- South Korea

- /

- Auto Components

- /

- KOSE:A012330

Hyundai Mobis Co.,Ltd's (KRX:012330) Earnings Are Not Doing Enough For Some Investors

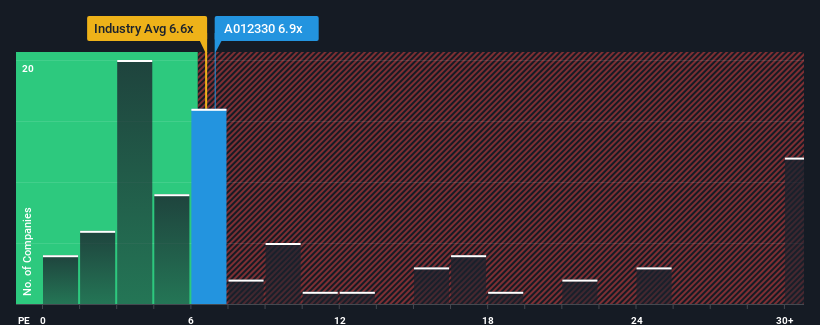

Hyundai Mobis Co.,Ltd's (KRX:012330) price-to-earnings (or "P/E") ratio of 6.9x might make it look like a buy right now compared to the market in Korea, where around half of the companies have P/E ratios above 12x and even P/E's above 24x are quite common. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the reduced P/E.

Hyundai MobisLtd's earnings growth of late has been pretty similar to most other companies. One possibility is that the P/E is low because investors think this modest earnings performance may begin to slide. If you like the company, you'd be hoping this isn't the case so that you could pick up some stock while it's out of favour.

View our latest analysis for Hyundai MobisLtd

Does Growth Match The Low P/E?

There's an inherent assumption that a company should underperform the market for P/E ratios like Hyundai MobisLtd's to be considered reasonable.

Taking a look back first, we see that there was hardly any earnings per share growth to speak of for the company over the past year. Still, the latest three year period has seen an excellent 48% overall rise in EPS, in spite of its uninspiring short-term performance. So we can start by confirming that the company has done a great job of growing earnings over that time.

Looking ahead now, EPS is anticipated to climb by 15% per year during the coming three years according to the analysts following the company. That's shaping up to be materially lower than the 17% per annum growth forecast for the broader market.

In light of this, it's understandable that Hyundai MobisLtd's P/E sits below the majority of other companies. Apparently many shareholders weren't comfortable holding on while the company is potentially eyeing a less prosperous future.

What We Can Learn From Hyundai MobisLtd's P/E?

While the price-to-earnings ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of earnings expectations.

We've established that Hyundai MobisLtd maintains its low P/E on the weakness of its forecast growth being lower than the wider market, as expected. Right now shareholders are accepting the low P/E as they concede future earnings probably won't provide any pleasant surprises. Unless these conditions improve, they will continue to form a barrier for the share price around these levels.

The company's balance sheet is another key area for risk analysis. Take a look at our free balance sheet analysis for Hyundai MobisLtd with six simple checks on some of these key factors.

If P/E ratios interest you, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

Valuation is complex, but we're here to simplify it.

Discover if Hyundai MobisLtd might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KOSE:A012330

Hyundai MobisLtd

Engages in the auto parts business in Korea, China, the United States, Europe, and internationally.

Very undervalued with flawless balance sheet.

Similar Companies

Market Insights

Community Narratives