- South Korea

- /

- Auto Components

- /

- KOSDAQ:A090150

Subdued Growth No Barrier To Kwang Jin Wintec Co.,Ltd. (KOSDAQ:090150) With Shares Advancing 46%

Kwang Jin Wintec Co.,Ltd. (KOSDAQ:090150) shareholders have had their patience rewarded with a 46% share price jump in the last month. Looking back a bit further, it's encouraging to see the stock is up 34% in the last year.

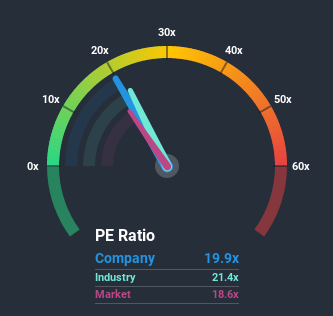

Even after such a large jump in price, there still wouldn't be many who think Kwang Jin WintecLtd's price-to-earnings (or "P/E") ratio of 19.9x is worth a mention when the median P/E in Korea is similar at about 19x. While this might not raise any eyebrows, if the P/E ratio is not justified investors could be missing out on a potential opportunity or ignoring looming disappointment.

With earnings growth that's exceedingly strong of late, Kwang Jin WintecLtd has been doing very well. It might be that many expect the strong earnings performance to wane, which has kept the P/E from rising. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's not quite in favour.

View our latest analysis for Kwang Jin WintecLtd

How Is Kwang Jin WintecLtd's Growth Trending?

In order to justify its P/E ratio, Kwang Jin WintecLtd would need to produce growth that's similar to the market.

Taking a look back first, we see that the company grew earnings per share by an impressive 450% last year. Still, EPS has barely risen at all from three years ago in total, which is not ideal. So it appears to us that the company has had a mixed result in terms of growing earnings over that time.

This is in contrast to the rest of the market, which is expected to grow by 41% over the next year, materially higher than the company's recent medium-term annualised growth rates.

With this information, we find it interesting that Kwang Jin WintecLtd is trading at a fairly similar P/E to the market. Apparently many investors in the company are less bearish than recent times would indicate and aren't willing to let go of their stock right now. They may be setting themselves up for future disappointment if the P/E falls to levels more in line with recent growth rates.

What We Can Learn From Kwang Jin WintecLtd's P/E?

Its shares have lifted substantially and now Kwang Jin WintecLtd's P/E is also back up to the market median. It's argued the price-to-earnings ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

Our examination of Kwang Jin WintecLtd revealed its three-year earnings trends aren't impacting its P/E as much as we would have predicted, given they look worse than current market expectations. When we see weak earnings with slower than market growth, we suspect the share price is at risk of declining, sending the moderate P/E lower. Unless the recent medium-term conditions improve, it's challenging to accept these prices as being reasonable.

Plus, you should also learn about these 5 warning signs we've spotted with Kwang Jin WintecLtd (including 2 which are significant).

If these risks are making you reconsider your opinion on Kwang Jin WintecLtd, explore our interactive list of high quality stocks to get an idea of what else is out there.

When trading Kwang Jin WintecLtd or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if iWINLTD might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

About KOSDAQ:A090150

iWINLTD

Engages in the manufacturing and selling of automobile seat heaters in South Korea and internationally.

Mediocre balance sheet with very low risk.

Market Insights

Community Narratives