- Japan

- /

- Gas Utilities

- /

- TSE:9536

Saibu Gas Holdings (TSE:9536) Profit Margin Hits Multi-Year High; Earnings Beat Reinforces Value-Narrative

Reviewed by Simply Wall St

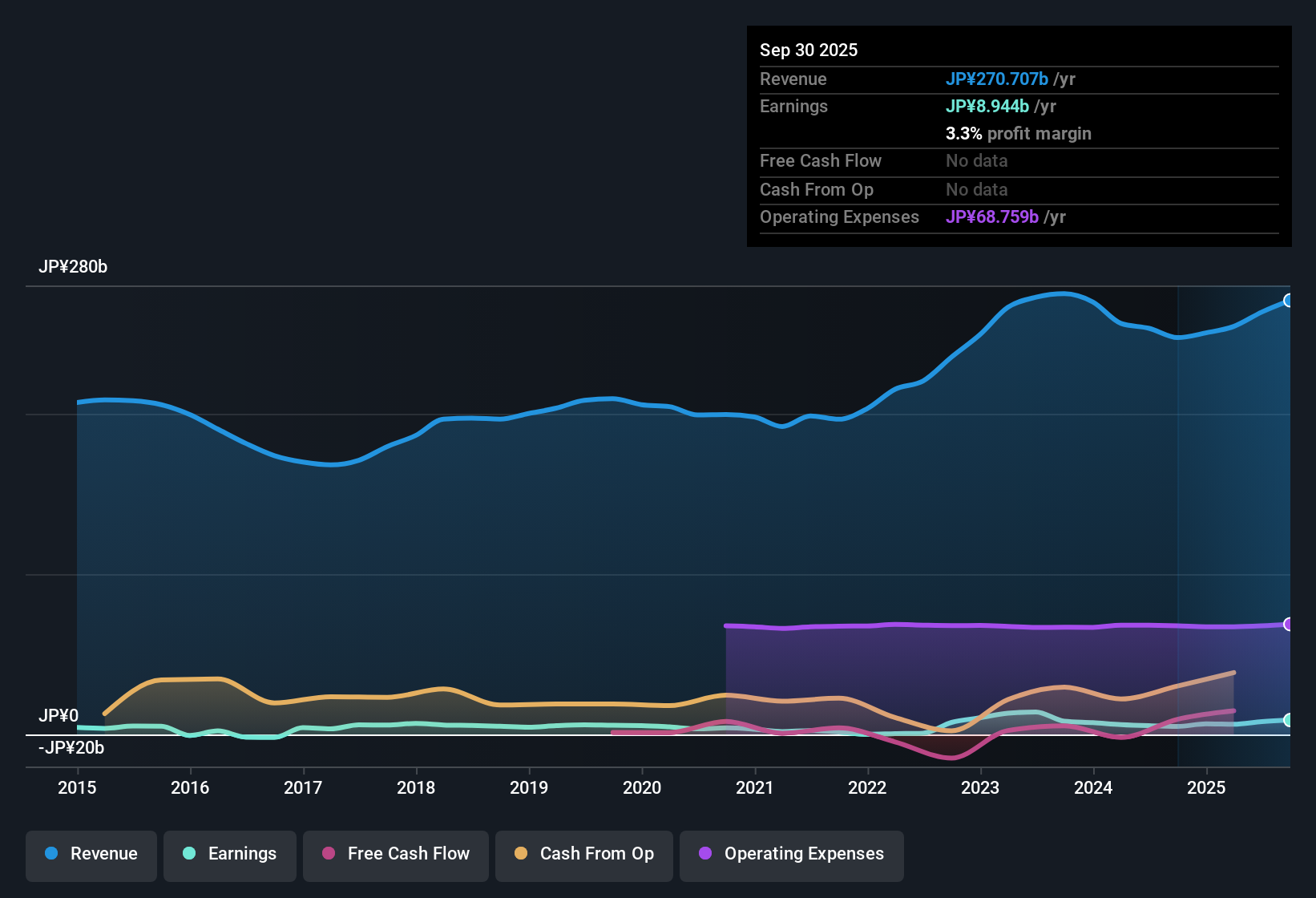

Saibu Gas Holdings Ltd. (TSE:9536) reported a net profit margin of 3.3%, up from 2% in the previous period, as earnings soared by 77% over the past year, handily outpacing its five-year average growth rate of 22.6% per year. Profits have climbed sharply over the last five years, and the recent acceleration in profit growth has underscored improved financial performance for the company. With high-quality earnings, an attractive dividend, and steady profit or revenue growth, Saibu Gas Holdings enters the latest results season well positioned for value-focused investors.

See our full analysis for Saibu Gas HoldingsLtd.The next section breaks down how these strong headline figures align with the current market narratives. Some expectations may be reinforced, while others could face new scrutiny.

Curious how numbers become stories that shape markets? Explore Community Narratives

Profit Margin Expansion Brings Stability

- Net profit margin improved to 3.3%, advancing from 2% a year ago and marking a multi-year high for Saibu Gas Holdings as outlined in the latest statement.

- The prevailing market view finds this margin expansion underpins the company's reputation for stable cash flows, especially as incremental increases grow more meaningful in the traditionally defensive utilities sector.

- Steadier margins tend to back management's focus on reliability and operational discipline, confirming market perceptions of the company as a dependable income generator.

- However, the gradual improvement calls attention to cautious optimism, since investors are likely seeking signs of bolder growth initiatives to push sentiment from neutral to more positive.

Valuation Discount Compared to Industry

- The price-to-earnings ratio for Saibu Gas Holdings stands at 7.5x, significantly lower than the peer average of 10.2x and the Asian Gas Utilities industry benchmark of 13.7x.

- This prevailing market view sees the valuation gap as a supporting factor for value-minded investors, with the P/E discount reflecting either underappreciated fundamentals or lingering concerns about the pace of sector innovation.

- The current share price of ¥1,848 is also well below the DCF fair value estimate of ¥6,111.86, giving credence to arguments that the stock is undervalued relative to both peers and its underlying cash flows.

- Such a deep discount might invite renewed attention from investors hunting for income and potential re-rating opportunities, though ongoing sector shifts could keep the gap persistent without additional catalysts.

Bulls and bears are still searching for their narrative, but a discount this big gets value-watchers talking. See what the community is saying about Saibu Gas HoldingsLtd

Dividend Reliability and Growth Consistency Stand Out

- Saibu Gas Holdings’ steady profit and revenue growth over the last five years, with a 77% increase just this year alone, highlight a record of resilient cash generation.

- Market commentary centers around the strength of these consistent returns, noting that the company’s attractive dividend and sustained growth reinforce its appeal for investors seeking portfolio stability.

- The recurring improvement in profitability materially strengthens the case for regarding Saibu Gas as a reliable income stock, especially amidst larger sector trends toward operational modernization.

- Yet, prevailing analysis also notes that future gains may rely on clearer progress around innovation or green investment, given how investors are rewarding comparable peers for those advances.

Next Steps

Don't just look at this quarter; the real story is in the long-term trend. We've done an in-depth analysis on Saibu Gas HoldingsLtd's growth and its valuation to see if today's price is a bargain. Add the company to your watchlist or portfolio now so you don't miss the next big move.

See What Else Is Out There

While Saibu Gas Holdings offers attractive value, analysts warn that its relative lack of bold growth initiatives and innovation could limit future upside.

For investors searching for companies with more consistent progress and forward momentum, discover those already posting reliable performance and fewer stalled outlooks using our stable growth stocks screener (2094 results).

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:9536

Saibu Gas HoldingsLtd

Produces, supplies, and sells natural gas in Japan.

Solid track record established dividend payer.

Market Insights

Community Narratives