- Japan

- /

- Electric Utilities

- /

- TSE:9509

How Investors May Respond To Hokkaido Electric Power (TSE:9509) Raising Guidance and Boosting Dividend

Reviewed by Sasha Jovanovic

- On October 31, 2025, Hokkaido Electric Power Company revised its consolidated earnings guidance for the fiscal year ending March 31, 2026, and announced a higher second quarter-end dividend of ¥15 per share, up from ¥10 per share a year earlier.

- This combination of updated financial targets and a dividend increase provides shareholders greater clarity about the company’s operating outlook and capital return intentions.

- We'll explore how the company’s upward earnings revision and larger dividend shape its investment narrative amid evolving sector dynamics.

These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

What Is Hokkaido Electric Power Company's Investment Narrative?

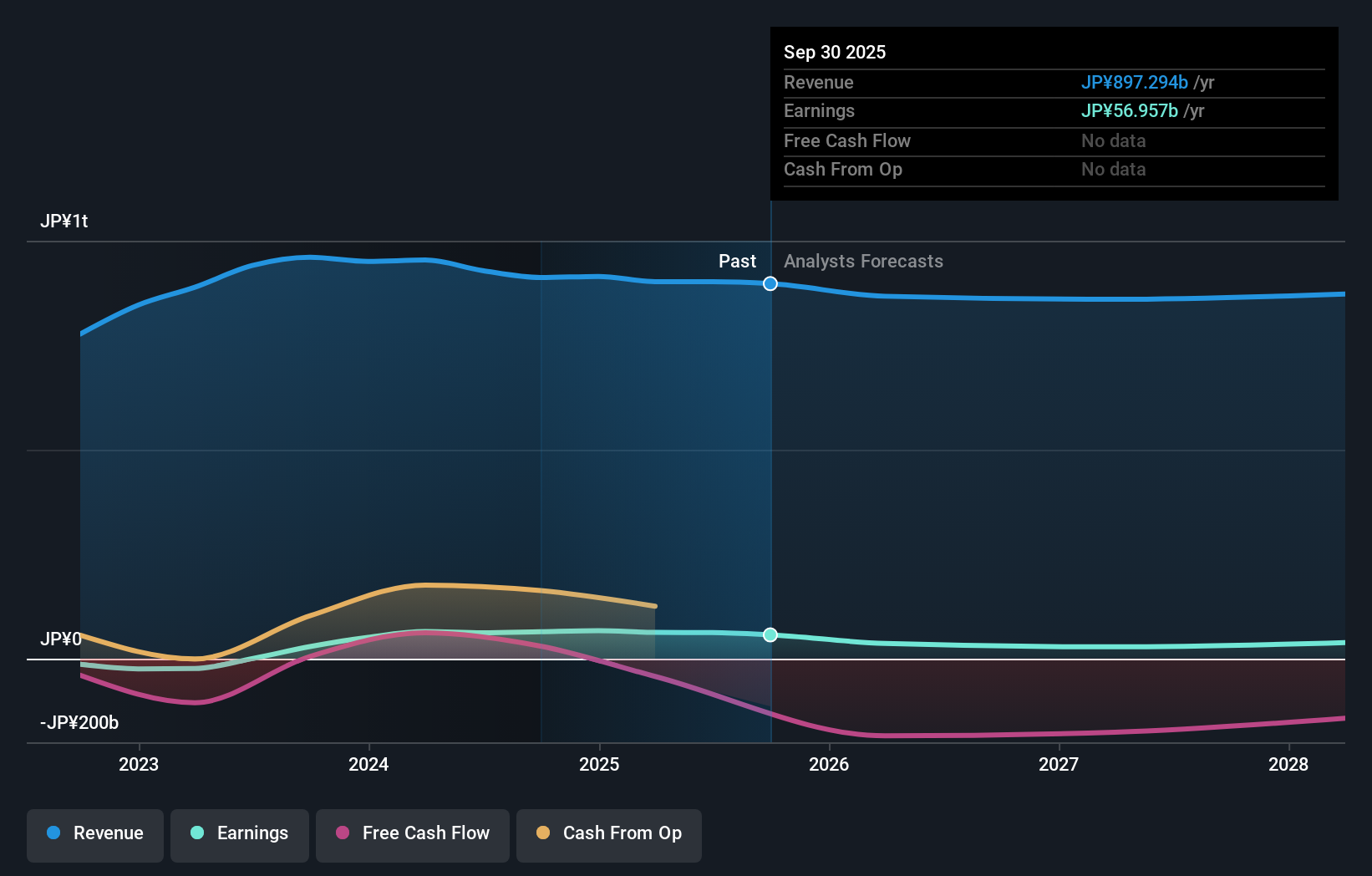

For anyone considering Hokkaido Electric Power Company, the big picture centers on stable cash flow in the electric utility sector and a commitment to returning capital to shareholders, as seen in the recent dividend hike. The revised earnings guidance and dividend increase on October 31, 2025, may refresh short-term investor sentiment, especially since analyst price targets already pointed to a meaningful gap between share price and perceived value. Before this update, slow expected earnings growth, risks from projected revenue declines, weak board independence, and sustainability of dividend payments were prominent themes. With earnings and dividends trending higher than earlier forecasts, the risk profile may shift: the company’s ability to maintain these improvements against lingering pressures on cash flow and profit margins becomes even more important. The recent announcement could temper concerns but hasn’t completely erased the issues highlighted pre-update.

By contrast, questions remain about free cash flow cover for the new, larger dividend, worth unpacking further.

Hokkaido Electric Power Company's shares are on the way up, but they could be overextended by 19%. Uncover the fair value now.Exploring Other Perspectives

Explore another fair value estimate on Hokkaido Electric Power Company - why the stock might be worth 16% less than the current price!

Build Your Own Hokkaido Electric Power Company Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Hokkaido Electric Power Company research is our analysis highlighting 3 key rewards and 3 important warning signs that could impact your investment decision.

- Our free Hokkaido Electric Power Company research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Hokkaido Electric Power Company's overall financial health at a glance.

Contemplating Other Strategies?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- AI is about to change healthcare. These 32 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Hokkaido Electric Power Company might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:9509

Hokkaido Electric Power Company

Generates, transmits, and distributes electricity in Japan.

Fair value with mediocre balance sheet.

Market Insights

Community Narratives