- Japan

- /

- Electric Utilities

- /

- TSE:9507

Shikoku Electric Power (TSE:9507) Valuation: Profitability Gains and Raised Dividend Forecast Shape Outlook

Reviewed by Simply Wall St

Shikoku Electric Power Company (TSE:9507) recently shared financial results showing a dip in net sales, but progress in profitability across several key measures. The company also raised its annual dividend forecast for the coming fiscal year.

See our latest analysis for Shikoku Electric Power Company.

Shikoku Electric Power Company’s recent boost in profitability and higher dividend outlook have given investors reasons for optimism, even as revenue dipped. The stock’s momentum is building, with a 10.8% year-to-date share price return and a 6% total shareholder return over the past twelve months.

If you’re looking to expand your opportunities beyond utilities, now is a great moment to discover fast growing stocks with high insider ownership.

With profitability on the rise and shares trading just below analyst price targets, investors are left asking: Is Shikoku Electric Power Company undervalued at current levels, or is the market already factoring in its brighter outlook?

Price-to-Earnings of 4.8: Is it justified?

Shikoku Electric Power Company is trading on a price-to-earnings (P/E) ratio of 4.8, which is noticeably higher than the average for its local peers but lower than the broader Asian utilities sector. At a last close price of ¥1,380, it appears the market is giving some premium to the company’s recent profitability and momentum, while still discounting its stock compared to much of the Asia-Pacific utilities space.

The P/E ratio reflects the price investors are willing to pay for each yen of earnings. In the context of utility companies, a lower P/E is often typical due to slower growth prospects and stable cash flows. A higher ratio can signal perceived resilience or superior earnings power.

Standing well above the Japanese peer average of 3.1, 9507’s P/E suggests the market sees greater value or lower risk in this name compared to its local competitors. Yet, against the Asian industry average of 17.1, it remains a relative bargain. Notably, a fair P/E ratio for the stock is estimated at 6.2, indicating potential for the market multiple to move higher if recent positive trends persist.

Explore the SWS fair ratio for Shikoku Electric Power Company

Result: Price-to-Earnings of 4.8 (ABOUT RIGHT)

However, persistent negative revenue and net income growth could undermine recent optimism if these trends continue in upcoming quarters.

Find out about the key risks to this Shikoku Electric Power Company narrative.

Another View: Discounted Cash Flow Perspective

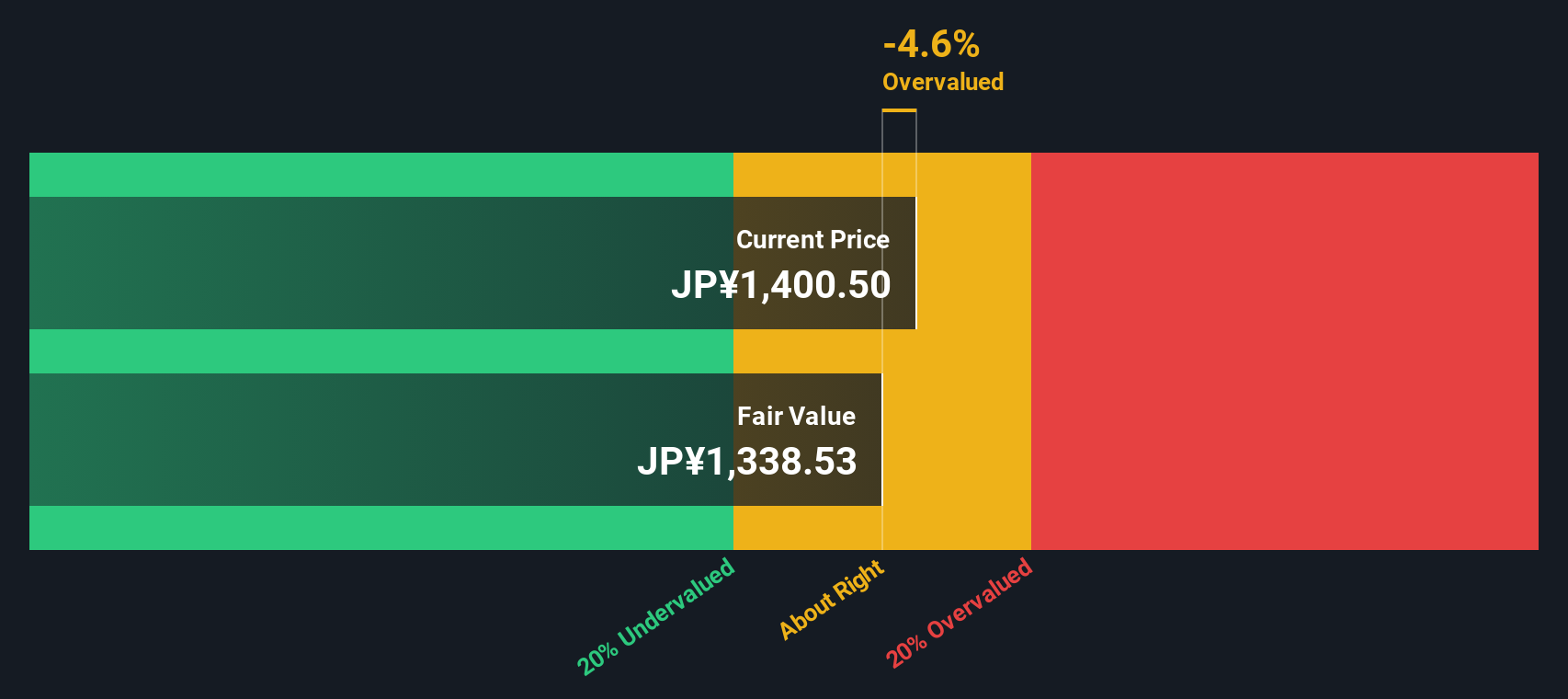

Taking a fresh look with the SWS DCF model, Shikoku Electric Power Company appears to be trading at approximately 4.8% below its estimated fair value of ¥1,449.53. This model suggests the stock is modestly undervalued. However, does the DCF approach tell the whole story, or could market sentiment shift expectations?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Shikoku Electric Power Company for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 834 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Shikoku Electric Power Company Narrative

Feel free to dive into the financial figures and valuation trends firsthand. If you have a different perspective, you can craft your own story in just a few minutes. Do it your way

A great starting point for your Shikoku Electric Power Company research is our analysis highlighting 1 key reward and 3 important warning signs that could impact your investment decision.

Ready for Your Next Investment Move?

Don’t let opportunity pass you by. Expand your horizons with carefully selected stock ideas that could take your portfolio to the next level using the Simply Wall Street Screener.

- Tap into early-stage growth stories by checking out these 3574 penny stocks with strong financials that combine strong financials and big potential before the crowd catches on.

- Maximize your search for hidden bargains and uncover value gems with these 834 undervalued stocks based on cash flows that stand out for attractive cash flow metrics.

- Take advantage of a rapidly evolving sector and find the innovators shaping healthcare’s future through these 34 healthcare AI stocks.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:9507

Shikoku Electric Power Company

Shikoku Electric Power Company engages in generating, transmitting, distributing, and selling electricity in Japan and internationally.

Proven track record average dividend payer.

Market Insights

Community Narratives