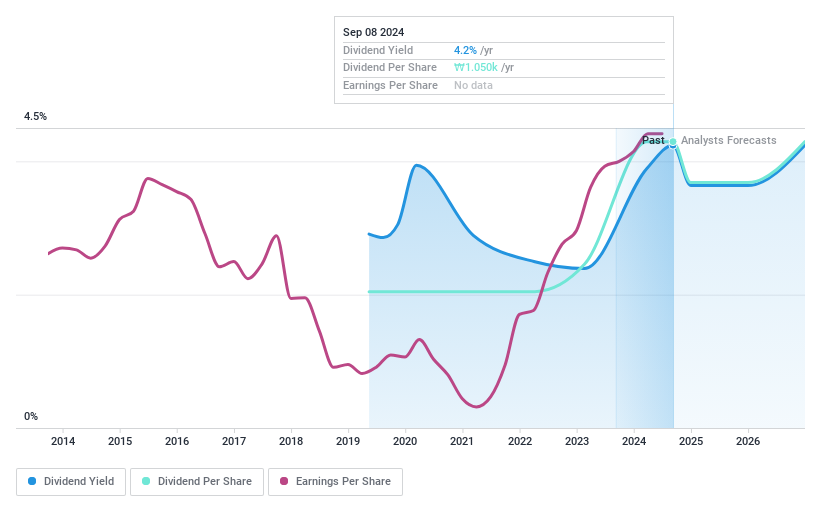

Hy-Lok (KOSDAQ:A013030)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Hy-Lok Corporation operates in the fluid and control system industry worldwide with a market cap of ₩283.21 billion.

Operations: Hy-Lok Corporation generates revenue of ₩189.37 billion from the manufacture and sale of fittings for mechanical equipment, flange valves, unions, and nipples.

Dividend Yield: 4.5%

Hy-Lok's dividend payments are well-covered by earnings and cash flows, with payout ratios of 26.8% and 33.5%, respectively. Despite a short track record of five years, dividends have grown reliably with minimal volatility. The stock trades at a significant discount to its estimated fair value and offers a dividend yield in the top quartile of the Korean market. Recent buyback activity may support share price stability, although no shares were repurchased in the latest tranche ending September 2024.

- Navigate through the intricacies of Hy-Lok with our comprehensive dividend report here.

- In light of our recent valuation report, it seems possible that Hy-Lok is trading behind its estimated value.

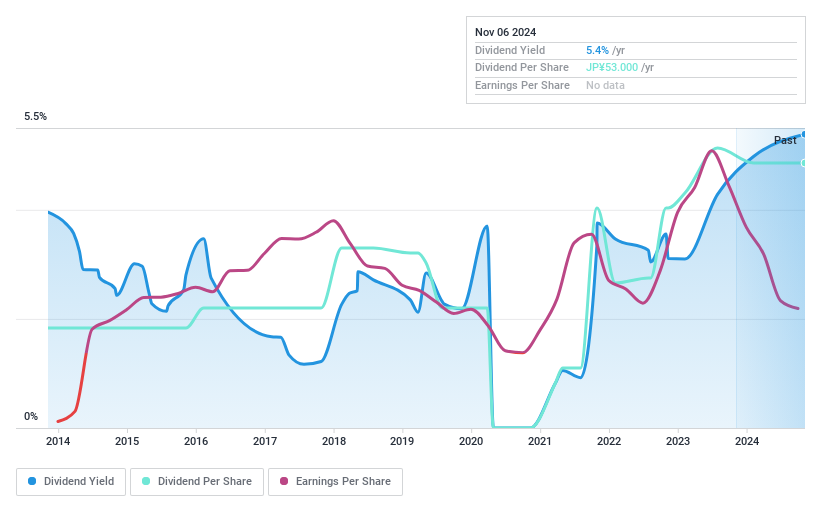

Sumida (TSE:6817)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Sumida Corporation designs, manufactures, and sells electronic components and modules for consumer electronics, automotive, and industrial applications across Japan, the rest of Asia, Europe, and North and South America with a market cap of ¥32.52 billion.

Operations: Sumida Corporation's revenue segments include ¥59.56 billion from its EU business and ¥93.84 billion from its Asia Pacific business.

Dividend Yield: 5.4%

Sumida's dividend yield of 5.39% ranks in the top 25% of the JP market, but its sustainability is questionable due to a high payout ratio of 91.1%, not covered by earnings. Despite growth over the past decade, dividends have been volatile and unreliable. While cash flows adequately cover dividends with a cash payout ratio of 35.8%, profit margins have declined from last year, and interest payments are poorly covered by earnings, indicating financial strain.

- Get an in-depth perspective on Sumida's performance by reading our dividend report here.

- Upon reviewing our latest valuation report, Sumida's share price might be too optimistic.

Tze Shin International (TWSE:2611)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Tze Shin International Co., Ltd. primarily offers transportation services in Taiwan and has a market cap of NT$4.43 billion.

Operations: The company's revenue is primarily derived from its Transportation Division, contributing NT$341.89 million, followed by the Hotel Sector with NT$307.27 million.

Dividend Yield: 9.8%

Tze Shin International's dividend yield of 9.81% is among the top in Taiwan, yet its sustainability is concerning due to a high cash payout ratio of 15486.5%, not supported by free cash flows. Despite growth in dividends over the past decade, they have been volatile and unreliable. The company's earnings have surged significantly, but a high level of non-cash earnings raises quality concerns, affecting dividend reliability and coverage by cash flows.

- Delve into the full analysis dividend report here for a deeper understanding of Tze Shin International.

- Upon reviewing our latest valuation report, Tze Shin International's share price might be too pessimistic.

Seize The Opportunity

- Unlock more gems! Our Top Dividend Stocks screener has unearthed 1957 more companies for you to explore.Click here to unveil our expertly curated list of 1960 Top Dividend Stocks.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Hy-Lok might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About KOSDAQ:A013030

Very undervalued with flawless balance sheet and pays a dividend.