- Japan

- /

- Electric Utilities

- /

- TSE:9507

Shikoku Electric Power (TSE:9507): Assessing Valuation After Dividend Increase Signals Management Optimism

Reviewed by Simply Wall St

Shikoku Electric Power Company (TSE:9507) announced a boost to its second quarter dividend, increasing the payout to JPY 25 per share, up from JPY 20 per share last year. The higher dividend is set for distribution beginning November 28, 2025. This move highlights management's confidence in the company's outlook.

See our latest analysis for Shikoku Electric Power Company.

Alongside the dividend boost, Shikoku Electric Power Company’s share price has steadily gained ground, with a year-to-date increase of 12.4%. Taken together with a total shareholder return of 7.5% over the past year and triple-digit returns over the last three and five years, this recent momentum suggests sustained investor confidence in the utility’s long-term prospects.

If this dividend hike has you thinking about where else consistent growth might be hiding, it could be an ideal moment to broaden your search and discover fast growing stocks with high insider ownership

Yet with the share price rallying and returns outpacing benchmarks, investors must ask whether Shikoku Electric Power Company is still undervalued at current levels, or if the market is already anticipating stronger future growth.

Price-to-Earnings of 3.8x: Is it justified?

Trading at a price-to-earnings ratio of 3.8x, Shikoku Electric Power Company looks attractively valued compared to both the industry and wider Japanese market, based on the last close price of ¥1,400.5.

The price-to-earnings (P/E) ratio measures a company's current share price relative to its per-share earnings. For electric utilities like Shikoku, it reflects not just immediate profit but also how investors perceive the sustainability of those earnings in a capital-intensive, regulated sector.

While Shikoku's P/E is lower than the industry average of 17.1x and the Japanese market's 14.3x, it does sit slightly above the average among its closest peers (3.1x). This signals investors may be paying a slight premium, but the multiple still suggests a meaningful discount to broader options. In comparison to the estimated fair P/E ratio of 5.6x, Shikoku’s current valuation could leave room for market adjustment in its favor.

Explore the SWS fair ratio for Shikoku Electric Power Company

Result: Price-to-Earnings of 3.8x (UNDERVALUED)

However, slower revenue and net income growth may challenge the outlook for future gains if operational trends do not improve soon.

Find out about the key risks to this Shikoku Electric Power Company narrative.

Another View: What Does the SWS DCF Model Suggest?

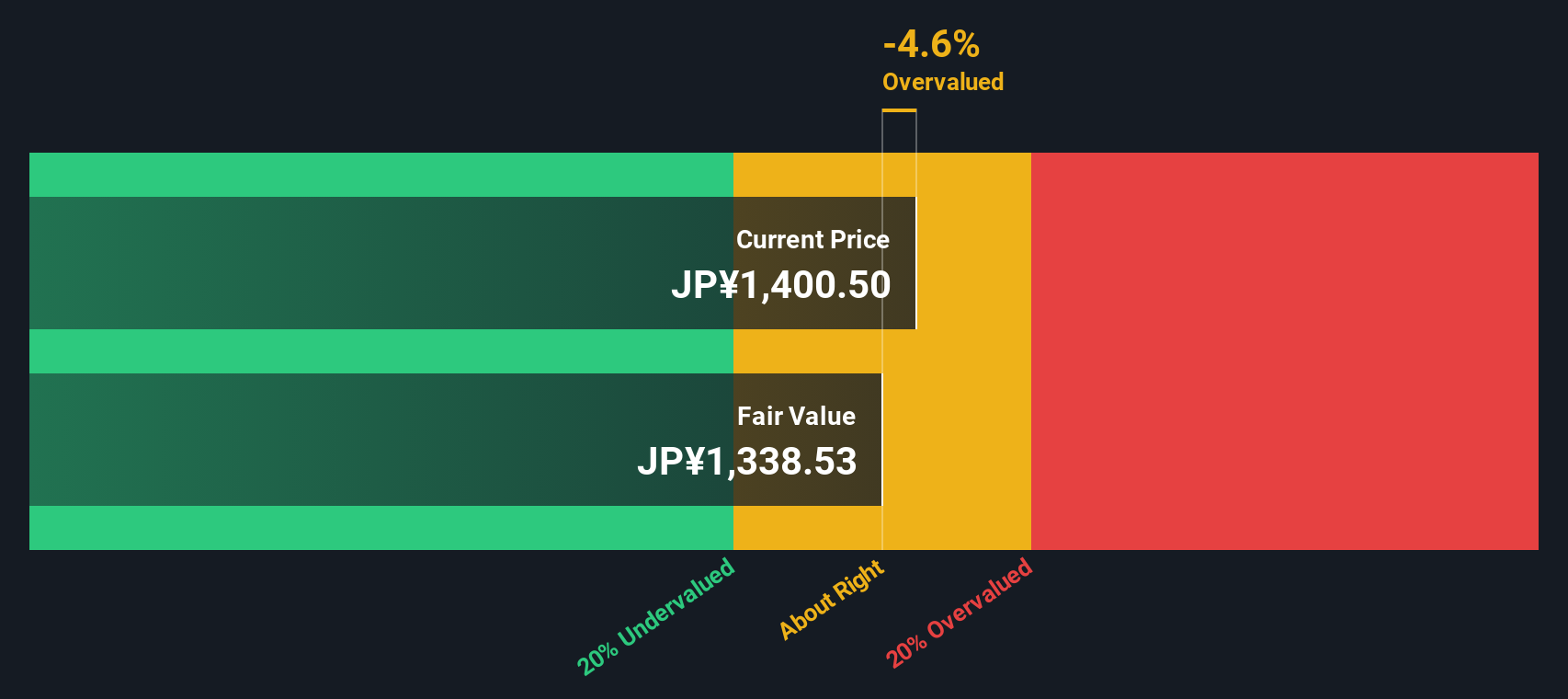

While the low price-to-earnings ratio hints at a bargain, our SWS DCF model presents a different picture. Based on future projected cash flows, the shares are currently trading about 4.6% above their estimated fair value. This indicates the market may be pricing in added optimism or overlooking downside risks. Does this conflicting verdict mean value could prove elusive?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Shikoku Electric Power Company for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 870 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Shikoku Electric Power Company Narrative

If you want to test your own assumptions or dig deeper into the numbers, you can easily build your own perspective in minutes. Do it your way

A great starting point for your Shikoku Electric Power Company research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

Looking for more investment ideas?

There are outstanding investment opportunities in fast-evolving corners of the market, and you do not want to miss out on strong growth and innovative trends. Get started now.

- Accelerate your search with these 870 undervalued stocks based on cash flows, which stand out for their attractive cash flow potential and market mispricings others are overlooking.

- Unlock fresh returns by analyzing these 32 healthcare AI stocks, focusing on the intersection of artificial intelligence and breakthrough medical technology.

- Capture emerging possibilities by scanning these 82 cryptocurrency and blockchain stocks, which are poised to benefit from the rapid evolution in digital assets and blockchain adoption.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:9507

Shikoku Electric Power Company

Shikoku Electric Power Company engages in generating, transmitting, distributing, and selling electricity in Japan and internationally.

Proven track record average dividend payer.

Market Insights

Community Narratives